Consumers Set to be Reamed by REMA?

Proposals for zonal pricing set to send bills even higher

Introduction

The Government began its Review of Electricity Market Arrangements (REMA) a couple of years ago. The second consultation on REMA began in March 2024 and one of the issues that REMA is seeking to address is to reduce constraints on the transmission network. Zonal pricing is one option the DESNZ is still considering to address this problem. By zonal pricing they mean calculating different wholesale prices for electricity across about seven regions or making pricing even more granular across c.850 individual nodes. Regional pricing appears to be the favourite zonal pricing mechanism.

The industry seems to be split on the efficacy of regional pricing with Octopus Energy being strongly in favour and companies like SSE being much more sceptical. Consumer groups like Citizen’s Advice have expressed caution about the impact of zonal pricing on consumers.

This article will walk through the arguments from Octopus and SSE and then step back and cast a critical eye on the whole idea.

Octopus in Favour of Zonal Pricing

Octopus Energy has commissioned work from FTI Consulting (link above) that purports to show that zonal pricing, or more specifically nodal pricing would deliver significant benefits. They explored scenarios that calculated how lower wholesale prices would benefit large industrial users of electricity if they were to relocate closer to renewable generators.

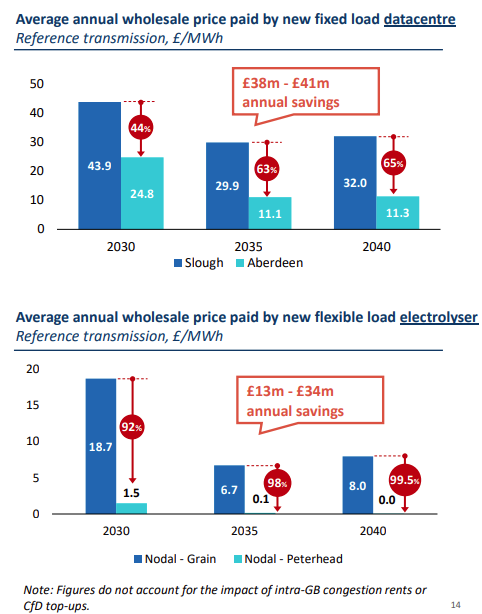

They found that with nodal pricing, wholesale prices could be significantly lower for both fixed load installations like datacentres and flexible load applications like electrolysers (see Figure 1).

They claim a datacentre could save 65% on its electricity costs by 2040 if it was located in Aberdeen rather than Slough. They also claim that an electrolyser operating flexibly and located in Peterhead rather than Grain in Kent could save over 99% of its electricity costs. Essentially, the electrolyser would receive almost free electricity.

Before we dissect their claims from the point of view of the electricity market in the analysis section below, it is worthwhile looking at the big engineering problem associated with placing electrolysers in Peterhead. The problem is storage of the hydrogen made by the electrolyser. Last year, the Royal Society made a great deal of noise about using hydrogen stored in salt caverns to generate electricity to balance a renewables only grid. They found that transporting hydrogen just 100 miles from the electrolyser to the salt cavern would add £22/MWh to the cost of electricity produced (see s4.3 of the report). The trouble is, Peterhead is some 300 miles as the crow flies from our largest salt caverns in Cheshire and a pipeline would have to be even longer making the costs much higher. The whole idea is non-starter from the outset.

SSE Sceptical About Locational Pricing

SSE commissioned LCP Delta to update a prior study on the impact of zonal pricing. The new report finds that the supposed benefits of zonal pricing are very much eroded and could in some circumstances turn into costs instead of benefits as shown in Figure 2.

The main reason for the increase in system costs is that NESO has recommended an additional £58bn of investment in the electricity network to connect additional offshore wind and other renewables to the grid. Of course, this extra investment costs money and will negate any benefits that might accrue. The supposed benefits are wiped out if the cost of capital attached to the investment goes up by 0.6% and turn into significant costs if the cost of capital goes up by 1%. If interconnector constraints are removed (what they term “no redispatch inefficiency”), the costs of zonal pricing begin to spiral out of control.

Analysis

If we start first with the Octopus claim that flexible electrolysers could receive power that is almost free. We know that producing electricity from whatever source is not and never will be a costless activity, so we must dig a bit deeper to understand how they came to their conclusion. There is a clue in the note to the chart in Figure 1 above (my emphasis): “Figures do not account for the impact of intra-GB congestion rents or CfD top-ups.”

What they mean is that as we add more wind generators to the grid, there will be more times when wind is generating more power than the grid can handle or consumers need. The result will be that wholesale prices often plunge to zero or sometimes even lower. This is a signal that the market value of the electricity being generated is nil. However, Contracts for Difference (CfDs) guarantee the price that operators receive for their electricity. They need this protection because of course the cost of production is not zero. In consequence, the wind farm will receive almost all its revenue from the top up it receives from consumers to the CfD strike price. By way of example, so far this year, the average CfD strike price for offshore wind operators has been ~£150/MWh. If the electrolyser paid on average £1/MWh for its power, then the rest of us would pick up the balance of £149/MWh CfD top up.

However, the analysis is not quite as simple as it might first appear. The argument used by Greg Jackson of Octopus and others is that if the electrolyser or other source did not use the surplus electricity, then the wind farm would have to be turned off and consumers pay the associated curtailment charge. There is some truth to this argument, but it is not as strong as Greg makes out.

In the Government’s REMA consultation document, they explain how the negative pricing rule has evolved. In Allocation Rounds 2 and 3, if the day ahead price falls below zero for six or more consecutive hours, no CfD payments are made. This rule was tightened in AR4 and beyond so that no CfD top-up is paid if the day-ahead price goes negative for any day-ahead period.

Of course, it is obvious that wind farms produce most when it is windy. So as wind capacity increases, the market value of most of their production is going to be zero, or less. They need large, flexible sources of demand close by to keep prices above zero. We can see that Jackson’s plea for locational pricing is little more than a way of protecting newer wind farms from zero prices so they can continue to harvest subsidies rather than receive nothing for most of their output.

Jackson claims that we “can’t run an efficient renewables-heavy, distributed energy system without price signals to match supply & demand.” He does not seem to understand that the price signals are already there. At times of excess wind generation, prices plunge below zero. When it is calm, prices rise because supply is lower than demand. The problem is that wind farms cannot respond to the price signals because electricity prices do not alter the wind speed.

Jackson wants whole industries to up sticks and relocate to places close to wind farms. In essence, he wants to despoil some of our best coastal landscapes with industry, to make his vision of a renewables grid work. But that will not bring down prices because we will still pick up the tab for CfD top-ups and the extra grid investment. No price is too high for his Net Zero nirvana.

In a way, the SSE/LCP Delta result is obvious. If you need to spend extra on the grid to bring offshore wind power to market, system costs are bound to increase. Imagine a Net Present Value or Levelised Cost of Energy calculation where the up front capital cost increases and the energy output is unchanged. The unit price charged for the electricity must go up to balance the equation. This is what Ed Miliband, DESNZ and NESO are forcing upon us. They say that £260-290bn must be spent on new generation capacity and grid infrastructure by 2030 to deliver their Clean Power plans. This extra capital expenditure must be paid for and the paltry 11% increase in output is not enough to cover the costs of the investment, so prices must rise.

Conclusions

This extra spending on the grid is a feature of installing lots of geographically distributed, low density, intermittent power sources, not a bug. The claims of cheaper pricing coming from Octopus are obviously false as they hint at in their own report. The reality is that massive extra spending with only a marginal increase in output must mean unit prices rise.

The proposed solutions like zonal pricing only add even more complexity and cost to the system. The “solutions” are a way of trying to compensate for the uncontrollable output of intermittent renewables. They want consumers to run their lives around the grid or pay penal rates at peak times because the grid is not being designed to meet the needs of its customers.

The extra costs will be added to our electricity bills, which are already the highest in the countries measured by the IEA. Consumers are going to end up being reamed by REMA.

If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

David - I would like add a couple of points based on my experience of REMA and nodal pricing. In principle I am strongly in favour of it but you can never trust DESNZ to do anything competently. That leads to my first point. A couple of years ago I participated in the early online meetings in which the goals for REMA were discussed. The crucial point that came over was that DESNZ was entirely captured by the concerns of renewables lobbyists and related parties. The overwhelming concern was how to make life easier and more profitable for investors in battery systems. The Department's interest in consumer interests was minimal because the staff was preoccupied with responding to lobby groups. This is a classic example of a ministry that is dominated by producer interests.

Second, I have spent a lot of time recently studying the PJM market, which is the largest regional transmission system in the US by population. It uses nodal pricing, which works well. The differences in area prices are relatively small with nodal premia rarely more than 10% of the base energy price. However, there is a crucial difference with the way PJM works and the views espoused by Octopus. In PJM it is supply - not demand - which moves in response to nodal price differences. No-one expects a chemical plant to move from New Jersey or Pittsburgh to Virginia. However, utilities locate and operate their gas plants where they can take best advantage of nodal price differences.

The point here is that renewable producers like Octopus want everyone else to fit in with their convenience and profit. In PJM the utilities and system operator understand perfectly well that most large energy users don't see the choice as being one of moving from NJ or PA to Virginia. If electricity prices are too high where they are now, they will move to the Middle East or Asia. That, of course, is what is happening in the UK but the Department and renewables firms can't admit that. So what you get is the ridiculous idea of moving very expensive and completely uneconomic uses like electrolysis, because, after all, they are heavily subsidised and what difference does a bit more subsidy make. It is all a self-sustaining fiction in which the idea that UK businesses have to compete in the rest of the world is simply ignored.

Greg and his minions, Clem Clowton their Director of External Affairs being one, still repeatedly claim prices will ‘fall for everyone’. But it’s obvious over several months now it is always without exception a one way conversation, Greg simply doesn’t like answering questions on the subject of the subsidy offloading. Talk about heat pumps and he and the rest of octopus are all ears and still remain very ‘chatty’ it’s as if by failing to engage they will prevent the grubby truth emerging, after all it’s the exact same ‘listen to me’ policy Ed Miliband has used for many years.c

Yes you could theoretically make constraint costs disappear by resisting demand to generation, but all the other costs? If that were the case we’d have standalone renewables sited with demand, with zero subsidy requirements.

Whilst there have been many examples of co-located fossil fuelled generation next to demand (Lynemouth, Wilton, Rocksavage & Saltend being a few) it’s never really happened with ‘new renewables’. But it has happened in the past, Dolgarrog hydro and aluminium in North Wales is long gone, the purpose built hydro and aluminium smelter at Lochaber is I believe the last aluminium smelter standing in the UK, still with cheap hydro, as they are grid connected at 132kv I wonder if they get ROC or FiT subsidies?

Besides the staffing and housing issues and people simply not wanting to move we simply don’t have enough spare supply to even meet ‘decarbonisation’ let alone supply for anything new (witness the bottleneck in west London on housing and commercial development due to distribution demand constraints) an issue that like everywhere else in the country be could, with an adequate water supply, be fixed with a suitably sized SMR at each Grid/Bulk supply point with very little requirement for new HV overhead or cable infrastructure build..

Meanwhile the rest of industry just dies as deindustrialisation to China etc is deemed normal.

The cynic in me would say locational pricing is merely the warming up act before all the electricity related costs are instead placed on gas to make electricity ‘cheaper’ That is what Miliband and the obvious supporters of locational pricing like Greg at Octopus are looking forward to, a captive electricity market where people cannot say ‘gas is cheaper’