Lies, Damned Lies and Wind Power Lobbyists

Despite lobbyists claiming wind is cheap, wind power costs are rising sharply

It Is Difficult to Get a Man to Understand Something When His Salary Depends Upon His Not Understanding It. Upton Sinclair

Introduction

It seems hardly a day goes by without some lobby group or other claiming that renewables and in particular wind power are cheap and we should quickly install more capacity. For example, Renewable UK tweeted that new clean energy projects will deliver cheaper power (See Figure 1).

It’s worth remembering that Renewable UK include EDF Renewables, Equinor, RES, Scottish Power Renewables, SSE Renewables, Siemens Gamesa and Vestas among their Sponsoring Members. All those companies have investments in or vested interests in UK wind.

Energy UK have also got in on the act. In fact, they have gone through the looking glass, claiming we need more subsidies for wind at higher prices to bring energy bills down (emphasis mine):

“Developers are facing challenging investment conditions, but the Government simply hasn’t gone far enough in recognising the effect of higher costs in the forthcoming round.

“The stark reality is that without rapid Government intervention, the UK is set to fall short of our clean energy targets. As the 2030 target moves further and further into the distance it will lead to increased costs and emissions, and risk the UK falling behind in an increasingly competitive international market.

“We’re calling on the Government to revisit the AR5 budget, and to take urgent action to ensure the UK continues to attract crucial international investment. We have been a leader in offshore wind, but underdelivering on the Contracts for Difference programme will jeopardize the UK’s ability to maintain and expand our position as a clean energy superpower. We can’t afford to lose out on homegrown energy projects that will bring down bills, lower emissions, and bolster our energy security.”

Energy UK also lists many of the same companies with vested interests in wind power as “full members” such as EDF, Equinor, SSE and Scottish Power. Time to look at the real numbers.

UK Grid Balancing Costs Soaring

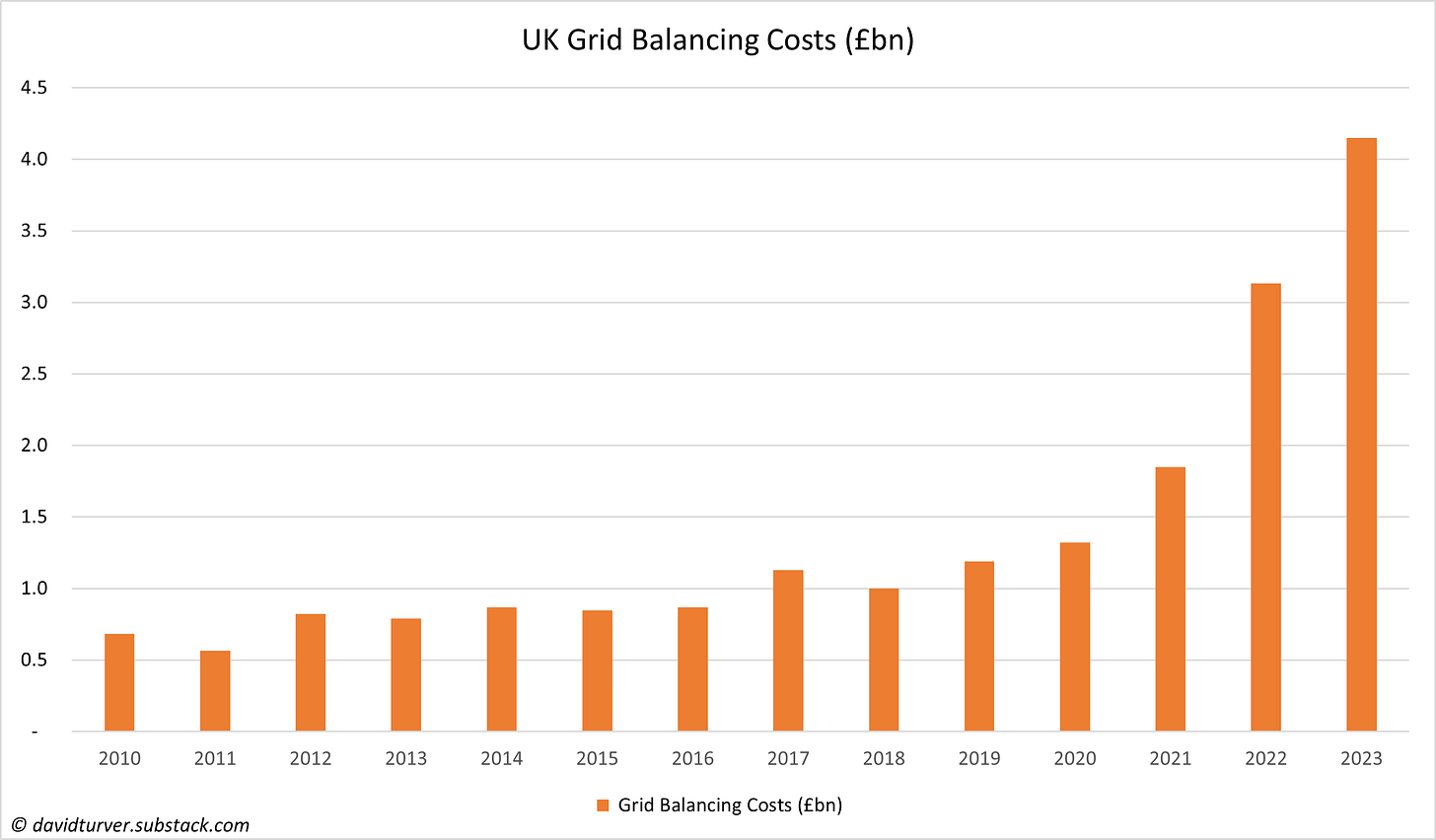

Grid balancing costs are the hidden costs of renewables. They arise because wind and solar in particular are intermittent and need to be backed up when the wind isn’t blowing or the sun isn’t shining. This costs money that should be properly attributed to renewables.

Recently, National Grid has released the Monthly Balancing Services Summary (MBSS) report which shows the cost of balancing the grid for fiscal year ended March 2023. By combining this with prior year data we can see the trend in Figure 3.

Grid balancing costs soared by over £1bn from 21/22 to £4.1bn in 22/23. These costs are not included in the CfD strike prices for wind, but they do make their way on to our bills. Adding more wind or solar power is only going to make this problem worse.

Wind Power CfD Strike Prices Rising

The Low Carbon Contracts Company (LCCC) has also released a new report on Contract for Difference (CfD) payments made to wind generators and updates to the strike prices. Claims that wind power is cheap also arise from its proponents only quoting the original CfD strike price. However, CfD prices rise each year with inflation, so the recent big increase reflected the current high rates of inflation. Figure 4 shows a chart of strike prices in £/MWh for each offshore wind farm by year.

The lines for Dudgeon and Burbo Bank are the same as for Walney, so appear hidden on the chart. For this financial year, all three are being paid £209/MWh. Similarly, except for year 23/24, the lines for Beatrice (£186/MWh) and Hornsea (£196/MWh) are very similar so they are difficult to differentiate. Triton Knoll will be paid £107/MWh this year. It is clear to see is that prices are rising and they will continue to rise for the life of the contracts, so claims of “cheap wind” are false. The prices paid under Renewable Obligation Contract (ROC) scheme that funds older wind farms are also index-linked, so they too will be rising fast.

Wind Power CfD Payments Rising Again

The increase in the strike price is reflected in the rising payments being made to wind farms under the CfD scheme. For a brief period in late 2021 and parts of 2022 wind farms were being paid more for the electricity they generated than the strike prices, so they had to make repayments. As gas and wholesale electricity prices have fallen, they are now back to harvesting subsidies at a rate of over £100m per month as can be seen in Figure 5. This means that the market reference prices have fallen below the CfD strike prices, which means that wind is more expensive than the market, the complete opposite of cheap. These subsidies are likely to rise in May because market reference prices have fallen since April.

Industry Prices for Wind Turbines Rising

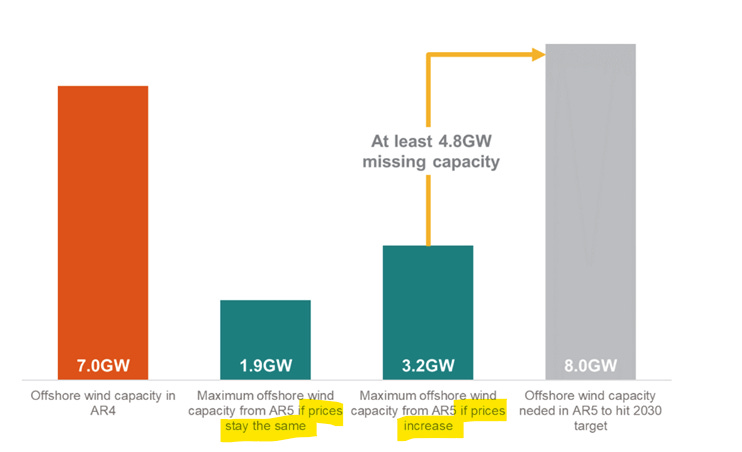

Proponents of wind farms say that future wind farms will be much cheaper, sometimes even claiming wind power is nine times cheaper than gas. However, even Energy UK and Renewables UK are reluctantly admitting the extraordinarily low bids that won Allocation Round 4 (AR4) last year will not get built for those prices.

This is because industry prices per MW of turbine capacity have risen sharply as seen in Figure 6.

The data comes from the investor presentations of Siemens Gamesa and Vestas. It shows that turbine prices have risen 51% and 62% respectively since 4Q20. Since producing that chart, Vestas have released their 1Q23 figures that show a reduction in selling prices, however, they say this is down to changes in the mix and foreign exchange and underlying selling prices are unaffected. Their service order book is index-linked, so maintenance costs for wind farms are rising too.

Conclusions

The reality is that prices of wind power from already installed wind farms are very high and will continue to rise with inflation. Not only that, as penetration of renewables increases, the hidden costs of balancing the grid will likely go up too. There will be no respite from future developments (if they ever happen) because the costs of turbines has risen as well as the costs of capital and maintenance. And after all that expense, all we get is unreliable energy.

It is clear that lobbyists are going through contortions to maintain their support for “cheap” wind power. I suspect it is easier for the people in those institutions to construct narratives than to understand the numbers. Of course, understanding the numbers will be even harder when the funding of their organisations depends on not understanding them.

The edifice is crumbling. The Government should call time on this sham.

This is a bonus article that I couldn’t resist writing after seeing some nonsense on Twitter. I will return in late June with an article on how to bring down the costs of nuclear power. If you have enjoyed this article, please share it with your family, friends and colleagues and sign-up to receive more content.

I just saw your post on twitter. Essentially, the question is how efficient wind power is. To be efficient, the energy used to construct wind power stations, including construction, must be much less than the energy produced by these structures. It would be fantastic if you could find data on it. I simply don't have time to delve into it.

Is there a good explanation anywhere of how these CFDs are supposed to work? I’m having trouble understanding the mechanism and where the data on it all is published. If it is. How does this “market” actually work? Something not right when wind generators get paid gas prices... unless that’s what those refunds were? The whole thing seems way too complex. So you can’t see what’s going on.