The Great Unravelling

The social and economic fabric of the nation is unravelling. Rational energy policy must be part of the solution.

Social Fabric Unravelling

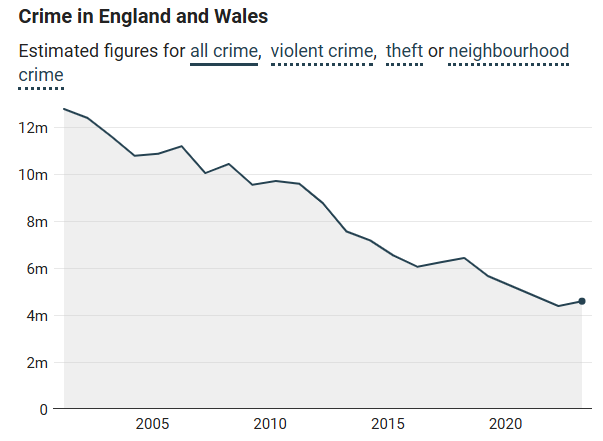

Fraser Nelson has recently made the news with an article in The Times that basically claims that we never had it so good. Nelson displayed a chart (see Figure 1) using data from Crime Survey of England that shows overall crime is falling.

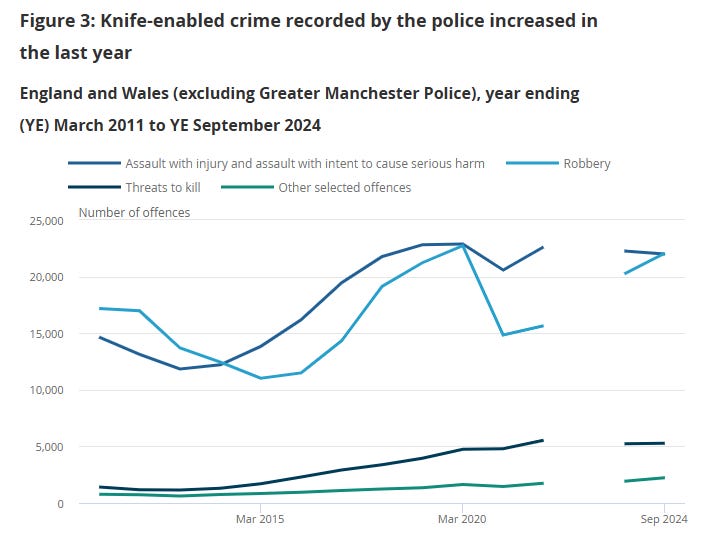

However, a more in-depth analysis of the crime statistics from the ONS shows a somewhat different story. As Figure 2 shows, knife crime is rising.

And although the ONS do not show a chart, they report an increase in sexual offences. The increasing prevalence of locked cabinets in supermarkets also reflects a pernicious erosion of trust and a wider unravelling of the social fabric of the nation.

The erosion of trust is also evident in the growing perception of two-tier policing. The Southport rioters were dealt with quickly and harshly, however the trial of former Labour councillor Ricky Jones was delayed and he was acquitted even though there is video evidence of him in front of a baying mob calling for people to have their throats cut.

Dissembling and Censorship Erode Trust

The sense of distrust of is exacerbated when even after the cover up of industrial-scale abuse of young girls in places like Rotherham, Rochdale and Telford, the police advised Warwickshire Council to hide the identity of the people suspected of kidnapping and seriously assaulting a 12-year old girl in Nuneaton. The police even lied about escorting counter-protesters to confront those concerned about the conduct of unvetted illegal migrants in a hotel in Epping. If the authorities are prepared to dissemble over such serious matters, then what else are they prepared to lie about and cover up?

For over a decade, the Treasury fooled itself into believing that mass migration has a positive effect on the economy. Now it emerges that an official from the OBR has serious concerns that middle and low income migrants are each a net drain of £0.4-1.5m on the public finances over the long term.

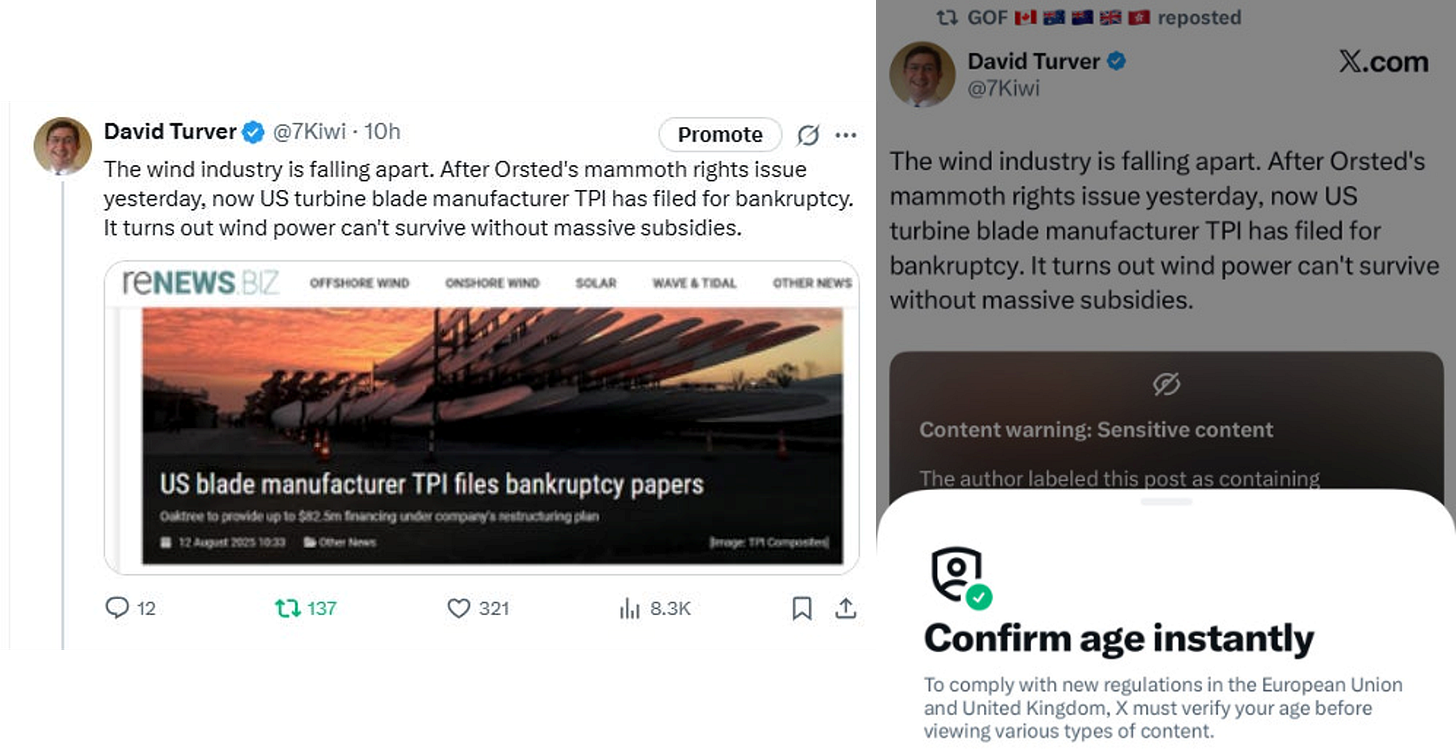

Now that the deception is being exposed, censorship is increasing and there are moves to implement greater controls over ordinary people. There have been louder calls for the introduction of digital-id, Tony Blair’s universal solution to all problems. The new Online Safety Act is increasing censorship and has so far included censoring Katie Lam’s speech in the House of Commons. Yours truly has even had a post censored (see Figure 3) about the bankruptcy of a US turbine blade manufacturer.

There are plenty of obscene things about the wind power industry, but nothing that justifies censorship.

Economies Unravelling

This unravelling of the social fabric is a symptom of a broader unravelling of the economy. As we have covered before, GDP per son has all but stagnated since 2007. But the economic malaise is not confined to the UK, it infects other G7 nations too. We have idiotic professors supporting Modern Monetary Theory and claiming that we can never run out of money, because the government can just print more pounds (see Figure 4).

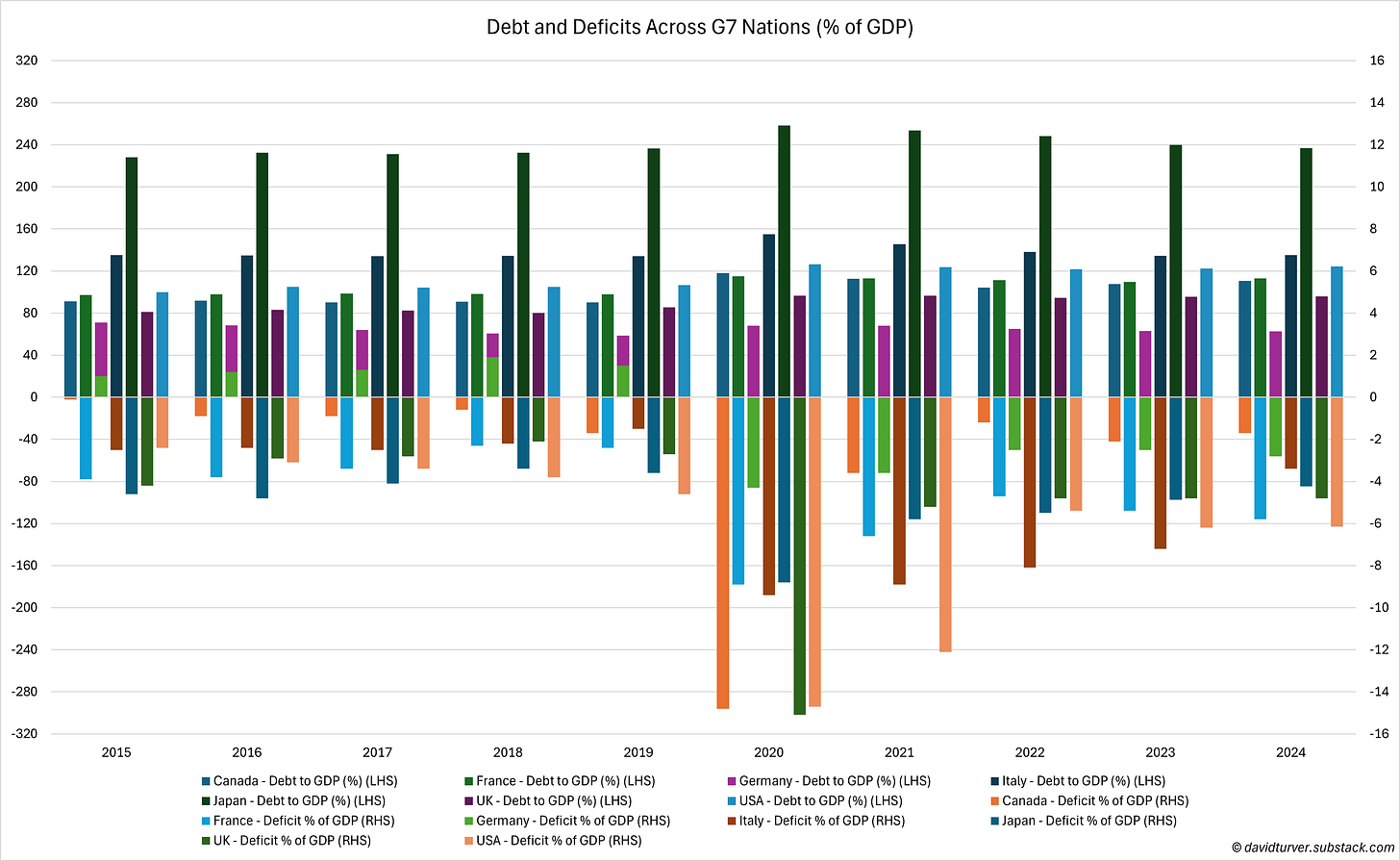

We can see the stupidity of his proposition by looking at debt and deficits as in Figure 5 using data from Trading Economics.

Debt to GDP ratios have been rising over the past decade. Five of the seven nations, Canada, France, Italy, Japan and the USA have debt to GDP ratios over 100%, with Japan well over that threshold with debt at 237% of GDP. The UK is almost at the threshold with debt at 96% of GDP. It can only be a matter of time before we cross the event horizon of 100% debt to GDP with the latest forecast from NIESR of a £50bn black hole in the public finances. Yet the Government unable to pass a law to make even a small reduction in welfare spending and is committed to spending tens of billions of pounds on the Chagos Islands giveaway, overseas climate aid and carbon capture machines.

Deficits have remained stubbornly higher than pre-Covid times and will make it difficult to bring down the debt to GDP ratio and impossible to bring down the debt in absolute terms. In the UK during the last fiscal year, we paid £105bn in debt interest out of the £148bn we borrowed. As Liam Halligan noted, the UK public finances are rapidly resembling a Ponzi scheme.

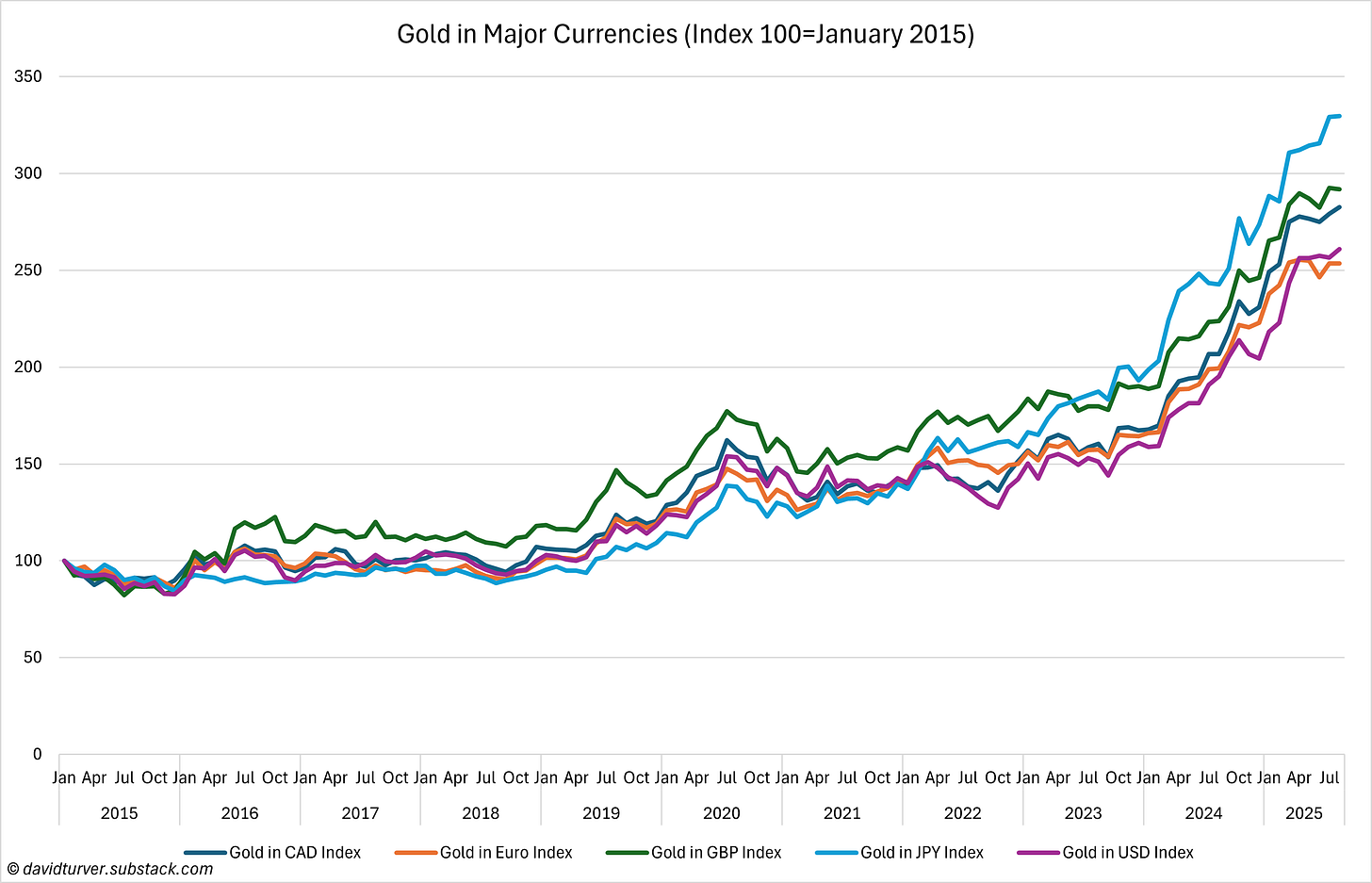

We can see the recklessness of Professor Murphy and others like him because all the G7 currencies are rapidly devaluing against gold (see Figure 6, all currencies based to 100 against gold in January 2015, data from investing.com).

The more pounds, dollars, euros and yen are printed, the less each is worth. The Yen has devalued most against gold since 2015, but the pound is the second worst performer. The chart for all major currencies is starting to resemble the early stages of the demise of the German Mark under the Weimar Republic in the early 1920s that eventually led to hyper-inflation and the rise of very dark forces.

Debt is a Claim on Dwindling Energy

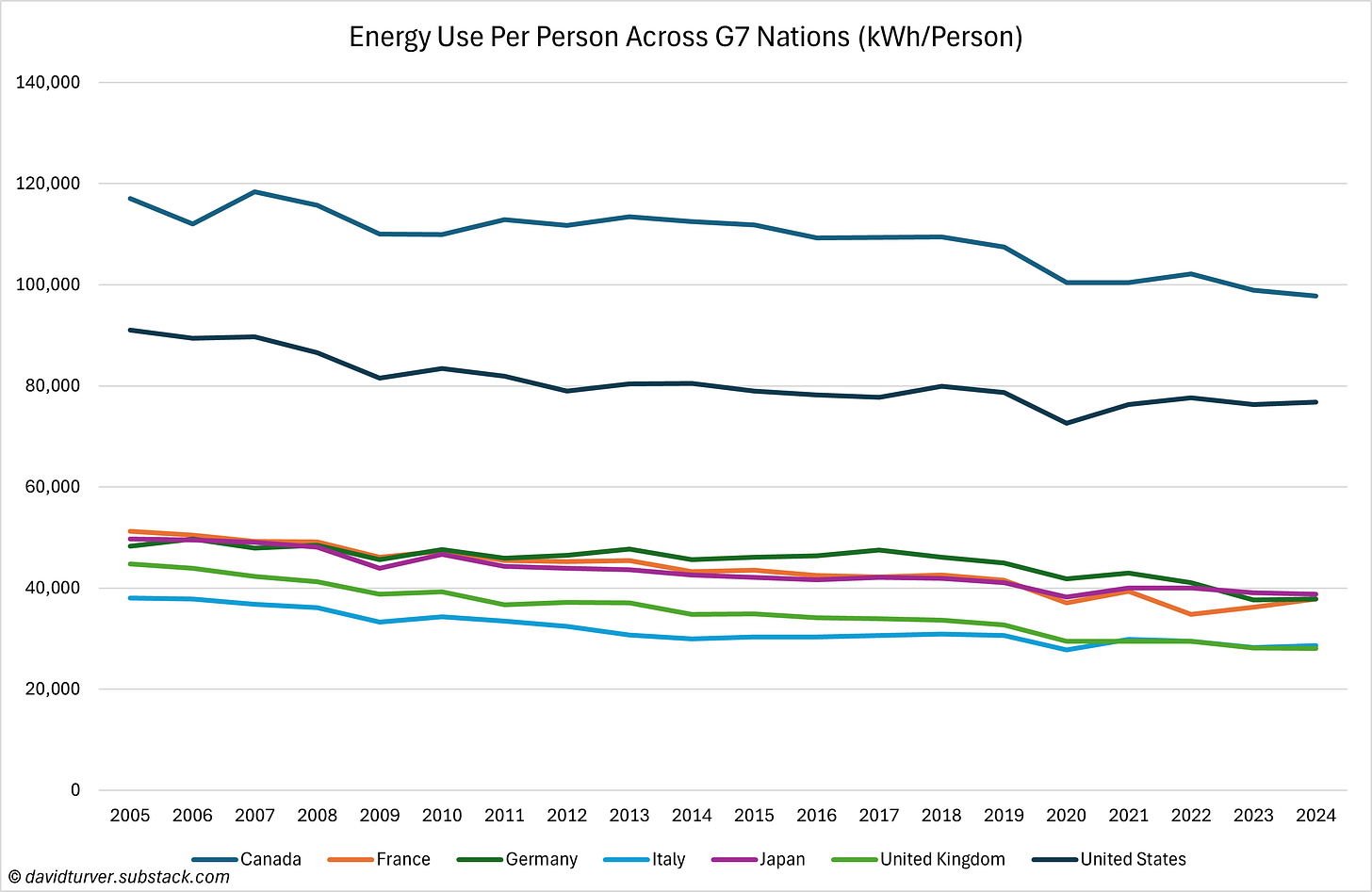

So, why does this matter to a Substack that is mostly concerned with energy? We need to consider that debt is borrowing from the future output of the economy. In effect, debt is a claim on future labour, minerals and energy. The reason the big increase in debt and deficits matters more than ever is because energy consumption per capita across the G7 nations is falling, so we are becoming progressively less able to repay the debt (see Figure 7 sourced from Our World in Data).

Energy use per person has fallen least in the US and Canada, both by about 16% since 2005. France, Germany, Italy and Japan have seen reductions of 22-26%. The UK has seen the largest fall in energy consumption with a reduction of 37% since 2005 and we now have the lowest energy consumption per capita amongst the G7. We should note that Fraser Nelson lauded our 53% reduction in greenhouse gas emissions as one of the UK success stories we should be proud of. He seems unconcerned about rapid deindustrialisation and the loss of well-paid jobs in highly productive industries.

Money printing is bound to devalue the currency. Money printing with reduced energy consumption is a toxic cocktail that will end up in economic dislocation, huge currency devaluations and possibly hyper-inflation. This is why central banks, particularly from developing countries, are buying gold.

We have seen that the social fabric is unravelling and unless we change course rapidly we are heading for a much bigger unravelling of the main developed economies. It is too early to say if the authorities in each country will voluntarily change course or whether they will be forced to by global bond markets.

Net Zero Unravelling

Before we all become too depressed and start overdosing on black pills, there are signs that the institutional stupidity that has captured the ruling powers for decades may be losing its grip and the whole Net Zero agenda may be unravelling too.

First we had the Supreme Court confirm that a woman is an adult human female. It is staggering that we needed the court to tell us this, but nevertheless it is a sign that reality is beginning to triumph over fantasy. As mentioned above, we have also seen a senior official from the OBR admitting that mass uncontrolled immigration is not such a great idea.

On energy, we see signs that Berlin Wall holding up Net Zero is beginning to crack. First, the US has declared a national energy emergency and is focusing on cheap and reliable energy abundance. Second, New Zealand has lifted the Ardern-era ban on new oil and gas exploration and BP has decided to re-open the Murlach oil and gas field because new technology means they can recover more hydrocarbons. The boss of Mercedes Benz has warned that the 2035 ban on new petrol and diesel cars by 2035 has plunged Europe’s car industry into crisis. In the UK, the cosy consensus on Net Zero has collapsed with the Reform Party saying it will strike down any contracts signed in the upcoming AR7 renewables auction.

There are also signs that the renewable energy industry is falling apart. Three years ago Siemens Energy was forced to take back control of the wind turbine unit Siemens Gamesa after poor performance. China’s solar companies quietly shed a third of their workforce last year as the companies grapple with excess capacity and steep losses. Ailing offshore wind giant Orsted has been forced to make a massive $9bn rights issue to shore up its finances and its share price has plunged as a result. The share price of other quoted wind power companies like Greencoat is down 29% from its peak in September 2022. Turbine maker Vestas’ share price peaked in early 2021 and has since fallen by 63%.

Conclusions

We have seen that despite the Micawber-like proclamations of Fraser Nelson the social fabric of the nation is unravelling. Uncontrolled immigration is a significant factor in this decline, but energy scarcity is also leading to rapid economic decline. So we also face a wider economic unravelling resulting from irresponsible spending, excessive money-printing and reckless energy policy.

We need to arrest the decline of the UK and other western countries that we can see around us every day. We have to hope that Net Zero unravels faster than the social and economic fabric of the nation and there is enough time to put us back on to the path to prosperity before we go down the dark path of hyper-inflation and the inevitable political upheaval that will bring.

This Substack now has over 4,400 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content. I would be grateful if more people would sign up for a paid subscription, so for a limited time I am offering a discount off annual subscriptions.

Excellent article. I’ve already worked reference to it into a post I’ve been drafting on the same theme (but not as broad) entitled “The Charade of Net Zero”.

President Trump will hopefully shield us, as long as he survives. Sample paragraphs from my draft without the hyperlinks:

“Overcoming these deeply-embedded malign globalist goals and the malign influence of globalist bodies like the WEF might seem like an insuperable task but all it needs is a courageous leader prepared to sidestep unaccountable globalist agencies and treat them as irrelevant, as steely President Trump is doing in the USA.

He is terminating Net Zero, stopping corruptly-abetted mass immigration, neutering the tyrannical WHO and Big Pharma, restoring freedom of speech, dismantling DEI wokery and “draining the swamp” of institutionalised grift. With meticulous planning he is taking a wrecking ball to everything people like Starmer believe in. No wonder people like Barack Obama wanted him in prison, or dead.

For many years our UK Uniparty politicians have conspired together to disenfranchise the electorate on many major issues, particularly on climate change and Net Zero. They have clearly been acting against the interests of the general public, increasingly so over the last few troubled years. They are more aligned to the dubious interests of the Davos WEF UN Big Money globalist establishment, as Starmer has openly admitted, than to the best interests of the people they are supposed to serve.

Their days of outrageous political overreach are nearing an end. The electorate is fighting back all over the world. Energy analyst David Turner ventures into a broader analysis to join the dots on how and why our social fabric is unravelling in this landmark article. The majority of our Uniparty politicians have shown themselves to be rotten (bad or mad) and they need to be swept away.”

Great post David. The rot runs deep and sadly it starts at the top of the intellectual head of the fish in the universities. See if you can find graduates who even recognise the names Karl Popper and Jacques Barzun.

https://rafechampion.substack.com/p/the-two-faces-of-karl-popper

https://rafechampion.substack.com/p/jacques-barzuns-monumental-contribution

One way to lower the crime rate is to stop counting all the crimes, that's what they did in Washington DC.