The Agile Octopus Freeloader Problem

Who is paying for the “free” electricity from the Agile Octopus tariff?

Introduction

Hardly a weekend goes by without someone popping up on Twitter/X to boast that they are getting free electricity during that day, or in some cases being paid to use electricity. Often, these people are signed up to the Agile Octopus tariff as shown in Figure 1.

Free energy, or even better being paid to use electricity, sounds good. Too good to be true. The trouble is things that are too good to be true often turn out to be not true. So, what is really going on with this supposedly free electricity and who is paying?

What is the Agile Octopus Tariff?

Octopus describes the Agile tariff as providing “100% green electricity” and one of their “innovative beta smart tariffs, helping bring cheaper and greener power to all our customers”. They do note that prices can spike up to 100p/kWh or (£1,000/MWh) at any time. But they go on to say, “whenever more electricity is generated than consumed, energy prices fall – sometimes to the point where prices drop below zero, and suppliers are paid to take energy off the grid.” They also boast that Plunge Pricing “lets you take advantage of these negative price events, and get paid for the electricity you use” (emphasis theirs).

As renewables advocates are often keen to point out, the wind and the sun are free. But of course, the wind turbines and solar panels cost money and need to be paid for, so wind and solar power are not free. Quite the contrary, they are very expensive, as the subsidies for current generators and prices offered for new capacity in AR6 demonstrate. So how is it that some customers can get paid to use electricity?

What Happened to Wholesale Prices

Part of the trick is those “price plunge” events driven by excess generation from intermittent renewables. The tweet reproduced above was posted showing prices on 23rd March 2024. It is instructive to look in detail at what was going on in the market that day in terms of wholesale prices, demand as well as wind and solar generation.

Price data for 23rd March was downloaded from Elexon’s BMRS portal with generation and demand data coming from Gridwatch and compiled into the chart shown in Figure 2.

This is quite a busy chart that requires some explanation. The green bars are the system selling prices (effectively wholesale prices) in half hour intervals for the whole of March 23rd, shown on the RH axis in £/MWh. The orange line is total demand in MW. The blue and yellow areas are wind and solar generation, respectively in MW all on the LH axis.

For most of the time up to around 2pm on 23rd March system prices were negative, getting as low as £-50/MWh at 8am. There were a couple of spikes during the day, but prices did not turn decisively positive until 4pm when solar generation started to fall and demand started to rise, holding a peak of £81/MWh for several hours. As demand fell, wholesale prices then turned negative again for the rest of the day apart from a couple of positive spikes.

The negative prices occurred mostly when wind and solar made up a substantial proportion of the generation. Wind and solar are essentially uncontrollable sources of power so on sunny, windy weekend days when demand is low, excess generation from renewables pushes wholesale prices negative. In effect, the market value of the power generated falls below zero, because there is not enough demand for it.

Subsidies for Renewables

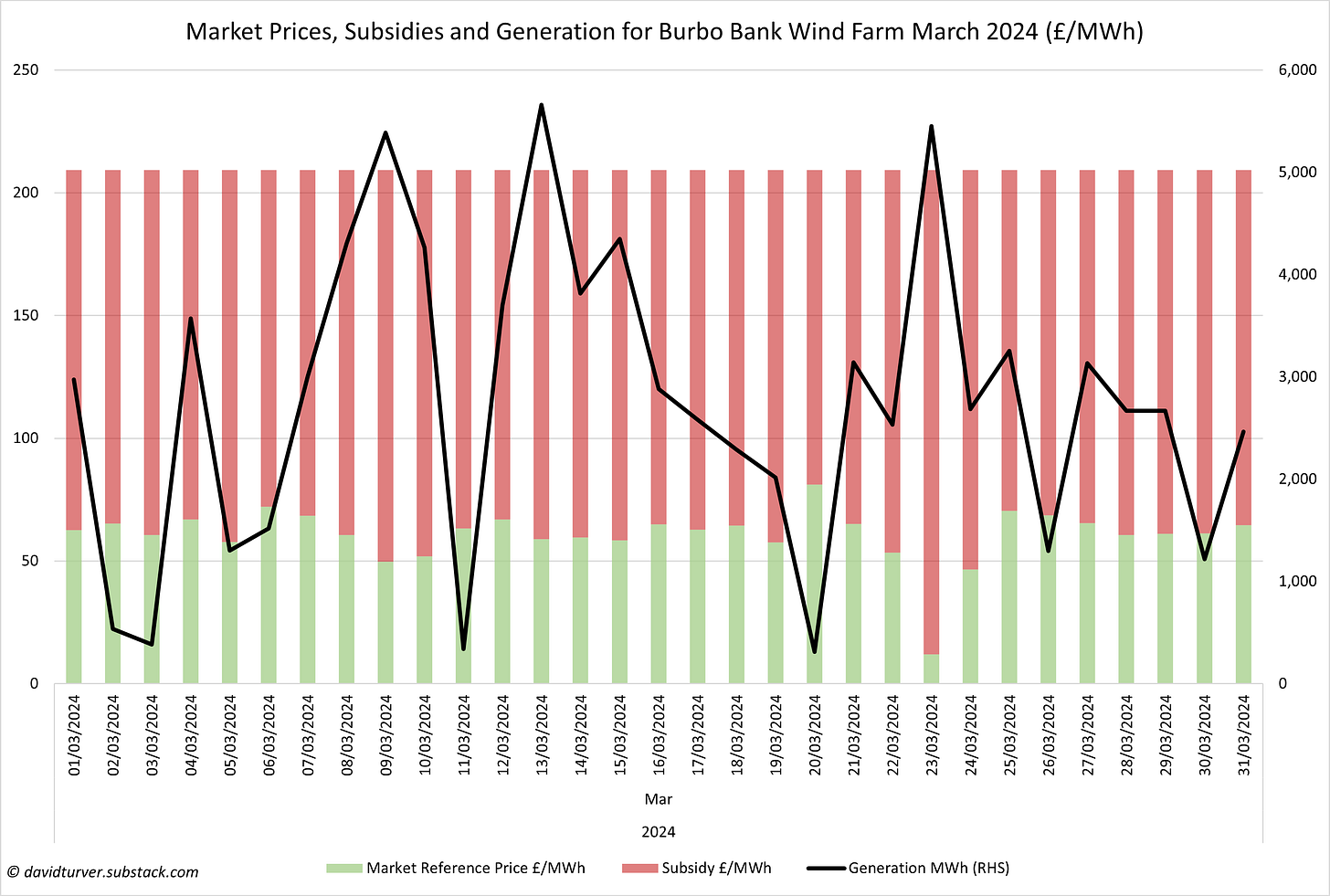

Most of us are not lucky enough to get paid to use electricity. We must pay the full system cost of electricity that includes subsidies for renewables. Figure 3 shows the Weighted Market Reference Price and the subsidies paid to Burbo Bank Wind Farm during March 2024 in £/MWh (data from the LCCC).

The generator received a constant amount of £209/MWh for its generation throughout the whole month as shown by the total of the green and red bars. The intermittent market reference price (IMRP) shown by the green bars, fluctuated up and down during the month and fell to just £11.90/MWh on March 23rd. Burbo Bank was paid over £197/MWh in subsidy (red bar) during that day. Moreover, Burbo Bank generated a lot of electricity on that day, so received a massive amount of subsidy in absolute terms. We pay this subsidy through our bills.

Although the precise sums vary, similarly shaped charts can be created for other generators funded by Contracts for Difference (CfDs). In fact, for the two CfD solar farms, Charity Farm and Triangle Farm, on 23rd March, the IMRP fell to just over £2/MWh and £1/MWh, respectively. Subsidies of over £100/MWh made up the total payment of £106/MWh made to these two generators. A grand total of £13m of CfD subsidies was paid to all generators on March 23rd 2024.

Of course, not all renewables are funded by CfDs, some are subsidised using Renewables Obligation Certificates (ROCs) and others by Feed-in-Tariffs (FiTs). On average, offshore wind generators funded under the ROC scheme receive 1.9 ROCs per MWh, with onshore wind receiving 1 ROC/MWh and large scale solar 1.43 ROCs/MWh. The buyout price for ROCs in year ended March 2024 was £59.01 per ROC. This means that every MWh generated by offshore wind received certificates worth nearly £112, with onshore wind receiving £59 and solar £84 per MWh in addition to the market price. These subsidies are paid through our bills regardless of the market value (wholesale price) of the electricity generated.

Power plants funded through FiTs are mostly solar power. These generators receive most of their income as generation payments, with a small top up for the electricity exported. For the year-ended March 2023, the total payments made under this scheme were over £1.7bn, or almost £193/MWh. Again, these subsidies are what we pay through our bills while Agile Octopus customers get paid to consume surplus electricity.

Impact of Agile Octopus on Other Consumers

We can see that although Agile Octopus customers are benefiting from zero or negative wholesale prices, the rest of us are picking up the tab for the renewables subsidies. Indeed, if Agile Octopus customers were only receiving the claimed “100% green electricity”, they should be paying more than everyone else, because in all but exceptional circumstances, wind and solar receive subsidies which demonstrates they are much more expensive to produce than gas and the market value of their output.

Some may argue that the freeloading effect is mitigated by the Agile pricing formula (see Figure 4).

This formula multiplies the wholesale cost by 2.2 and adds a peak time premium to arrive at the price charged to the customer. However, if the wholesale price is zero during off-peak times, then 2.2 times zero is still zero, and the peak time premium is also zero in off-peak hours. The link above to the pricing formula does not really explain what happens if prices go negative. Theoretically, if off-peak prices went to -5p/kWh, customers should be paid 11p/kWh, but this probably never happens. Moreover, the factor of 2.2 in Octopus’ formula, plus the peak time premium is supposed to include some element of additional costs for transmission, balancing, distribution, capacity market and subsidies. The transmission costs are 4-9p/kWh, but strangely only at peak times. Distribution costs are 5-16p/kWh and are close to zero at off-peak times. Balancing costs are supposed to cost around 1p/kWh and capacity market costs 5-10p/kWh during the winter peak; they don’t give an average. However, it is obvious that actual transmission and distribution costs do not magically fall to zero during off-peak hours, because the whole network is still there and its costs need to be financed.

The subsidies are made up of renewable obligations, FiTs and CfDs. They say renewables obligations should cost 2.6p/kWh, FiTs about 1p/kWh and CfDs 0.8p/kWh. However, if the customer is being charged zero, or even being paid to use electricity, then clearly they are not being charged these subsidies. In fact the total subsidy charge of 4.2p/kWh (or £42/MWh) falls well short of actual subsidy levels. In March 2024, the weighted average CfD subsidy for wind and solar was £103/MWh. We do not yet know the precise weighted average subsidy for ROC generation, but it is probably around £82/MWh, based on 2023 figures. Similarly the total payment of ~£193/MWh for FiTs means the subsidy is also well above £42/MWh, probably around £125/MWh. When one considers that Agile Octopus is supposed to be delivering “100% green energy”, it certainly looks like Agile Octopus customers are freeloading off the rest of us.

The only hope for ordinary consumers is if the peak-time premium and the factor of 2.2 make up for the freeloading at off-peak times, which seems unlikely.

The Coming Battery Scam

The Government has at least partially recognised the freeloader problem and the more recent CfD contracts contain provisions which mean that operators do not get paid if the day-ahead wholesale price falls below zero for six or more consecutive hours (or even fewer hours in more recent contracts). As an example, Hornsea 1 did not get paid the full strike price on 23rd March 2024. This sounds like a step in the right direction, but this arrangement is ripe for exploitation by some operators.

The market is particularly vulnerable to those seeking to install big batteries on the grid. For instance, it has been reported that NatPower is planning to spend £10bn installing over 60GWh of battery capacity by 2040. What impact might this have on the market?

Imagine a day like 23rd March 2024 in say 2030, when a substantial number of batteries are likely to have been installed. By then, if we continue current energy policies, we will have even more renewables on the grid so generation will be even less controllable than today. It is highly likely we will have more days with “price plunges.” In those circumstances, battery operators could bid say £0.01/MWh to buy some of this excess electricity. Provided they had enough battery capacity, wholesale prices would not go negative, so the wind and solar generators could continue to generate and receive their full subsidised price. The battery operator would get (almost) free electricity, ready to sell on at a large profit when prices spiked later as demand increased or the wind dropped.

This sounds reasonable until you look at it from the point of view of the average consumer. The consumer would pay the full subsidised price for the original generation (less £0.01/MWh) and then pay again for the same electricity when it was released from the battery. Effectively, consumers would be paying twice for the same energy. Moreover, the Agile Octopus customers could be worse off because there would be fewer occasions when price plunges fed through into their bills, because the battery arbitrageurs would snap up the cheap electricity before it got to the rest of the market.

Conclusions

Free electricity sounds too good to be true. Agile Octopus customers benefit from “price plunges” at times of low demand and high renewables generation. Then rest of us pick up the tab for the subsidies paid to the wind and solar generators. It certainly looks like Agile Octopus customers are freeloading off the rest of us - another example of something sounding too good to be true not being quite as advertised.

Moreover, even though there are some measures being taken in the terms of CfD contracts, there is ample scope for battery operators to game the system, making money for themselves and keeping the wind and solar operators happy because suddenly they do not have to contend with negative prices. Note that the planned £10bn spend on batteries will not generate any more electricity. Its just an extra cost to give the illusion that wind and solar power are reliable. That cost needs to be added to the cost of renewables too.

The losers in this arrangement are all the other energy customers who pay for this “free electricity” gimmick.

Philip Steele of Octopus Energy contacted me on X offering to review this article after he saw my “teaser” post. I replied asking if he wished to review it before or after publication. I received no response, but will send a link to him upon publication.

If you enjoyed this article, please share with your family, friends and colleagues and sign up to receive more content.

Bombinho, you are talking utter twaddle. Pointing out the logical flaws in your writing would be pointless as you insist on making them. You deny that paying subsidy for nothing and unreliable fuels is better than a consistent, known quantity.

You argue that wind is reliable, when it isn't. Worse, you argue it is cheap. It isn't. The facts prove you wrong. The energy 'market' in hte UK works at a very simple level like this - reliable, efficient conventional fuels are heavily taxed. That tax subsidises unreliable, inefficient unreliable energy, and the bill payer pays at both ends.

Base load exists and is a known quantity. Please, educate yourself.

You may fight, argue, rant, squeal but the simple truth is if wind were a money maker then it would not need subsidy. It does, therefore it isn't. It's a scam.

Stop arguing black is white. By all means, play pretend. Take the tariff you want, but there is only so long the lie can continue.

Thank you for this great analysis! Gave my brain a bit of a workout - I found the bit about battery providers especially interesting - had never thought about that sort of profit angle to the wave of batteries required for renewable energy to work! I was wondering, more fundamentally, why do renewables need such generous subsidies to set up? And are these subsidies basically required forever? Or is there some feasible way that renewable power could stand on its own two feet at some point? Thank you very much for the analysis!