UK Industrial Electricity Prices Highest in Europe

New data from the Government shows the UK has the highest industrial electricity prices in Europe.

Introduction

Every six months, the Government publishes comparisons of energy prices across Europe. This is a different dataset to the annual IEA comparisons that came out a few months ago. The latest data for the first half of 2024 was published a few days ago.

The data covers the 27 countries that make up the EU plus the UK. All prices quoted below are in pence per kilowatt hour and include taxes and levies.

Some of the results are horrifying, let us dig in to see how UK energy prices compare to the EU.

EU and UK Industrial Electricity Prices

Starting with industrial electricity prices. Helpfully, the Government includes a chart to compare average industrial electricity prices of the EU14 countries (Table 5.4.1) which shows UK prices are more than twice the EU average for medium consumers (see Figure A).

UK prices are 113.7% higher than the EU14 median. For large and very large users, the relative position is even worse with UK prices more than 150% higher than the EU14 median. UK industrial electricity prices are also higher than the rest of the full EU27.

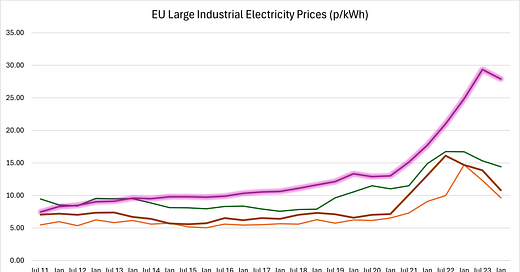

We can see how prices for large users have evolved compared to France, Germany and the EU14 median in Figure B below.

In 2011, UK prices were below those of Germany and only slightly above the EU14 median. By 2020, prices had risen steadily to be well above those of Germany, France and EU14 median. Prices then rose further partly because of the energy crisis, but have not fallen back by as much as other countries, so now the gap between the EU14 and the UK is the widest on record.

As is obvious from the closure of the Stellantis van plant in Luton shows, we cannot hope to compete in traditional energy intensive industries or industries of the future like making batteries or AI with such extortionate electricity prices.

EU and UK Industrial Gas Prices

Turning to industrial gas prices (Table 5.8.1) as shown in Figure C, at first glance, the picture looks a little more sanguine.

UK industrial gas prices are around the median of the EU14. This sounds reasonable, until you remember that only a few months ago, the Government published data for industrial gas prices across the IEA for 2023 that showed UK prices were some five times higher than the US and Canada. Europe, through its refusal to exploit its own shale gas resources, has priced itself out of international markets. This why Europe is deindustrialising.

UK and EU Electricity to Gas Price Ratios

In the UK, industrial electricity prices are some six times the price of gas, this compares to France where the electricity is 2.5 times gas and Germany where the electricity to gas ratio is 3, as seen in Figure D.

The ratio fluctuated during the energy crisis, but the general trend since 2011 is up. Clearly, it is not the price of gas that is driving electricity prices higher. It’s renewables subsidies and their associated costs such as grid balancing, capacity market, storage and extra spending on the grid.

International Domestic Gas Prices

Domestic gas prices (Table 5.10.1) present a slightly better picture than industrial gas prices as shown in Figure E.

UK domestic gas prices are well below the EU14 median for the first half of 2024. But as before, EU domestic gas prices were 2.5 times those in the US and roughly double those in Korea in 2023.

International Domestic Electricity Prices

Sadly, UK domestic electricity prices (Table 5.6.1) are much less competitive than gas prices, as seen in Figure F.

The UK has the third highest domestic electricity prices in Europe, behind only Germany and Ireland. UK prices are 59.4% higher than the EU27 median for small users and 46% higher for large users. As shown in Figure G, UK domestic electricity prices are more than four times those for domestic gas.

Widening Gap Between Rich and Poor

The data also shows a widening gap between rich and poor as small users are paying much more per unit of energy than large users as shown in Figure H.

In 2011, small electricity consumers paid 2.73p per kWh more than large consumers. By the first half of 2024, this differential had widened to 6.97p so now small consumers are paying 24.6% more than large consumers. For gas, the difference is even more stark, with the gap widening from 1.25p/kWh in 2011 to 3.93p/kWh now. Small domestic gas consumers now pay 60.5% more per unit than large users. This shows how high standing charges disproportionately impact the poorest small users.

UK Has Second Most Expensive Diesel Prices in Europe

Whilst we are here, it is worth mentioning that the Government also publishes international road fuel prices too. Petrol prices are reasonably competitive with the EU, with our prices being the 19th cheapest across the EU27, some 8% above the median. However, diesel prices are an entirely different story, with UK prices being the second most expensive behind Finland, some 12% above the median.

Conclusions

When it comes to gas prices, the UK is reasonably competitive compared to the EU average. But this is something of a pyrrhic victory because European gas prices are so much higher than key industrial competitors like the US, Canada and Korea.

However, when we turn to electricity prices, the UK is woefully uncompetitive, particularly for industry where our prices are much more than double those in the EU. When we factor in EU prices being very much higher than other international competitors, then we can see the UK position is dire. This level of price differential is an existential threat to the economy.

We can pretend to be “climate leaders” on the world stage and set a mission for a Net Zero grid by 2030, but this is coming at the cost of winning the gold medal in the international electricity price Olympics. We can also see that it is not the gas price that is driving our electricity prices to such uncompetitive levels, because we are also winning the gold medal for the electricity to gas price ratio. As discussed previously (here and here), it must be the ~£11bn of renewables subsidies, £4.6bn of carbon taxes in the form of the Emissions Trading Scheme, £2.5bn of grid balancing costs and £1bn of capacity market costs that are driving electricity prices skywards. There is an extra £112bn of transmission network costs in the pipeline to connect remote, intermittent renewables to the grid that will continue to push up prices.

Now we also find that the fuel most used to transport goods around the country is the second most expensive in Europe, we can see that expensive energy is acting as a tax on all businesses, not just energy intensive industry.

All this is in direct contradiction to Labour’s number one mission of increasing economic growth. As discussed earlier, Labour’s top two missions are mutually incompatible; we cannot have top tier growth with the highest industrial electricity prices in the developed world.

Having the highest electricity prices in the EU and by extension the rest of the developed world, ought to be considered a national emergency. The Government’s primary mission should be to cut energy prices because cheap energy is the key to unlocking growth. In addition, the pernicious impact of high fixed charges on our gas and electricity bills is making the poorest suffer most from this madness in energy policy. Surely, the “progressive” thing to do would be to cut energy prices.

It is good to see rising disquiet in the press about high energy prices, but there is precious little sign that Labour is paying attention. We can but hope that reality dawns on the Government before the economy collapses under the weight of Net Zero.

We might be able to accelerate the awakening of Government if more of us sign and share this new petition calling for a referendum on Net Zero.

If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Hopefully when I go on BBC question time next week I will be able to ask my question “Is Ed miliband the most dangerous politician in government today?”

Interesting that the median value is used rather than the mean as then our prices would even more egregious. If the outliers were removed (us) and then we compared to the mean we'd look even worse.

Does the price of gas include the necessary doubling in price to account for the 75 odd percent 'levy' added to it by government (which is then handed to the unreliables to make their costs appear reasonable)?

However the data is examined, it precludes any concept of growth - but then that's the point: the whole intent of the 'climate change' tax scam is ideological, not rational.

Reeves recently complained no one put forward alternatives to her plan. This isn't true. Countless people have, she just ignored them because they didn't suit her agenda. After all, cutting taxes and waste are not things the current state ever considers. The OBR specifically excludes such from it's calculations as they'd be the recommendation of every report in how to create growth.

I'm coming to realise that where we all thought Labour meant creating economic growth they really meant growth in taxes, waste, debt, unemployment and poverty. Same as we'll all be saving money on our energy bills not because energy is cheaper, but because it's unaffordable we don't use it, thus saving money!