Offshore Wind is the New Big Lie

The latest levelised costs of energy for offshore wind far too low, ignoring cost increases and interest rate rises.

If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State.

Attributed to Joseph Goebbels

Introduction

Last year, various commentators reacted with glee when some offshore wind developers won CfD contracts at 2012 prices as low as £37.35/MWh. After accounting for inflation, those CFD contracts were worth £45.37/MWh in March 2023 and will continue to increase with inflation. Last week, the Government released its latest levelised costs of energy (LCOE) report that showed the current LCOE for offshore wind was £44/MWh. The new report has been lauded by renewable energy advocates like Dr Simon Evans from Carbon Brief. However, Vattenfall has recently pulled out of the Norfolk Boreas offshore wind farm project which was one of those awarded last year. It took a financial hit of over £400m and cited rising commodity prices and costs of capital as reasons for getting cold feet. If real companies investing real money are pulling out of projects at such low strike prices how can the Government claim that the cost of offshore wind lower than those companies would now receive This analysis demonstrates the faulty assumptions in the Government’s calculations and exposes the big lie at the heart of the renewable energy debate and the wider Net Zero agenda.

Government Claims for Levelised Cost of Energy 2023

A comparison of the change in the costs of different energy technologies from the 2020 report and the 2023 report is shown in Figure 1. Both datasets are for technology to be deployed in 2025.

As can be seen, the LCOE of gas has gone up 34% from £85/MWh to £114/MWh. The cost of offshore wind has fallen 23% from £57/MWh to £44/MWh. Onshore wind and large scale solar have fallen 4% and 7% respectively. There is a change in the cost basis from 2018 prices in the 2020 report to 2021 prices in the 2023 report.

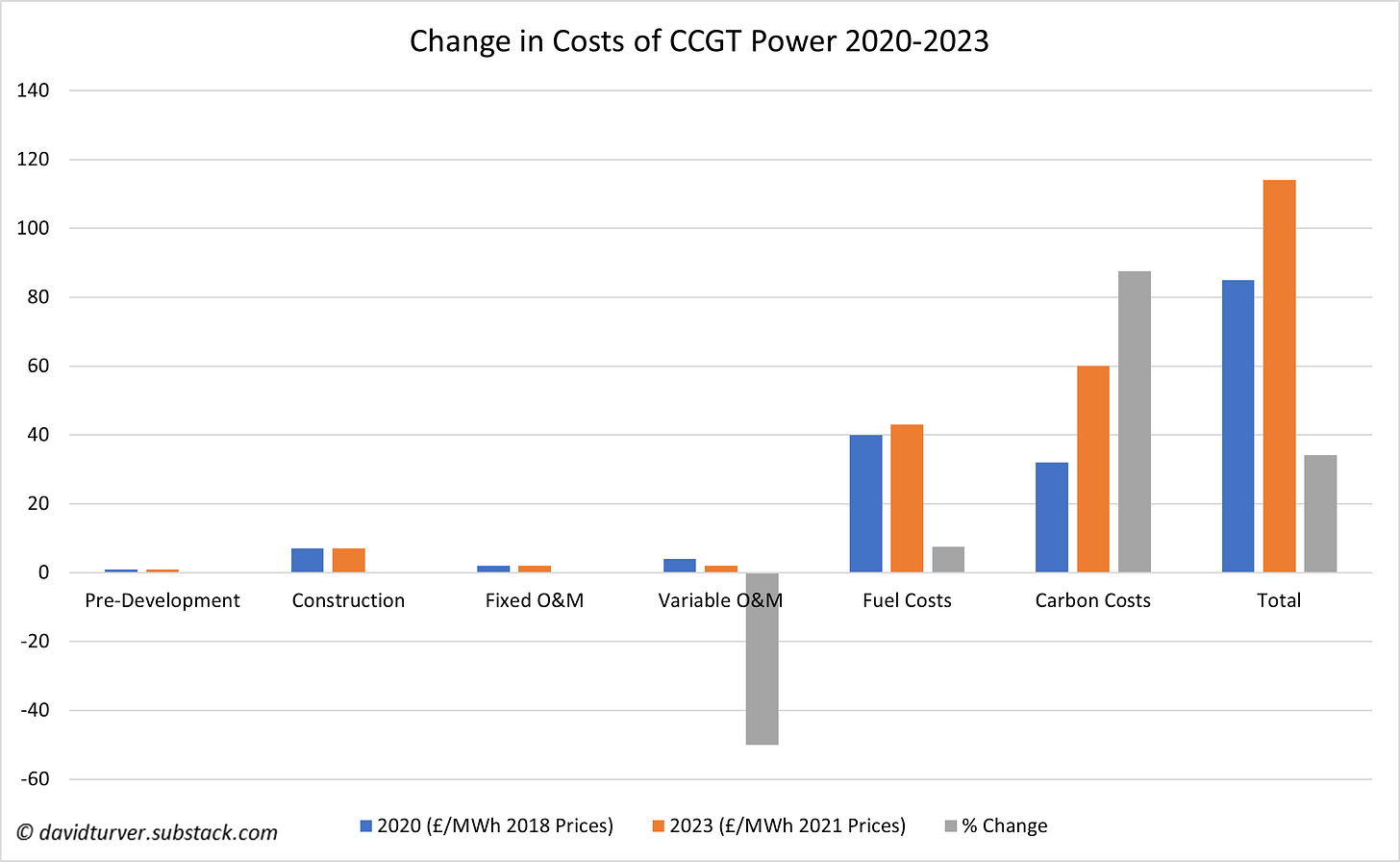

Cost Drivers for Gas-fired Power (CCGT)

Digging into the figures, the change in the elements making up the cost of gas-fired power is shown in Figure 2.

The biggest change is in the costs of carbon which goes up 88% from £32/MWh to £60/MWh. This effective carbon tax now makes up more than half the cost of gas-fired electricity. Fuel costs have gone up 8% while variable operations and maintenance (O&M) costs have fallen 50% to £2/MWh. If the carbon tax were removed, the cost of gas would be only slightly higher than the reported cost of wind power. They also assume a 7.5% cost of capital, 1.2% higher than that assumed for offshore wind and 2.3% more than onshore wind.

Cost Drivers for Offshore Wind

The change in the elements making up the cost of offshore wind power is shown in Figure 3.

Almost all of the elements that make up the overall costs have seen reductions in cost. Predevelopment costs have fallen 33% to £2/MWh. Construction costs have fallen 26% from £31/MWh to £23/MWh. Fixed O&M costs have fallen from £19/MWh to £17/MWh and variable O&M costs have fallen from £3/MWh to £1/MWh. Decommissioning and waste costs remained stable at £1/MWh. Buried in the detail of the annex containing key assumptions, we can see that the assumed load factor has increased from 51% in 2020 to 61% in 2023. This means they are largely relying on the increase in load factor to produce more energy from the same equipment, thus reducing the cost per unit.

They have also assumed a big 81% reduction in infrastructure costs from £344.8m for a 1GW offshore plant for 2025 deployment in the 2020 report to £64.3m in the 2023 report. Incidentally, the 2016 report had infrastructure costs of £323m for Offshore Round 3. Also hidden in the annex is an increase in absolute fixed O&M costs which must be offset by the aforementioned increase in load factor. Connection and system usage charges have been reduced from £56,800/MW of capacity/year to £44,800/MW/year. Importantly, the discount rate or cost of capital has remained the same at 6.3%.

How Realistic are the Government Assumptions about Offshore Wind?

Now let us go through how realistic these assumptions are, bearing in mind Vattenfall’s recent decision. Moreover, renewables lobbyists have been warning for some time that Government estimates of offshore wind costs are way too low and have been calling for even more subsidies at higher strike prices.

Load Factor

Starting with the load factor, as mentioned above, they have assumed that the load factor will rise from the 51% assumed in 2020 to 61% in the latest report. In developments due to deliver in 2040, they assume the load factor goes up to 69%, compared to the 63% they assumed in the 2020 report. However, as can be seen in Figure 4, all of the assumptions they have made are way above the actual performance of offshore wind farms already installed. Data from the Government’s Renewable Energy Trends Capacity and Generation.

As can be seen, the maximum load factor achieved by offshore wind was 45.7% in 2020. The average over the past five years has been 41%. For the Government to assume that new offshore wind farms will achieve a 20-point increase in load factor for each and every year of their lives compared to the average of the past five years is clearly ridiculous.

Cost of Capital

They have kept the assumed cost of capital stable at 6.3%. Back in their 2016 report, they assumed a discount rate of 8.9% for offshore wind. As we all know interest rates have risen substantially since 2020. For most of 2020, the Bank of England base rate was 0.1%. Now it is 5.25%. Moreover, gilt yields have also risen substantially. I have expressed the hurdle rates in 2016 and 2020 as premiums to the average of the 10-year and 30-year gilt yields as shown in Figure 5.

Using the average of the premiums in 2016 and 2020 I have calculated 11% as a more realistic cost of capital for 2023. Given gilt yields are where they are, 6.3% as a cost of capital for offshore wind is totally unrealistic. As we shall see below, this has a substantial impact on the LCOE.

Construction and Infrastructure Costs

The prices charged by wind turbine manufacturers have increased substantially since 2020 as shown in Figure 6.

Siemens Gamesa’s onshore prices have gone up 32% and Vestas’ Offshore and Onshore prices have increased 62% between the fourth quarter of 2020 and the fourth quarter of 2022. Averaging these two figures gives an increase of 47%. Yet, the Government has assumed that construction costs have remained stable at £1,500/kW. Given commodity and fuel costs have gone up substantially since 2020, it is also inconceivable that infrastructure costs have fallen over 80% since 2020. This is especially so as newer offshore windfarms are likely further offshore, probably in deeper water and will require deeper foundations and longer cables to connect them to shore.

Offshore Wind LCOE Sensitivity Analysis

Pulling all this together, I have conducted a sensitivity analysis of the costs of offshore wind. The results are shown in Figure 7.

By putting the various parameters in the 2023 Annex into a discounted cashflow model, I came up with a baseline cost of £44.64/MWh, just a rounding error away from the Government’s £44/MWh. If the construction costs are increased by the average 47% increase in turbine costs, the infrastructure and variable O&M costs are restored to 2020 levels, then the LCOE increases nearly 39% to £61.50/MWh. Increasing the discount rate from 6.3% to 11% pushes up the cost ~37% to £61.13/MWh. Pushing the load factor down from 61% to the 41% average for the past five years increases the cost over 47% to £65.91/MWh. Moreover, the assumed asset life of 30 years seems excessive given that Siemens has recently taken a $1.1bn charge to cover warranty claims and 25 years is typically used as an asset life in developers’ published accounts. Reducing the life to 25 years increases the costs 4.5% to £46.66/MWh.

Taking all those sensitivity factors into account together pushes the cost LCOE up by a staggering 193.6% to £131.05/MWh. Remember, this does not include the substantial costs of balancing the grid due to the inherent intermittency of wind power. Nor does it include the massive costs of installing new power lines to connect the offshore wind farms to the parts of the country that need the power. Taken together, these dodgy assumptions amount to the big lie that offshore wind is cheap.

Conclusions

In Figure 8, I have stripped out the carbon costs for gas-fired generation because that is an artificial cost. The carbon costs are more akin to an arbitrary tax. I have also plugged in the numbers for offshore wind based on the more realistic estimates I went through above.

And low and behold, gas-fired generation comes out much cheaper than offshore wind.

We always seem to be hearing claims of “cheap and clean” offshore wind from Government, lobbyists and commentators. In effect, the nation is being gaslighted into believing that offshore wind is cheap. The reality is that claims of cheap offshore wind are just a big lie to keep the whole Net Zero edifice intact. It looks suspiciously like policy-based evidence making.

Not only that, National Grid ESO uses the same flawed LCOE figures and ignores EROEI to design the grid of the future. The false claims of “cheap” offshore wind are part of the reason why they are coming up with a Heath-Robinson (for US readers Rube-Goldberg) grid design with as yet unproven hydrogen and compressed air storage as the means of mitigating intermittency. It transpires that the underpinning calculations are just a sham.

This is a national scandal that needs to be exposed and the people responsible removed from office. Now, before we see even more damage.

[Update 7 August 2023: An abridged version of this article has been published in the Telegraph. And free to view here.]

If you enjoyed this article then please share with your family, friends and colleagues and sign up for more content.

These Govt Green Energy activists will stop at nothing to promote their pet beliefs. I've been in construction for 30+yrs and I don't care what major infrastructure project you are tackling the cost savings being predicted are ridiculous. Everyone in the UK has experienced massive increases to their energy costs and it all coincides with expanding renewables Final thought to ponder... when was the last time the Govt was able to estimate the costs of infrastructure work to any degree of moderate accuracy? Answer - NEVER. Great piece of work David.

There is a simple way to gauge the cost of Weather-Dependent "Renewables". Take comparative costs say from the US EIA and divide them by the productivity they achieve. That gives you a true comparative cost of providing a unit of power to the grid.

The simple sums which are optimistic for "Renewables" are shown here

https://edmhdotme.wpcomstaging.com/a-comparative-costing-model-for-power-generation-technologies/

and here

https://edmhdotme.wpcomstaging.com/a-few-graphs-say-it-all-for-renewables/