UK Industrial Electricity Prices Still Highest in Europe

New Government data for 2H2024 shows the UK has the highest industrial electricity prices in Europe

Introduction

Every six months, the Government publishes comparisons of energy prices across Europe. The latest data for the second half of 2024 was published a few days ago.

The data covers the 27 countries that make up the EU plus the UK. All prices quoted below are in pence per kilowatt hour and include taxes and levies. This article updates the analysis of EU energy data for the first half of 2024. We will have to wait until the Autumn to update the energy prices for 2023 for IEA countries with 2024 data.

The latest results are just as horrifying as the earlier analysis.

EU and UK Industrial Electricity Prices

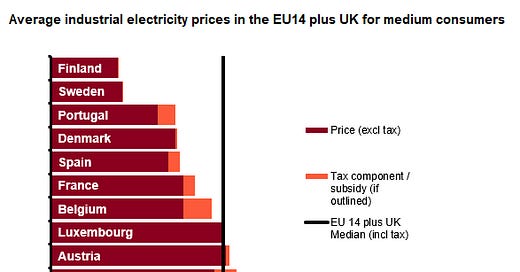

The Government includes a chart to compare average industrial electricity prices of the EU14 countries (Table 5.4.1) which shows UK prices are almost twice the EU average for medium consumers (see Figure A).

UK industrial electricity prices for medium users are some 89.3% higher than the EU14 median. For large and very large users, the relative position is even worse with UK prices more than 132% and 113% respectively higher than the EU14 median. UK industrial electricity prices are also higher than the rest of the full EU27. Very large users in the UK pay 22.32p/kWh, more than five times more than Finland, with the lowest prices, where large industrial users pay just 4.19p/kWh.

We can see how prices for large users have evolved compared to France, Germany and the EU14 median in Figure B below.

In 2008, UK prices were below those of Germany and only slightly above the EU14 median. By 2020, prices had risen steadily to be well above those of Germany, France and EU14 median. Prices then rose further, partly because of the energy crisis, and have fallen back somewhat but the gap between the EU14 and the UK is still very wide indeed.

We cannot hope to compete in traditional energy intensive industries or industries of the future like making batteries or AI with such extortionate electricity prices. Without drastic action, further deindustrialisation is inevitable.

EU and UK Industrial Gas Prices

Turning to industrial gas prices (Table 5.8.1) as shown in Figure C, at first glance, the picture looks a little more sanguine.

UK industrial gas prices are below the median of the EU14. This sounds reasonable, until you remember that last year, the Government published data for industrial gas prices across the IEA for 2023 that showed UK prices were some five times higher than the US and Canada. Europe, through its refusal to exploit its own shale gas resources, has priced itself out of international markets. This is a big reason why European deindustrialisation is also inevitable.

EU and UK Domestic Gas Prices

Domestic gas prices (Table 5.10.1) present an even better picture than industrial gas prices as shown in Figure D.

UK domestic gas prices are pretty much the lowest in the EU14 and well below the EU14 median for the second half of 2024. Luxembourg is a special case where the price excluding taxes and levies is lower than when they are included. However, Bulgaria, Croatia, Estonia, Hungary, Lithuania and Romania all have much lower domestic gas prices than the UK. Hungary has the lowest price at 2.64p/kWh.

UK and EU Domestic Electricity Prices

Sadly, UK domestic electricity prices (Table 5.6.1) are much less competitive than gas prices, as seen in Figure E.

The UK has improved from the first half of 2024 because we now have the fourth highest domestic electricity prices in the EU14, down from third in the first half. Our prices are below only Ireland, Germany and Denmark, all with large proportions of their power coming from intermittent renewables. UK prices are 25.4% higher than the EU14 median and 43.9% higher than the median for the EU27.

Big Gap Between Gas and Electricity Prices

The data also shows a very large gap between domestic gas and electricity prices, particularly for small users as shown in Figure F.

In 2011, small domestic electricity consumers paid 14.99p/kWh for electricity and 5.16p/kWh for gas, a gap of 9.84p/kWh. In the second half of 2024, these consumers were paying 33.75p/kWh and 9.96p/kWh respectively, making the gap widen to 24.11p/kWh. Small consumers pay 29.4% more for their electricity than large domestic users and 58% more for their gas, reflecting very high standing charges. This shows how high standing charges disproportionately impact the poorest small users.

This large gap between gas and electricity prices perhaps explains why the Climate Change Committee and Ed Miliband are desperate to move the cost of renewables subsidies from electricity to gas.

They want to hide the cost of their ruinous policies in our gas bills, so making gas more expensive so it is easier to sell heat pumps and EVs to the public. Of course, the poorest and most vulnerable will be hit by this most, making more expensive to heat their homes. They never explain how these charges will be levied once we're all using heat pumps. Classic bait and switch tactics.

Conclusions

When it comes to gas prices, the UK is very competitive compared to the EU average. But this is something of a pyrrhic victory because European gas prices are so much higher than key industrial competitors like the US and Canada.

However, when we turn to electricity prices, the UK is woefully uncompetitive, particularly for industry where our prices are much more than double those in the EU for large users. When we factor in EU prices being very much higher than other international competitors, then we can see the UK position is dire. This level of price differential is an existential threat to the economy.

We can pretend to be “climate leaders” on the world stage by setting a mission for a Net Zero grid by 2030, but this comes at the cost of winning the gold medal in the international industrial electricity price Olympics.

We can also see that it is not the gas price that is driving our electricity prices to such uncompetitive levels, because our industrial gas prices are competitive in Europe. As discussed previously renewables are much more expensive than gas-fired electricity. We pay about £12bn per year in renewables subsidies and over £3bn in the extra costs of grid balancing and backup. There is an extra £112bn of transmission network costs in the pipeline to connect remote, intermittent renewables to the grid that will continue to push up prices.

All this is in direct contradiction to Labour’s number one mission of increasing economic growth. As discussed earlier, Labour’s top two missions of high growth and Net Zero are mutually incompatible; we cannot have top tier growth with such high industrial electricity prices.

Having the highest industrial electricity prices in the EU and by extension the rest of the developed world, ought to be considered a national emergency. The Government’s primary mission should be to cut energy prices because cheap energy is the key to unlocking growth. In addition, the pernicious impact of high fixed charges on our gas and electricity bills is making the poorest suffer most from this madness in energy markets. Surely, the “progressive” thing to do would be to cut energy prices, as discussed here.

It is good to see rising disquiet in the press about high energy prices, but there is precious little sign that Labour is paying attention. We can but hope that reality dawns on the Government before the economy collapses under the weight of Net Zero.

Recently we achieved two significant milestones. First, we have published for more than 100 weeks in a row, putting us in the top 1% of publishers. Second, I am very grateful to have attracted over 100 paying customers which now makes Eigen Values a Bestseller on Substack. Thank you for your continued support.

This Substack now has over 4,100 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Thanks for the analysis. I'm less worried about the gas price advantage North America has. Although it has been a massive boon for them as soon as supply < consumption + LNG export the prices will return to 'normal' they just have a glut of gas due to fracking.

The industrial electricity price on the other hand is a huge problem. How RR isn't shouting about this internally every day I don't know; get energy right and the rest is easy. How any industry in the UK survives at all is a miracle.

Thank you David. I find the thought that those in power may not have made the connection between energy and the economy and may really be that dim, very unsettling. It brings to mind Bob Monkhouse: "I want to die peacefully in my sleep like my grandfather, not screaming in terror like his passengers".