How to Make Nuclear Power Cheaper

What we can learn from others to reduce construction costs, bring down the cost of capital and cut build times

Introduction

Over the past weeks and months I have covered the flaws of renewables and the risible UK plans for a decarbonised grid. I also put forward an alternative plan for a largely nuclear-powered grid that would deliver more reliable energy with a smaller overall environmental footprint than relying heavily on wind and solar power. However, I acknowledged one of the pitfalls of nuclear is the apparent high costs and long lead times for delivery of large new power plants.

The purpose of this article is to look at how we might deliver nuclear power faster and at a lower cost. The area is a bit of a minefield with different currencies used and values derived at different times, However, I have tried to highlight the currency and time basis in each comparison below.

Mechanics of Levelised Cost of Nuclear Energy Calculations

Let’s begin by looking at how levelised cost of energy (LCOE) calculations actually work. Essentially, they are discounted cashflow models. First the costs of pre-development, construction and infrastructure are estimated and spread over an appropriate timeline. Second, the operating costs, insurance and connection charges that will be incurred during the working life of the plant are estimated as well as the expected revenue from generating electricity. Then the total cashflows for each year are calculated. Once completed, you get a spreadsheet that looks at little like the one shown in Figure 1 below.

The “discounted” part of the cash flow model then works like this. The time value of money assumes that cash you have today is worth more than cash you might receive in the future. The value of cashflows across the lifetime of the project are discounted at an appropriate rate, usually the cost of capital. Once you have set an appropriate discount rate, you can vary the price of electricity sold to produce a Net Present Value of zero for the discounted cashflows over the lifetime of the asset.

This is a big problem for nuclear because in the Government LCOE calculation, first revenue is not achieved until Year 14 of the project and by then the discounted value of the revenue is only 30% of its nominal value using their discount rate of 8.9%. After that, the discounted value tails off sharply so that by Year 33 of the project the discounted value is only 5.5% of nominal value and by Year 73, the 60th year of operation, the discounted value of the revenue is only 0.2% of the nominal value.

The impact of this is that the final 40 years (two thirds) of the anticipated 60-year life only contribute 19.2% of the Net Present Value (NPV) of the total revenue. In effect, the long lifespan of nuclear power plants does not attract much value in DCF models even though that energy is likely to be very valuable at that time. This problem only gets worse if the lifetime of the plant is extended to 80 years. By contrast, wind and solar power plants would probably have to be replaced twice in the lifetime of the nuclear power plant and this is never considered in their LCOE models. The other problem is the LCOE models do not attribute a value to the stable power provided by nuclear and do not add in the costs required to produce stable dispatchable power to renewables.

I do not have a solution to these problems other than to highlight these inherent weaknesses in the evaluation method. The OECD and others have looked at a concept called Value Adjusted LCOE (VALCOE) to try and address the value of the energy provided, but that is beyond the scope of this article.

Sensitivity of Nuclear Power Costs to Changing Parameters

Having looked at the mechanics of LCOE calculation, it is now time to examine how sensitive the cost of nuclear power is to change in the parameters of construction cost, discount rate and construction time. My starting point for this analysis is the Government’s LCOE calculation for nuclear power published in 2016. I have tried to get their LCOE to match the results of my DCF model, but I can’t quite get it to match. The Government published a figure of £95/MWh and my calculations came to £92.70/MWh, both in real 2014 prices. The difference may well be due to variations in the ramp up profile of energy production or the treatment of decommissioning costs of £2/MWh that do not appear in the Government’s detailed costing parameters but do appear in their final LCOE number. However, I think the result I achieved is close enough for the purposes these numbers are now going to be used. By contrast in the 2016 report Offshore wind came out at £100/MWh.

It is possible to vary the different elements of the DCF calculation to work out the impact on the LCOE. For this article I have modelled an 20% increase and decrease in construction costs; shortening the pre-development time from 5 years to 3 years and the build time from 8 years to 6 years; as well as reducing the discount rate from 8.9% to 6.3% and 4.5%. The results are shown in Figure 2 below. If all three variables can be moved in a favourable direction (lower cost, shorter build time and cheaper money), the impact is massive.

Increasing or decreasing the construction and infrastructure costs by 20% increases or decreases the LCOE by close to 15% to £106.46 or £78.93/MWh respectively.

Reducing the discount rate to 6.3% from 8.9% reduces the LCOE by over 30% to £64.84/MWh. I chose 6.3% because this is the discount rate used by the Government for Offshore Wind in its 2020 Generation Costs report. It had used 8.9% for Offshore Wind in its 2016 Generation Costs report. A big part of the reported cost reduction in wind power from £100/MWh in 2016 (2014 real prices) to £57/MWh in 2020 (in 2018 real prices) was driven by this reduction in the cost of capital. The 2020 report did not update the costs of new nuclear, so the reported costs of nuclear were kept artificially high.

If the discount rate could be reduced to the current UK Government cost of borrowing around 4.5%, then the levelised cost of nuclear power falls more than 46% to £49.54/MWh.

Reducing the predevelopment time from 5 years to 3 years and the build time to 6 years from 8 years cuts the LCOE by 8% to £85.33/MWh.

As can be seen the most important elements to focus on to bring down the costs of nuclear are construction costs and the cost of capital (the discount rate). Reducing the development and build time does reduce costs, but not by a huge amount. In reality, I suspect the cost reduction from reducing build time will be larger because costs are also likely to fall because the project management overhead will be carried for less time. Combining the improvements in construction costs, build time and cutting the discount rate to 6.3% results in a reduction in the levelised cost of nuclear power of over 42% to £53.16/MWh. This would put nuclear power on a par with the cost of gas-fired electricity prior to the recent price spike. It would also put the cost of nuclear lower than even the 2020 estimate of offshore wind, without even taking account of the extra costs of intermittency.

Now we have established the main sensitivity factors let’s examine how realistic it is to achieve those financial goals.

Reducing Construction Costs of Nuclear Power

First, taking the pessimistic view, the track record of delivering new nuclear plants in the West has been poor in the past decade or so. Several projects have been/are being delivered with large cost and time overruns. These include projects to deliver the French EPR reactor design in Flamanville (original estimate €3.3bn latest cost estimate €19.1bn, Olkiluoto in Finland (original estimate €3bn, delivered for €11bn) and Taishan in China. Many of the problems have been related to poor quality welds, for instance in the cooling system and containment vessel, and in sub-standard quality in the materials used for the pressure vessel. Problems have also been encountered in the Vogtle project in the US, delivering two Westinghouse AP1000 reactors, including a complete re-design of the containment building during the construction phase. The Barakah plant in the UAE is the first nuclear plant in the Arab world, built to a Korean design by KEPCO that was delivered for $24.4bn around 22% than the original estimate of $20bn.

It is clear that large projects are inherently difficult to bring in on time and on budget. However, it is also clear that many of the problems faced have been due to immature designs, lack of recent experience and under-developed supply chains. This is a consequence of Western nations not having serious nuclear development plans since the 1980s. Good ways to fix these problems would be to stabilise the designs, develop the supply chains and learn through practice.

The UK Government estimated that the learning benefit from delivering a number of nuclear reactors would be considerable. It’s estimate of £95/MWh for the first of a kind (FOAK) fell to £78/MWh for the Nth of a kind (NOAK), both in real 2014 values, a reduction of nearly 18%. The only thing to vary was the construction costs, which means they estimated a reduction in construction costs of more than the 20% I postulated above.

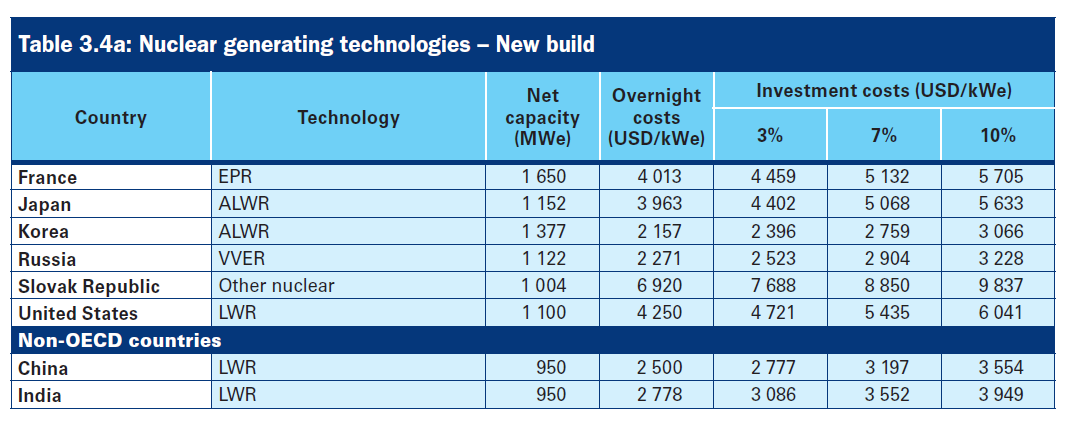

The OECD also produced their own estimates of the costs of new nuclear power plants for a range of technologies in a number of different countries. Their estimates are reproduced in Figure 3 below. Note that these costs are expressed in 2018 US dollars and will therefore be higher than if they were expressed in 2014 dollars.

It certainly looks like western countries have a lot to learn from Korea, China, India and even Russia. I have converted the dollar amounts above into GBP at current exchange rates, added the Barakah plant and summarised the results in Figure 4 below for an easier comparison.

It certainly looks like reductions in construction costs of 20% or more are achievable. However, we should probably look to Korea for expertise and technology rather than France. If we were to commit to a programme of 10-15 multi-reactor plants to deliver 30-50GW of power, partnering with Korea we could rebuild domestic expertise and supply chains and deliver new nuclear plants at considerably lower cost than the Hinkley C plant being built using French EPR technology.

We should also note that commodity prices have increased considerably since these estimates were produced which will likely increase the current costs of all generating technologies above those estimated above. However, the relative positions of the different solutions are likely to remain largely unchanged.

Reducing Costs of Nuclear Power Through Small Modular Reactors (SMRs)

No discussion about reducing construction costs of nuclear power would be complete without mentioning Small Modular Reactors (SMRs). Typical large nuclear reactors are of 1GW capacity or more and are often built in clusters of 2, 3 or 4 reactors to deliver a power plant generating 3-5GW of power. Most of the construction of this type of project tends to be carried out on-site in relatively uncontrolled conditions which is one of the reasons why they suffer from the cost overruns outlined above. One way of mitigating this is to standardise on a smaller design that can be largely constructed as modules in the controlled conditions of a factory where it is easier to control quality and economies can be achieved from improving processes over time through production of a relatively large volume of power plants. This is where SMRs come in.

There are many SMR concepts in various stages of design. Two of the most promising designs are NuScale’s VOYGR reactor modules and Rolls Royce’s SMR. NuScale has agreements in place to build reactors in several locations including Idaho, Romania and Poland. NuScale’s initial target in 2016 was to supply electricity at $55/MWh (£45.23/MWh at today’s exchange rate). However, they announced earlier this year that increasing commodity prices and costs of capital have pushed that to $89/MWh (£70/MWh) in 2022 dollars.

The Rolls-Royce estimates a LCOE of £35-50/MWh dependent upon the financing model, based on 2019 economics. We might expect this to rise as Roll-Royce will face the same challenges as NuScale in terms of rising costs of materials and increasing interest rates.

We might expect the delivered cost of all generation technologies (including renewables) to rise because they will face the same inflationary pressures as conventional and SMR nuclear. It will be important to ensure that any cost comparison between technologies is carried out using a similar cost basis.

Cost of Financing Nuclear Power Plants

As we saw in Figure 1 above, cost of capital is probably the largest driver of the LCOE for large-scale nuclear power plants. If we are to bring down the costs of nuclear power, a mechanism needs to be found to reduce the cost of capital. The hurdle rate used in 2016 was 8.9% that represented a ~7% premium to the average of the 10-year and 30-year gilt yields prevalent around that time. At the time of writing, the average of the 10-year and 30-years gilt yields is ~4.3%. If hurdle rate was to rise to say, 10% to reflect rising interest rates, then the LCOE of nuclear power would rise from £92.70/MWh in the model above to £106.62/MWh.

If we are to bring costs down, we need to find a way for nuclear developers to fund their projects at a lower cost. One method under consideration is a “Regulated Asset Base” (RAB) model. This works by allowing nuclear developers to claim regulated revenues to cover the interest costs associated with developing the project. For capital intensive, long lead time projects like nuclear power plants, the costs of finance represent a very large part of the overall cost. Allowing developers to claim revenues to cover interest costs reduces the overall funding requirement and it is claimed this brings down the overall cost to the consumer compared to the CfD model used for Hinkley C. However, the disadvantage of this approach is that consumers bear an extra charge on their bills during the build phase to cover the cost of interest.

I have been unable to find any detailed information on how the RAB model will work in practice. However, I did produce a rudimentary model of my own that should be treated with a large pinch of salt. This suggested using the same baseline costs and shorter development timescales discussed below and using the baseline 8.9% cost of capital, the LCOE falls from £85.33/MWh in Figure 1 to around £70.39/MWh. Reducing the discount rate to 6.3% brings the LCOE down further to £54.33/MWh.

Clearly, there are opportunities to reduce the costs of capital to bring down the costs of nuclear power as assumed in the 2016 report. Even in these days of increasing interest rates, it should be possible to reduce the effective cost of capital using the RAB model.

Speeding Up Delivery of Nuclear Power

There are two elements to my proposals to speed up delivery. The first is a cut in the predevelopment time from five years to three years. The second is a cut in the construction time from the eight years in the Government’s LCOE calculation to six years.

Cutting the Pre-Development Time for Nuclear Power Plants

The overall process for approving nuclear power plants has been set out by the Office for Nuclear Regulation. They propose a two-phase process. The first phase is the Generic Design Assessment or GDA and is outlined in Figure 5.

This part of the process is intended to sign-off on the basic design of the proposed reactor. The indicative timeline indicates this part of the process should take 46-48months.

The second part of the process is the licensing and permitting of the proposed site as shown in Figure 6. It is intended that this part of the process takes 12-18 months.

The most obvious way of cutting the overall timeline from 5 years to three years is to standardise on a small number of “approved” reactor types. For instance, France’s EPR, Korea’s APR-1400 or Westinghouse’s AP1000. This should enable the GDA to be cut to say 18 months to approve any minor improvements made to the design between installations. The site assessment could remain at 12-18 months and then the predevelopment phase is cut to 30-36 months or less than three years. Of course, any parallel planning permission/public enquiry process would also need to be restricted to operate within this timeline too.

Cutting Nuclear Power Plant Construction Times

Hannah Ritchie has published an excellent piece on the build time of nuclear reactors. She found that over many decades the average time to build a nuclear reactor is 6-8 years, with the median time being 6.3 years and the mean at 7.5 years. In addition, one-in-five reactors have been built in less than 5 years. Of course, some projects have had long over-runs, sometimes over multiple decades, for example Hinkley C, France’s Flamanville and Vogtle Units 3 & 4 in the US. She also found that build time did not vary significantly by the capacity or type of plant.

Hannah also produced an analysis of build times by country and I have reproduced her table below in Figure 7.

Japan, South Korea and China are the fastest countries to build nuclear reactors, with means and medians in the five to six-year range. However, most countries with a nuclear fleet can and have built quickly. In the UK, we built one reactor in less than three years. This shows that cutting build times to six years can be done and in fact we have already done it in the UK.

I am swayed by the argument that the recent slowdown in western performance is down to lack of practice. There have not been many new nuclear plants built in Europe or the US since the 1980’s. Like an athlete coming back from injury, getting back to peak performance will take some time and commitment. If we are to cut build times, we need to standardise on a small number of designs and commit to large build programmes so we can learn from the process and each subsequent build becomes easier and quicker. If we are to decarbonise the grid and the wider economy, I have already argued that nuclear must be a large part of the future generation capacity. I think this should be a mix of conventional large-scale plants and SMRs. There’s certainly opportunity to commit to 30-50GW of capacity, say 10 to 15 Hinkley C sized projects. That should be more than enough to gain experience to bring down build times.

Conclusions on Reducing the Cost of Nuclear Power

The main factors governing the levelised cost of nuclear power are cost of capital (discount rate), construction costs and build times. This article has looked at the art of the possible on those three parameters.

My conclusion is that the cost of capital of nuclear can be reduced to the level used in the Government’s 2020 cost of energy report for offshore wind. Further improvements could be made by using the RAB model. Recent increases in interest rates will hit all forms of energy production and maybe nuclear power more than others because of the very long-term nature of the cashflows. However, policymakers should place additional weight on the actual value of the nuclear power delivered 30, 40 or 60 years in the future. The energy delivered will be reliable and stable, exactly what we will need as the backbone of the grid to power a modern economy.

Construction costs can certainly be reduced, possibly by more than the 20% assumed in my model (in 2014 terms) by learning from places like Korea and rebuilding our own domestic strategic capability. Here in 2023, costs have likely increased, but the relative cost performance of other countries is still likely to be better and we should learn from them.

We have built nuclear power plants much faster than the Government’s estimated 8 years. Other countries are consistently achieving build times in the 5 to 6-year range. With commitment and practice, we should be able to achieve fast build times again. However, that will require standardising on a very small number of designs that will also allow the pre-development time to be cut to the proposed three years too.

Taken together, these actions should reduce the LCOE of nuclear power to ~£55/MWh in 2014 pounds. Of course, recent increases in commodity costs and rising interest rates will push up that cost in 2023 terms. However, other forms of generation will have increased too, so it is important that comparisons are made on a like-for-like basis. In particular, extra value should be attributed to long term, stable nuclear generation and the additional costs of intermittent generation should be factored into any comparison.

The key to achieving these benefits is Government commitment over a couple of decades to a very significant build programme, similar to France’s Messmer programme of the 1970s and 80s and to support the rebuilding of our domestic capability in partnership with friendly countries. This will also require a focus on a very small number of pre-approved designs.

No discussion about reducing the costs of nuclear power would be complete without mentioning SMRs. This technology holds much promise, with the Rolls-Royce SMR offering to produce power in the £35-50/MWh in 2019 pounds, depending upon the financing model. The Government should get on with approving the first Rolls-Royce SMR so we can see if the reality lives up to the promise.

If you have enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content using the buttons below.

Work on Calder Hall, the World's first grid scale nuclear power station began in 1953 and the station opened 17 October 1956.

The station was closed on 31 March 2003, the first reactor having been in use for nearly 47 years.

So what has gone wrong?

Here's another view on the speed of building nuclear power plants.

https://jackdevanney.substack.com/p/nuclear-power-is-too-slow

ThorCon expects 2-year construction time for shipyard built 500 MW power plants, to deliver electric power under $0.035/kWh. Reasons include

High temperature, low pressure molten salt fission heat source, ergo 46% efficiency.

Designed specifically for construction by skilled, experienced, competitive shipyards in Asia.

Efficient regulation in developing markets yearning for more, ample, reliable, cheaper electricity.

Please explore website pages including ThorConPower.com/news