Real Cost of Offshore Wind Power

How much does it cost to produce offshore wind power and what happens when subsidies end?

Introduction

We have previously looked at the extortionate costs of wind power to consumers in several articles, for example here and here, and followed the offshore wind money to a vast array of offshore entities. But what does it actually cost to produce wind power and what might happen when the subsidy contracts expire?

If you create a database containing the salient numbers from the accounts of windfarms, we can work out how much it costs to produce wind power on several measures.

Statutory accounts are usually structured along similar lines. The top line is where the revenue or turnover is declared, which is the money received for sales of power plus the value of subsidies received. Then Cost of Sales is deducted to calculate the gross profit. The cost of sales is usually the direct costs of generating the revenue. For wind farms, the cost of sales includes items such as maintenance and probably network access charges that generators pay to access the transmission network.

Then other operating expenses such as administration and depreciation are deducted to calculate the operating profits. Building a wind farm is capital intensive and many wind farms borrow to fund the build phase. Finance costs are deducted from the operating profit to calculate the profit before tax.

Now we have three measures of the cost of wind power: direct costs, operating costs and total costs. These costs can be divided by the electricity generated during the year to derive costs per MWh.

Offshore Windfarm Database

The Offshore wind database consists of a variety of wind farms, some subsidised by Renewables Obligation Certificates (ROCs) and some by Contracts for Difference. The ROC funded developments are Race Bank, Sheringham Shoal and Greater Gabbard. The CfD funded units are Beatrice, Dudgeon, East Anglia One, Moray East, Triton Knoll and Walney Extension.

These windfarms have been chosen because they are large and have readily available data. All the cost data is from the statutory accounts. They year shown is the year in which the year-end for each company falls. Many have a year-end in December, but others in March. The generation data is sourced either from the accounts or for those windfarms that do not disclose generation data, from the LCCC CfD data or from Ofgem ROC data.

Direct Costs of Offshore Wind

Starting with ROC funded offshore wind, we can see the direct costs of operation in the latest reported year range from £53/MWh for Race Bank to £107/MWh for Greater Gabbard (see Figure 1).

The direct costs for both Greater Gabbard and Sheringham Shoal are well above the current market rate for power which is around £75/MWh. Moreover, the direct costs for all three developments are on a rising trend.

The picture for CfD funded units is more complex as shown in Figure 2.

The direct costs for Triton Knoll and Walney are remarkably high, the variation perhaps reflects reliability problems in the years with the highest costs per MWh. The direct costs for Dudgeon and Moray East are relatively stable around the £60/MWh mark. The direct costs for Beatrice and East Anglia One are low, but perhaps indicate a difference in accounting methodology.

Operating Costs of Offshore Wind

As we might expect, the operating costs for ROC funded offshore windfarms as shown in Figure 3 are higher than the direct costs, because administration and depreciation costs have been added to the direct costs. Again, these show a rising trend, with the average rising from £65/MWh in 2019 to £89/MWh in 2022. There’s not enough data to project the 2023 average yet. The operating costs of all the ROC-funded units are well above the market value of the electricity they produce.

Figure 4 shows that again, there is a more varied picture for the operating costs of CfD funded offshore wind farms.

The operating costs of Triton Knoll and Walney East are high. In year-ended 2022, the operating costs for Beatrice, Dudgeon, East Anglia One and Moray East were in the range £61-£81/MWh and a gently rising trend in costs can be seen.

Total Costs of Offshore Wind

The total costs of offshore windfarms rise again once financing costs are considered. Figure 5 shows the total costs of ROC funded offshore wind farms.

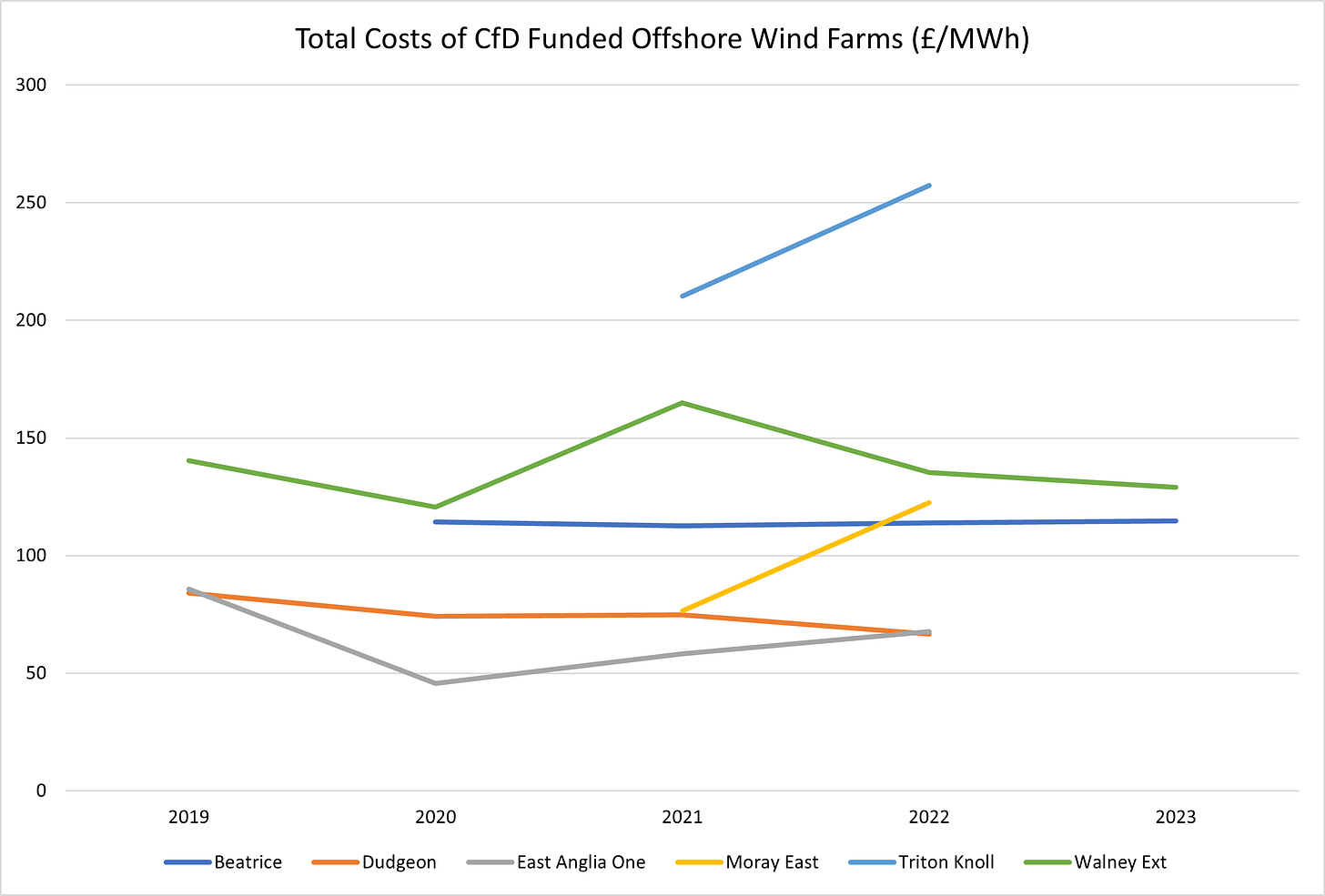

The total costs are on a rising trend and in the latest year available, all are above £100/MWh, well above current market rates. Figure 6 shows the total costs for a range of CfD funded windfarms.

Dudgeon and East Anglia One have the lowest total costs lower costs at £67 and £68/MWh, respectively. The total costs of the others are all well above £100/MWh with Triton Knoll at £257/MWh and Walney at £135/MWh. This is worrying for the industry because Triton Knoll and Moray East came on stream later than the other windfarms, yet their costs do not seem to be lower than earlier units, contradicting the claim that offshore wind is getting cheaper.

Economics of Windfarms

So far, we have looked at the direct costs, operating costs and total costs of offshore windfarms and compared to the approximate market rate of £75/MWh at the time of writing. However, this does not reflect the true economics of wind generation. Almost all the windfarms we have examined cannot produce electricity at a lower cost than the market rate.

However, this is not the whole story. As we saw when looking at the Agile Octopus tariff, we get the most wind power when the wind is blowing hardest and often this is when demand is low. At these times, the market value of the generation falls to zero. If these windfarms were operating without subsidy, their revenue would be close to zero. Conversely, market rates are highest when there is little wind and we struggle to meet demand with our dwindling stock of dispatchable power stations and pay through the nose to secure supplies through interconnectors to the Continent. In these circumstances, the revenue for wind farms is again close to zero because close to zero generation multiplied by a high price is also close to zero. Figure 7 below for the past couple of months of generation for Dudgeon illustrates the point that the market reference price (green bars) is often lowest when generation is highest (black line), and that generation is often extremely low when the market price is high.

Windfarms need a Goldilocks scenario of moderate to high wind coupled with moderate to high demand to properly compete in the market. These situations do not happen often. If windfarms operated without subsidy, they would rapidly go bankrupt.

What Happens When the Subsidies End?

This brings us to the question of what happens when the subsidy regimes end? ROC-funded generators are eligible to receive certificates for a period of 20 years from the date of accreditation. According to the Ofgem database, the earliest offshore wind ROCs were issued in 2007 for output generated in 2006. This means that in a couple of years, the subsidies for offshore windfarms will start to roll off. Even if the turbines are still capable of generating power at that point, even the direct costs of operation will highly likely be well above the market value of the power generated and so these units will either close or go cap in hand to the Government for even more subsidies.

Contracts for Difference are offered for a 15-year term and the first offshore wind contract came into operation in April 2017. By 2032 the contracts for early developments such as Dudgeon will come to an end and the economics of these windfarms when operating without subsidy will be in grave doubt.

Conclusions

Most offshore windfarms would be uneconomic today even if they could sell their output at today’s prevailing market rates. If these windfarms were forced to operate in the market without subsidy, then their operating economics would be destroyed and they would rapidly go bankrupt.

If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

.

These prices don’t factor in any backup storage energy. If wind operators had to fund stored backup, instead of using gas energy as a backup, this would double or treble the cost of wind and solar energy.

RE

David, thanks for this detailed analysis.

As the financial data are derived from official accounts, the analysis seems irrefutable, and strongly suggests that wind-farms of almost any type will never be economical - as many suspected.

PSB three broad and somewhat rhetorical issues/Qs, several of which may have been considered in some of your previous posts:

[1] The cost differences between cheapest and most expensive Total Costs in £ per MWh seems enormous. The CFD Funded Farms variation is c.£70 for E Anglia One & Dudgeon versus a wide range of £120-£250 per MWh for the others. The variation for the three ROC Funded Farms seems much smaller, within a range of c.£ 105-£115 per MWh. This begs several Qs. Is some/all of this merely creative accounting, as you suggested in one case? Is one particular design of farm so much better/cheaper that it should be the template for all others? Should these costs have been foreseen by either HMG or the contractor well in advance of construction (a long shot)? Is there any evidence to suggest what the future cost trend(s) will be for the various types of wind-farms, especially long term maintenance and replacement cost profiles?

[2] What about the non-financial costs, especially in two main areas: [a] the CO2 costs of construction and maintenance (though many would say these are relatively unimportant)? And [b] other environmental and wild-life impacts? I think you have touched on both areas before but altruists might suppose that the caring Church of Net Zero would be pleased to be fully transparent about the data in these areas.

[3] Back-up energy costs (not just electricity) are perhaps the issue of greatest concern. Unless nuclear fusion (which has always been 30 years away) suddenly becomes viable, it seems certain that the ongoing need for non-renewable back-up electricity generation (mainly CCGT?) would greatly exacerbate the already uneconomical supposedly renewable energy costs.

The renewable energy future for the UK is looking impossibly expensive and often smacks of illogical and lazy ideological planning. It looks as if the wind-farm emperors have very few clothes, but the government tailor is happy to keep lending expensive cloaks. Almost worse, there is a strong sense that HMG would never dare to end the subsidies regime. Please keep chipping away.