Net Zero Restricts Bill Cuts in Price Cap Change

Although bills have fallen, electricity bills have fallen by less than gas bills.

Introduction

Last week Ofgem announced the new energy price cap for the period July-September 2025. The good news is that overall bills (including VAT) have fallen £129 or 7%.

This move was broadly welcomed by various industry commentators such as Energy UK. They reluctantly admitted that the reduction in the price cap was driven by falling gas prices. However, they did insist that producing more of “our own clean power is the right way to stabilise bills over the long term.” Note, they no longer claim that renewables will cut bills, they only talk about stabilisation, presumably at today’s still elevated levels.

Ed Miliband welcomed the news but insisted that the only way we get long term energy security is through cheap, clean homegrown power. Maybe he means nuclear, because as we discussed last week, renewables are much more expensive than gas. He went on to say that we need to get off the rollercoaster of fossil fuel markets.

This article looks at how our energy bills have changed since the introduction of the price cap and what has changed since the last price cap announcement three months ago.

Gas Bills

We will start with gas bills that have fallen 9.3% or £81 since the last price cap was announced. Of the (ex-VAT) total of £797, £408 is the actual price of gas, £351 is other costs such as the cost of the gas network, operation costs of the suppliers and profit. Our gas bills also include £39 of Net Zero related costs. These form part of the Policy Costs in our gas bills and include the Energy Company Obligation (ECO) partly designed to reduce carbon dioxide emissions and the Green Gas Levy that funds the production of biomethane.

Electricity Bills

Electricity bills (ex-VAT) have fallen by only 4.7% or £42 since the last price cap to £840. Note that the percentage reduction is only about half the reduction in our gas bills, which indicates that factors other than gas are having a significant impact on electricity bills.

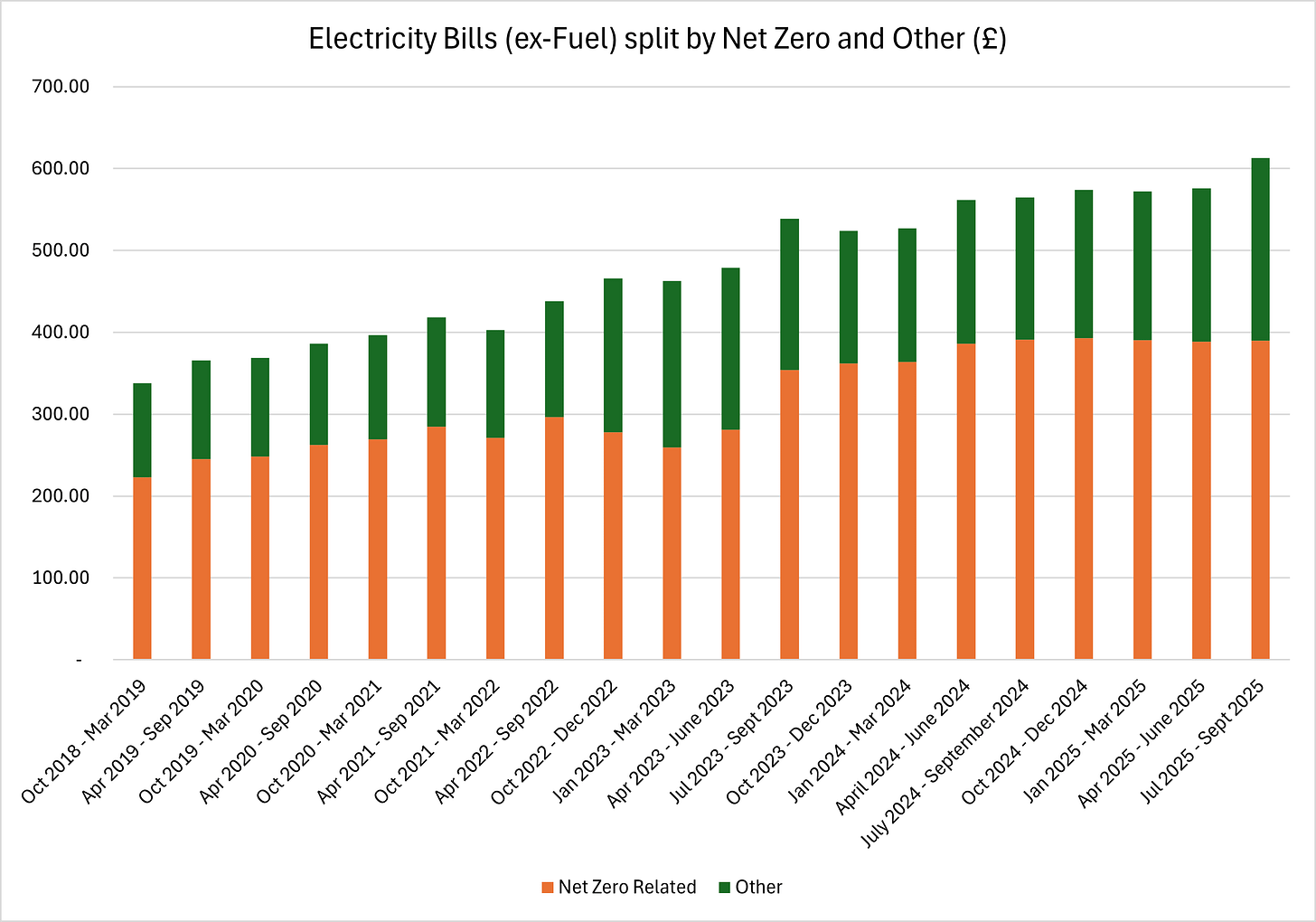

We can now look at the detail of how the different parts of our bill have changed over time, see Figure 1.

Up to March 2021, our electricity bills were quite stable at just over £500 per year. They then rose substantially through the energy crisis and most of that increase was driven by increases in the price of gas. Since April 2024, electricity bills have been running in the range £780-882 per year and we can see that the fuel component has fallen dramatically, but not down to pre-crisis levels. In fact fuel cost £166 in 2018 and £267 in the latest price cap.

An element of this cost will include carbon taxes on gas-fired generation that have risen recently and likely to rise even more as the UK re-joins the EU Emissions Trading Scheme. This element of fuel cost should properly be included in Net Zero related costs, but I cannot find data to show what proportion of the fuel cost assumed by Ofgem is the carbon tax.

The Net Zero related and other components of electricity bills have continued to rise. We can zoom in on this in Figure 2 that zooms in on electricity bills excluding fuel costs.

Net Zero related costs include:

Subsidies for renewables (Renewables Obligation Certificates, Contracts for Difference and Feed-in-Tariffs).

The Capacity Market required to back up intermittent renewables.

Network Costs include grid balancing and extensions to the grid to connect remote renewables installations.

Net Zero costs have risen by £167 from October 2018 to £389 in the latest price cap. ROC and FiT costs have remained stable, whereas the estimate for CfD costs have gone up from £2.3bn to £2.5bn in the latest price cap. When the gas price falls, the subsidies from CfDs increase so the generators maintain their fixed strike price.

Other costs include the balance of policy costs such as the Warm Home Discount, supplier operating costs, debt related costs, smart meters and an element of profit. It might be appropriate to include smart meters in the Net Zero category, but in the new price cap model most of there costs seem to have been rolled into Core Operating Costs. These other costs have gone up by £108 since 2018 to £223 today.

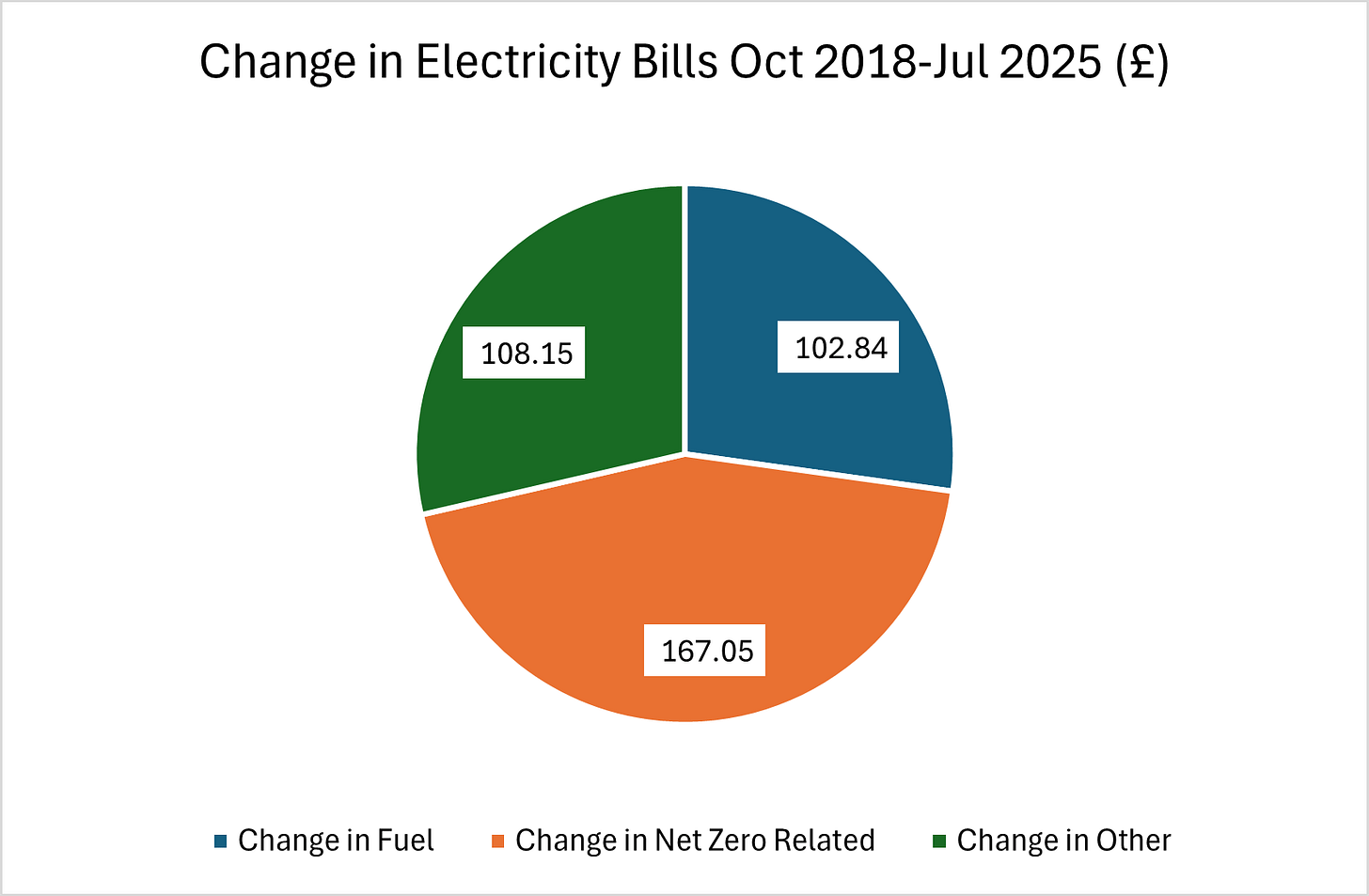

Figure 3 shows the breakdown of the change in our electricity bills since October 2018.

Some 44% of the increase can be attributed to Net Zero. And remember this probably understates the case since we can no longer separate out the cost of Smart Meters and the change in fuel costs includes the increase in carbon taxes.

Conclusions

The gas price certainly has an impact on our electricity bills. However, Net Zero is having a much bigger impact. In fact, we can argue that Net Zero has led to a smaller reduction in electricity bills than we might have expected from the fall in the gas price.

We can expect Net Zero costs to increase substantially as more intermittent renewables are added to the network and the grid is expanded to accommodate them. It certainly looks like Miliband wants to step off the roller coaster and board a rocket to the moon.

This week we achieved two significant milestones. First, we published 100 weeks in a row, putting us in the top 1% of publishers. Second, I am very grateful to have attracted over 100 paying customers which now makes Eigen Values a Bestseller on Substack. Thank you for your continued support.

This Substack now has over 4,100 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Mad Milliband is now lobbying for a huge increase in gas prices by adding new taxes and cost in an attempt to double the price of gas within 2 years to allow electricity to seem more competative for heat pumps.

Milliband is a very dangerous imbecile.

The more the gas price reduces the more exposed the renewable is cheap mantra becomes so triumvirate of Milibrain, Starkie and Pinchback have to find alternative ruses to keep the myth alive. Be in no doubt Milibrain will push something through be it zonal pricing or playing around with where the subsides fall as he now has upside protection from winter fuel allowance being reinstated along with the ever increasing largesse of the Warm Home Discount scheme to deal with those who would be affected who can't afford it. Rayner likes it as it load the costs onto everybody else and basically if your not on benefits your earning too much in her eyes anyhow.