Putting the Wind Up

Just about everything about wind power is going up, except the load factor

Introduction

It has been a difficult period for renewables advocates as increased subsidy payments have put up the price of wind and solar power. The new fiscal year means that strike prices for Contracts for Difference (CfDs) have indexed upwards and the buy-out price for Renewables Obligations Certificates (ROCs) have also increased with inflation. Moreover, last month, the Government released figures for the renewables industry, including installed capacity, generation and load factors. What does all this mean for our energy bills?

Putting the Wind Prices Up

Increasing CfD Strike Prices

Each year, the strike price of CfDs is indexed upwards with inflation. This year is no different and CfD strike prices for offshore wind have gone up as shown in Figure 1.

Moray East and Hornsea 2 activated their CfDs in March 2024, and their strike prices are below all the other offshore wind farms. The strike price for Hornsea 2 fell for year ended March 2025, probably because it sold its offshore transmission asset in the year.

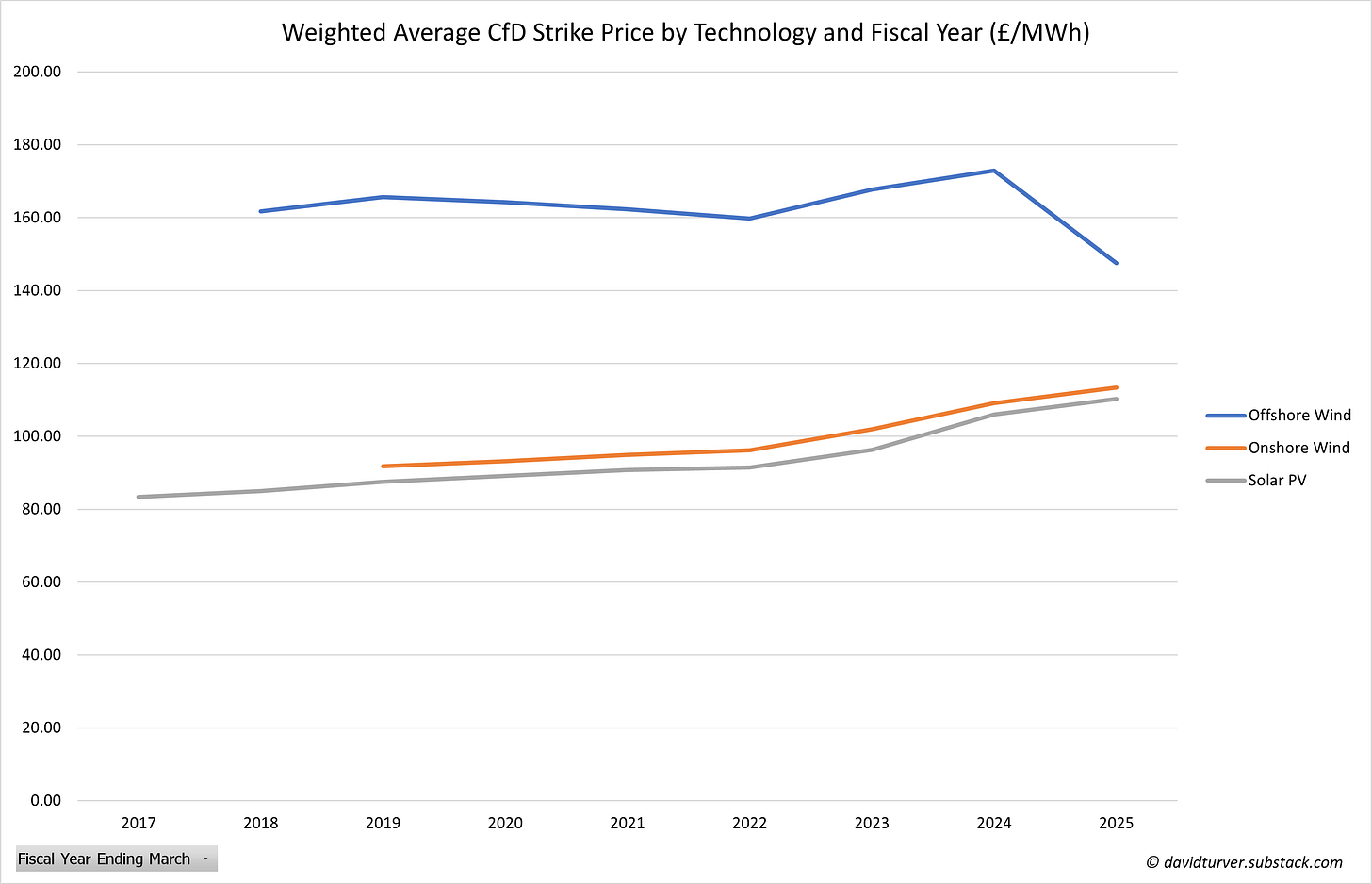

Figure 2 shows the impact of indexation on the average strike price by technology, weighted by generation. The generation for FY2024/25 is weighted by the generation in the first 22 days of April.

The addition of Moray East and Hornsea 2 has brought down the weighted average strike price for offshore wind to ~£148/MWh, still more than triple the £46/MWh reference price for the first 22 days of April, mostly set by gas. We should note that the reference price so far is probably below that of gas-fired electricity, because of the relatively high wind generation. However, unless the market price falls below zero for a period, the renewables operators still receive their full strike price, but more of it comes in the form of subsidy because the market value of their output is low. Even though the average strike price for offshore wind has fallen, the absolute level of subsidy awarded to offshore wind farms will rise as long as the price of gas-fired electricity remains well below the £78-79/MWh strike prices of Moray East and Hornsea 2.

The average strike price for onshore wind has risen to £113/MWh and solar has gone up to £110/MWh.

Rising ROC Buy-Out Prices

In January, Ofgem announced the buy-out price for ROCs in this fiscal year, running from April 2024 to the end of March 2025. The buyout price has continued its inexorable rise as seen in Figure 3, going up 9.7% from £59.01 last year to £64.73 this year.

The number of certificates issued per MWh of electricity varies by technology and the generator. However, offshore wind farms funded by ROCs receive on average about 1.9 certificates per MWh, onshore farms 1, and solar 1.4 certificates per MWh. This means that offshore wind will receive certificates of a value of £123/MWh, onshore £64.73/MWh and solar £92.56/MWh in addition to the market price they receive for the electricity they generate. So far in April 2024, the average reference price for was around £46/MWh meaning the full cost of ROC funded generation will be ~£169/MWh for offshore wind, ~£111/MWh for onshore and ~£139/MWh for solar (see Figure 4).

However, the total amount these ROC-funded generators actually receive will depend on market prices throughout the year, and these market prices are largely set by gas-fired power. So, they will always be more expensive than gas.

Putting the Wind Up Electricity Consumers

We can now compare the new ROC and CfD subsidised prices with current market prices as shown in Figure 5.

The current market price is calculated as the average of the reference price for onshore and offshore wind CfDs in the first 22 days of April.

These increased subsidies will certainly put the wind up electricity consumers because they will not feel the full benefit of falling gas prices in their energy bills. Increased subsidies will keep bills higher for longer. There will be no respite from the higher prices with new projects being offered prices far above current market prices in AR6. Grid balancing and grid expansion costs must be paid on top of the basic CfD prices too.

Putting the Wind Up Activists

These rising costs of renewables are also putting the wind up green energy activists. Higher subsidies mean it is becoming increasingly difficult to maintain the “cheap renewables” line. Although this has not stopped a phalanx of people who should know better trotting out the “cheap, cheap, cheap” renewables lie such as Emma Pinchbeck of EnergyUK on Times Radio and even Greg Jackson, founder and CEO of Octopus Energy (see Figure 6).

As we have seen above, gas-fired electricity is currently much cheaper than wind, even wind farms that have recently come online. The Octopus Energy claim, that gas is expensive and wind is cheap, strategically placed to the right of Mr Jackson’s head is clearly false.

Some activists are calling for levies (by which they mean subsidies) included in our electricity bills to be moved to gas, or even to general taxation (see Figure 7).

Moving electricity subsidies to gas would push up heating bills and moving them to general taxation would effectively hide the costs from the public. Of course, the latter is being pitched as the more “progressive” option. Surely, the most progressive thing would be to stop these subsidies altogether. The Government is bowing to this pressure and is considering moving some of the levies from electricity bills. Perhaps they realise that ever rising energy bills are not popular and will put their absurd Net Zero plans at risk. An anonymous source told the Telegraph that a lot of investment in heat pumps and electric cars is being held back because we have this “crazy energy situation.” Apparently, their source is unaware that the crazy situation is caused by the subsidies propping up intermittent renewables.

Putting Up Wind Generation

The other thing going up in the world of renewables is the installed capacity (see Figure 8).

Onshore wind capacity went up 535MW to 15,370MW, offshore up 818MW to 14,666MW and solar capacity rose 1,343MW to 15,993MW.

The increase in capacity also pushed up total amount of wind generation, although within that, onshore wind production fell. Solar PV generation went up too. However, overall electricity generation fell to 285.5GWh, the lowest on the Energy Trends record, going back to 1998, see Figure 9.

In Figure 9, coal and bioenergy have been lumped together, because burning trees (the largest component of biomass generation) produces more CO2 and as many particulates as burning coal. It does not seem appropriate to classify that as renewable or in any way green. Other includes hydro, wave/tidal, pumped storage and what the Government also classifies as “other fuels.” Wind and solar took a 33.5% share of total generation, up from 29% in 2022. Overall generation is down 28% since the peak in 2005. The thing is, we are supposed to be electrifying society with electric vehicles and heat pumps, so we should expect generation to be going up not down. The suspicion must be that the fall in generation is because of unaffordable prices curbing demand, increased electricity imports and industry relocating abroad.

Load Factors Falling

Just about the only thing about wind power that is not going up is the load factor (see Figure 10).

The load factor measures the actual output of a generator as a fraction of the theoretical nameplate capacity. The offshore wind load factor fell from 41.1% to 39.7% and onshore wind fell from 27.4% to 24.5%. Both are well short of the Government’s target for new developments commissioning in 2025. If load factors were improving, we would expect to see the average increasing as the share of newer, supposedly more efficient turbines goes up over time. But as is the case with many claims about renewables, reality is stubbornly refusing to conform to the theoretical models.

Conclusions

Even though the weighted average strike price of offshore wind has fallen, with Moray East and Hornsea 2 activating their CfDs, the absolute level of CfD subsidy will likely rise this year. Moreover, the offshore wind funded by ROCs will receive 9.7% more subsidy per MWh than last year, further increasing the subsidies paid to these generators. Onshore wind and solar will also receive more subsidies this year because of the indexation of CfDs and ROCs. FiT prices, mostly solar, will also have been indexed upwards from the beginning of April.

This will certainly put the wind up electricity consumers who are already struggling with their energy bills. These rising subsidies are also putting the wind up renewables activists who are sounding increasingly shrill in their claim that renewables are cheap. So much so, that there are now demands for these increasing costs to either be transferred to gas, to make gas look more expensive, or moved into general taxation where the costs can be effectively hidden.

Just about the only thing not going up in the wind industry is load factors which are stubbornly refusing to comply with the modelled forecasts.

The continuing increase in renewables subsidies is not tenable. But we are yet to see a politician brave enough to put the wind up the green energy industry and announce that there will be no more new subsidies.

If you have enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Excellent work exposing the corruption of our energy supply.

I updated my chart showing average CFD prices by technology against day ahead prices to cover the recent April indexation uplift

https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2024/05/Production-weighted-CFD-Strike-Prices-vs-IMRP-1714863079.2781.png

and likewise for wind, including ROC subsidies. I have used the actual final ROC value including recycle elements where this is know, and uplifted the cashout value by 13%, being the average recycle uplift where the final price is yet to be determined (i.e. since April 2023).

https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2024/05/Production-weighted-wind-princes-inc-floating-1714912436.393.png

The dramatic fall in day ahead prices is partly due to the big fall in gas prices, but also the fall in UKA carbon allowances, which have dropped to the point where RATS has been running coal much of the year because it is cheaper than gas (albeit they are now looking at trying to use up coal stocks rather than re-export them when it shuts down). A further influence has been low prices on interconnectors, motivated by ample gas stocks and high reservoir levels for hydro even in Spain - which has reduced French prices which have also been pressured lower by the return of nuclear capacity.