Why is my Energy Bill so High, Comrade?

Gas and electricity prices have fallen to pre-crisis levels, why are energy bills still high?

Introduction

Recently, the apparatchiks on the plenary committee of the people’s commissariat for energy, otherwise known as Ofgem, reset the price-cap for energy across the motherland. The headline average bill has fallen when compared to the prior period. However, despite wholesale energy prices falling to pre-crisis levels, the price cap is still much higher than before the crisis. Time to dig into the data to find out what is going on.

Wholesale Gas and Electricity Prices

Figure 1 shows what has happened to UK gas prices over the past ten years according to Trading Economics.

Similarly, Trading Economics also have a chart of UK electricity prices as shown in Figure 2.

Broadly speaking, both gas and electricity prices are back in the range we experienced before the gas price spiked in late 2021 and then rose further as sanctions were imposed on Russian gas in retaliation for Russia’s invasion of Ukraine in early 2022.

Ofgem Price Cap History

Ofgem publishes a dataset alongside its policy announcement. This shows the history of the price cap in two ways. The first uses historical consumption figures and calculates the price cap as it would have been calculated at the time. The second uses current consumption levels to calculate what the price cap would have been using current consumption. For the purposes of this analysis, the second of the two datasets has been used to avoid distortion caused by different consumption levels. Figure 3 shows how the current consumption based dual fuel price cap has changed over the period since April 2020.

We can see bills were relatively stable in the range ~£950-1,050 up to the period April-September 2021 and the began to rise sharply up to a peak of £3,865 at the beginning of 2023 in line with the increase in gas prices. The price-cap then began to fall, and the latest ex-VAT total is £1,610. However, despite both electricity and gas prices being back in the pre-crisis range, the price cap is some 56% higher than the April-September 2021 period. During that period, the total electricity component has risen 46% and the bill for gas has gone up 68%.

In its dataset, Ofgem breaks down the cost of the bill into twelve components. They also show the fixed portion of the bill, which is essentially the standing charge and the total bill assuming their standard consumption. The standard consumption is 2,700kWh of electricity and 11,500kWh of gas. Let us look at how those components have changed since April 2021.

Electricity Price Cap Changes

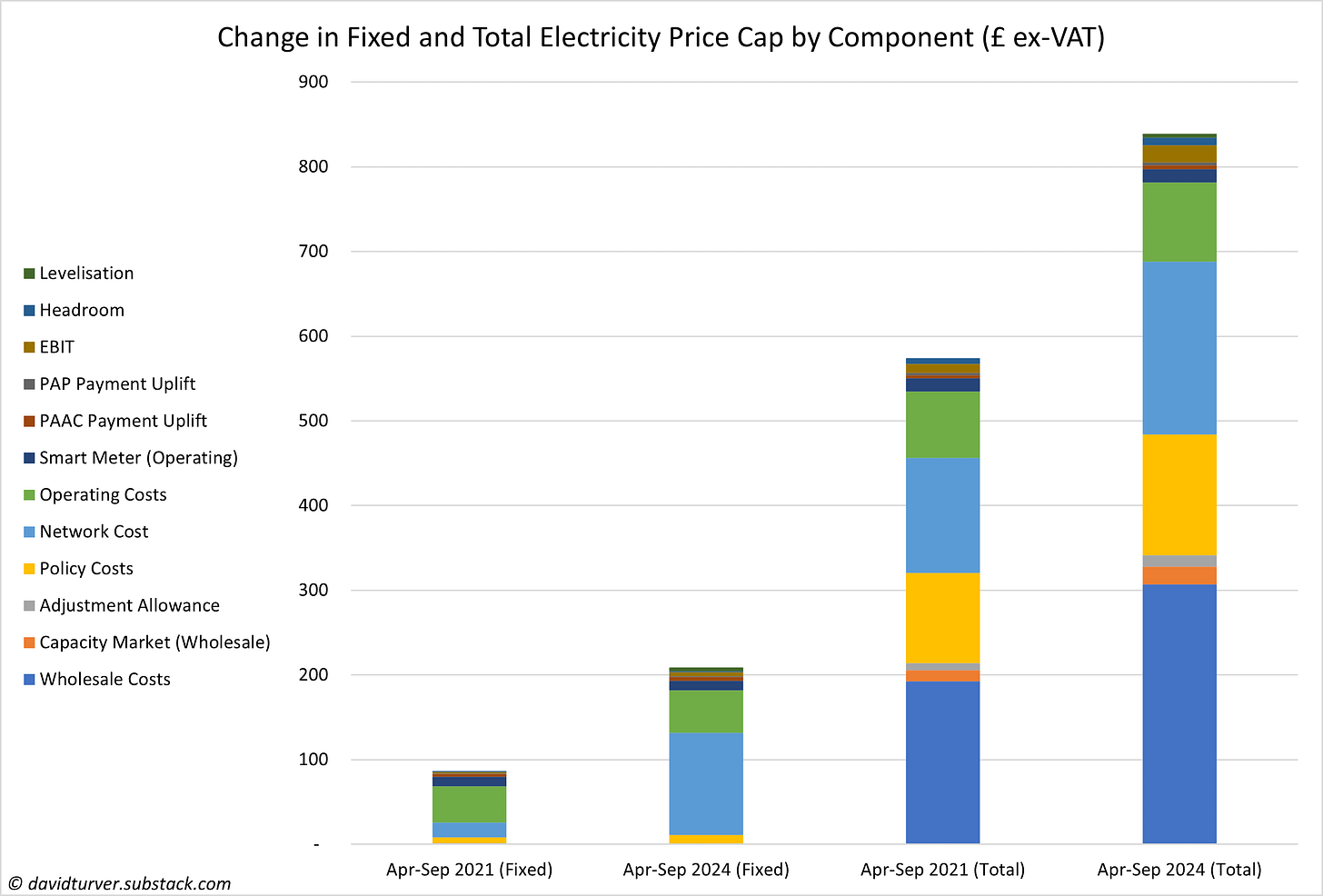

Figure 4 shows how the fixed element and total bill for electricity has changed since April 2021.

The fixed element of the electricity bill is up 141% over the period and the overall bill is up 46%. The main components of the increase in bills are network costs, policy costs, operating costs, wholesale electricity costs and profit (EBIT). Other costs such as payment uplifts for different methods of payment and headroom are up too, but they form only a small proportion of the total bills. Smart meter costs have fallen by £1. A new £4 “levelisation” charge has been introduced to ensure that prepayment meter customers and direct debit customers pay the same standing charge.

The fixed element of network costs has risen 592% from £17 in April 2021 to £121 in April this year. However, total network costs have risen by a more modest 51% from £136 to £204. This reflects the trend to charge many of these costs as fixed, rather than variable charges. However, the overall increase reflects the massive spending required to improve the transmission and distribution networks as well as the sizeable increase in grid balancing costs.

Total policy costs have gone up 34% from £106 to £142. This reflects the increase in Renewables Obligations, Feed-in-Tariffs, the Warm Homes Discount (WHD) and the Great British Insulation Scheme. Operating costs are up 19% to £94. Interestingly, the profit element is up 87% from £11 to £20. This partly reflects higher overall bills, but also reflects an increase in allowable margin from 1.9% in 2021 to 2.4% in 2024.

Wholesale electricity costs are up 59% from £193 to £307. This is partly because underlying assumption about wholesale electricity costs (See Annex 2) is up sharply from £51/MWh in April 2021 to £89/MWh this year. This is odd, because the back in February 2021, when the April 2021 price cap was calculated, the wholesale price was in the range £50-55/MWh (see Figure 2). The recent range has been £55-60/MWh, so the price cap is assuming wholesale costs about 50% above what the market is delivering. Moreover, the wholesale charge now includes the costs of servicing the CfD scheme, forecast to add £2.1bn to bills over the coming year. Capacity market costs have gone up 64% from £12 to £20, reflecting the increased costs of keeping the lights on when the wind is not blowing and the sun is not shining.

Much of the increase in costs is due to the increase in the various renewable subsidy arrangements and the extra costs we bear from the increased penetration of unreliable renewables. However, the underlying assumption about wholesale electricity costs also accounts for a substantial portion of the increase in the price cap since April 2021.

Gas Price Cap Changes

Figure 5 shows how the fixed element and total bill for electricity has changed since April 2021.

The fixed element of the gas bill is up 18% over the period and the overall bill is up 68%. The main components of the increase in bills are network costs, policy costs, operating costs, fuel costs and profit (EBIT). Other costs such as payment uplifts for different methods of payment and headroom are up too, but they form only a small proportion of the total bills. Smart meter costs have actually fallen by £10. Like with electricity, a new £6 “levelisation” charge has been introduced to ensure that prepayment meter customers and direct debit customers pay the same standing charge.

Overall network costs have risen by 38% from £119 to £164. Total policy costs have gone up a staggering 97% from £23 to £46. This reflects the increase in energy company obligations and the Warm Homes Discount. Operating costs are up 19% to £113. Interestingly, the profit element is up 130% from £9 to £20. This partly reflects higher overall bills, but also reflects an increase in allowable margin from 1.9% in 2021 to 2.6% in 2024.

The underlying wholesale gas price assumption is up sharply from £14.5/MWh in April 2021 to £33/MWh this year. These prices equate to 42p and 97p per therm, respectively. As Figure 1 shows, the wholesale price in February 2021 was 40-45p per therm and today is 60-65p per therm. It is odd that the latest price cap is assuming gas prices that are around 50% higher than the market.

Shifting Levies from Electricity to Gas

A cynic might conclude that they are keeping gas bills artificially high so they can shift some of the subsidies for electricity on to gas (see Figure 6). They could switch more of the policy costs of subsidies from electricity to gas, while reducing the wholesale gas price and keep gas bills at current elevated levels.

In his post on X, Andrew Sissons, Deputy Director for Sustainable Future at Nesta has argued for such a switch, as has Emma Pinchbeck of Energy UK (see Figure 7).

Moreover, in its sixth carbon budget, the Climate Change Committee called for a “rebalancing of policy costs between electricity and gas.” It is almost as if they are admitting renewables are expensive, so the costs need to be hidden by shifting the costs to gas, thus pushing up gas bills. In effect, this would be another boiler tax. This would also have the impact of making heat pumps more attractive compared to gas boilers.

Impact on Competition

One might assume that with the allowance for wholesale energy costs being much higher than the current market and the increased allowable profit margin, then there would be competitive pressure bringing down bills.

Back in 2021, there were a large number of energy suppliers and several ways that customers could shop around online for better deals such as U-Switch and Money Savings Expert’s (MSE) Cheap Energy Club. During the energy crisis, the Cheap Energy Club stopped offering comparisons because prices were effectively fixed by the Government’s various energy bill support schemes.

As we have seen above, underlying energy prices have now fallen dramatically, but the price cap is still assuming elevated prices. MSE has still not seen enough evidence of competition in the market to restart its comparison service. U-Switch is offering comparisons, but at the time of writing only two providers offered alternative prices for my home across four schemes. Only two of those schemes offered cheaper prices and both savings were smaller than the exit fee on my current bills with a fixed price agreed last summer with Octopus. It appears as though competition has been suppressed.

Conclusion

Energy prices are higher in part because of the increase in network and policy costs. However, the assumptions about wholesale energy prices are far higher than the market is currently delivering. It certainly looks like there is some jiggery-pokery going on with the wholesale prices of gas and electricity assumed in the price cap calculations. It maybe that the green lobbyists are getting their way, and the ground is being prepared for a shift of levies from electricity to gas. In effect, artificially inflating gas bills to make renewables look cheaper.

It also appears the price “cap” has in effect become a fixed price and competition in the market has all but evaporated. Not only that, the allowable profit margin has also increased. It is a well-established economic principle that price controls in the end lead to higher prices. In fact, the IEA predicted in 2015 that the then proposed energy price freeze would lead to higher prices.

It is time for the apparatchiks at the Ofgem commissariat to loosen their grip and let competition drive down prices once again. If we can eliminate entirely the massive subsidies and extra network costs for renewables at the same time, prices will be even lower.

If you have enjoyed this article, please share it with your family, friends and colleagues and sing up to receive more content.

National Grid has barely started on its rewiring programme although its fair to say that the two Scottish operators have been spending big although we aren't seeing much benefit as constraint payments North of B6 boundary still remain very large element of balancing costs as well as TuoS charges being higher. So as NG works get underway we will see ever increasing charges for the "wires and cables" element in the energy cap for the next decade.

One thing that is fairer is those on prepayment meters now being charged the same as everyone else so im happy to the adjustment for that. Then we have all the other social schemes though like warm home discount which is the increased despite the lower charges now applicable for prepayment meters! The energy company obligation which in my area is now up 22% is money pit who ensures how the money is spent. ROCs you've mentioned but 15% overall increase in cost to the end consumer although i know its only CPI to the generators.

All in all its about time the mainstream media got hold of this and exposed how much of our electricity (and gas) costs are nothing to do with world events but self inflicted wounds.

Very illuminating. Thanks. This is rampant eco-communism (aka stakeholder capitalism), Green in tooth and claw, softly, surreptitiously, ripping its way through our energy markets.