The CCC Reveal Their Errors

The cost of renewables in the 7th Carbon Budget are a complete fantasy.

Introduction

We covered the misinformation in the Climate Change Committee’s (CCC) seventh carbon budget back in March. However, late last month, the CCC released their methodology report that gives a little more insight into their thinking, or lack thereof.

They have released an additional spreadsheet that shows how they arrived at some of their costs for their balanced pathway. This article examines their latest claims.

Offshore Wind Cost Errors

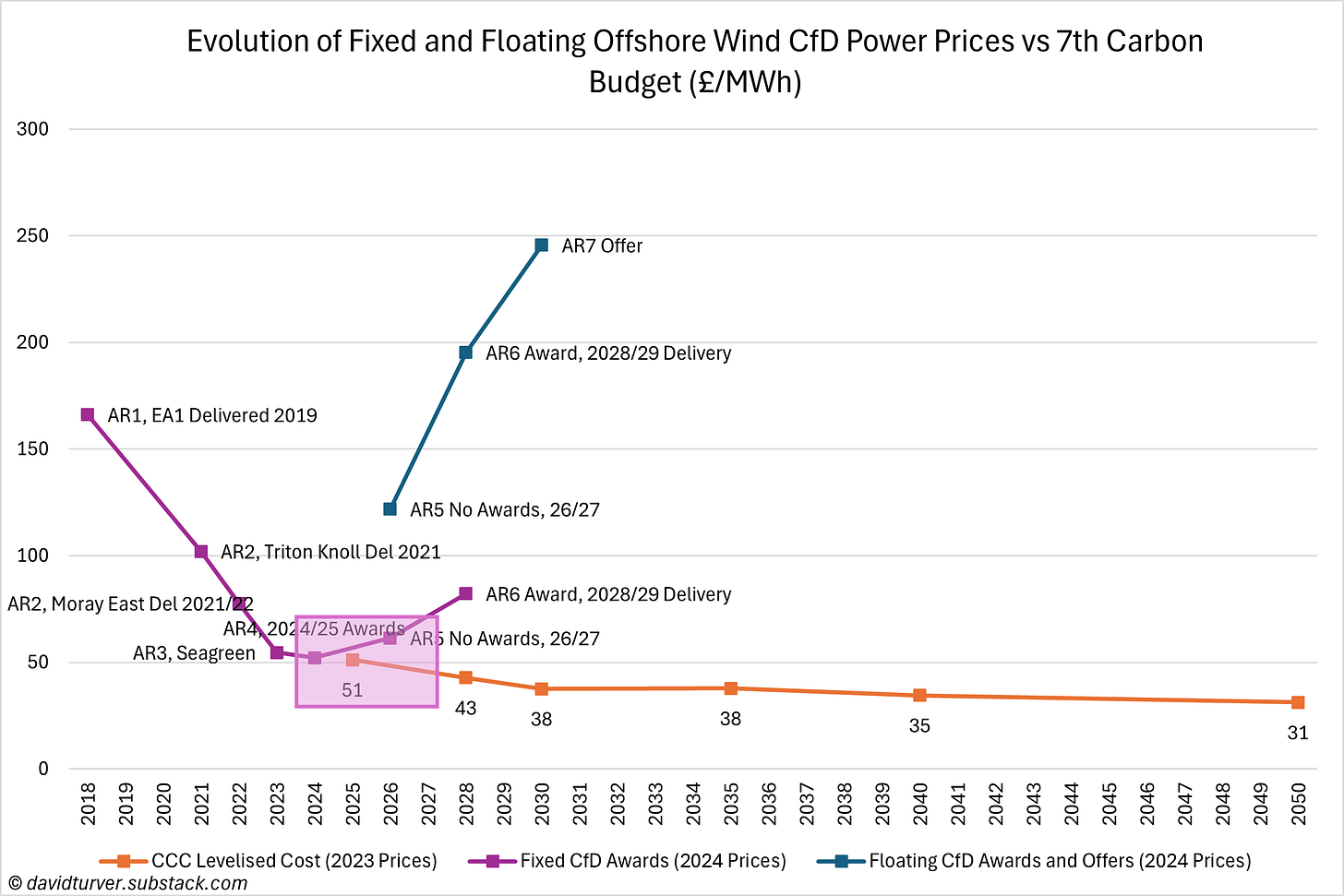

Starting with offshore wind. Regular readers will remember that the CCC’s estimates of the levelised cost of offshore wind were much lower than has been awarded or offered in recent Contract for Difference (CfD) auctions (see Figure 1).

In fact, the CCC’s estimates for 2030, 2035 and 2040 delivery are even lower than the Government’s estimates in the woeful Generation Cost Report from 2023. The new data accompanying the methodology report shows the CCC have compiled these miraculous estimates by making some audacious assumptions about the future capital costs of offshore wind (see Figure 2).

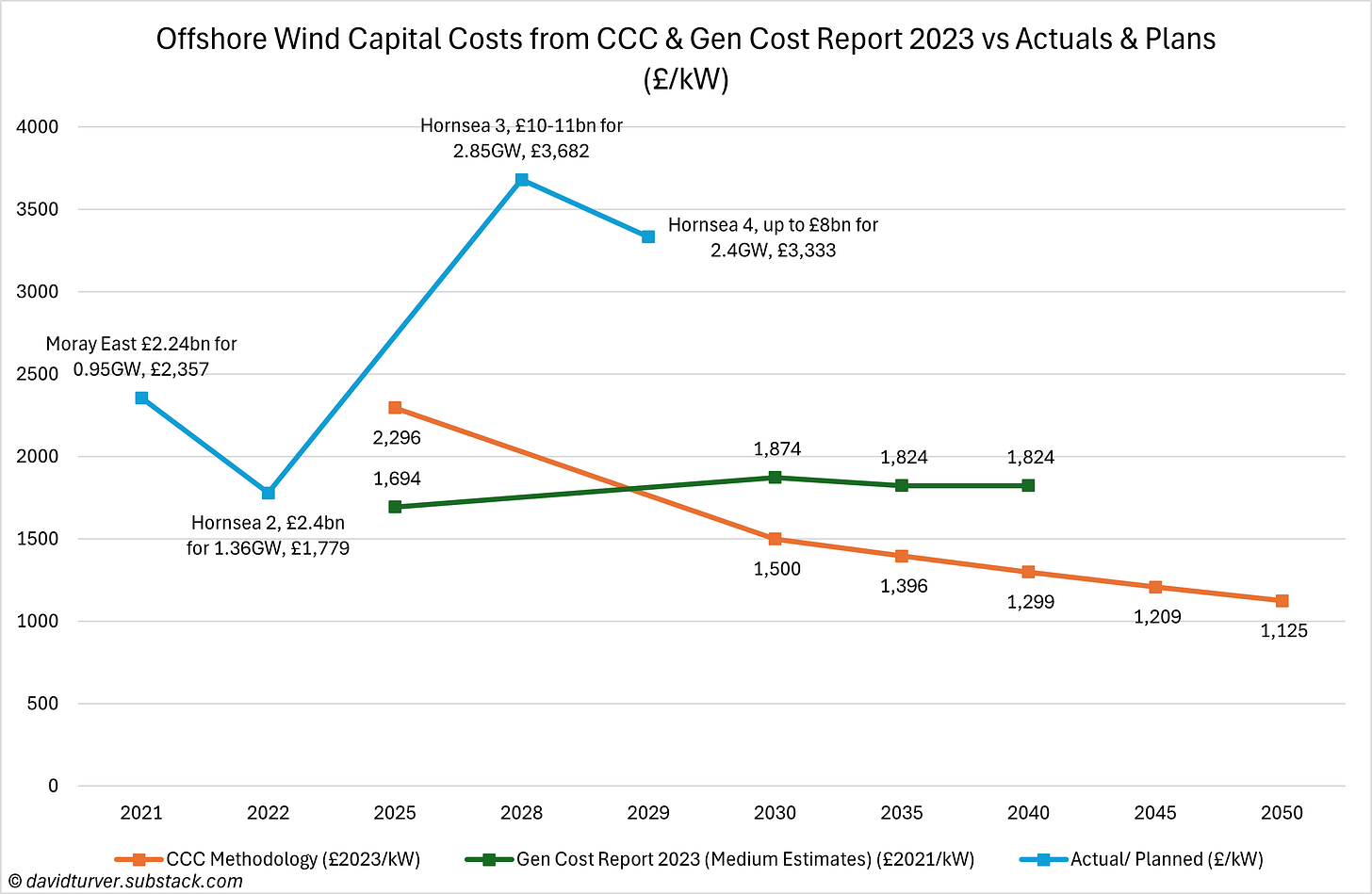

The orange line shows the estimates from the CCC. Their capex costs fall from a peak of £2,296 per kilowatt of capacity in 2025 to £1,125/kW by 2050. From 2030 onward, their capital costs are much lower than even the Government’s medium estimates (the sum of pre-development, construction and infrastructure costs) in the fallacious 2023 Generation Cost report (green line). The CCC’s egregious gerrymandering of the costs gets even worse though when you compare their estimates to the actual and forecast costs for actual wind farms (blue line). According to company accounts, Moray East cost £2.24bn for 0.95MW, or £2,357/kW and Hornsea 2 cost £1,779/kW (excluding the decommissioning asset). However, Hornsea 3 (2.9GW) forecast to come online in 2028 is forecast to cost £10-11bn, for a mid-point of £3,682/kW. The Planning Inspectorate forecast the 2.4GW Hornsea 4 project would cost £5-8bn in 2021. Hornsea 4 was recently cancelled by Orsted, so the costs have likely ballooned above even the high estimate that would have meant a cost of £3,333/kW, or more than double the CCC’s estimate for 2030 delivery.

To meet their target of 125GW of offshore wind by 2050 will also require floating offshore wind. Greenvolt won a contract for a 400MW floating wind farm in AR6 for delivery in 2028/29 that is forecast to cost £2.5bn, or £6,250/kW. This is more than four times the CCC’s £1,500/kW estimate for 2030 delivery of offshore wind.

There is little chance of these costs falling, because the cost of the turbines alone continues to rise as Figure 3 shows the selling price of Vestas turbines continuing to rise.

Vestas turbine prices are up some 76% from the fourth quarter of 2020 to €1.25m/MW of nameplate capacity in 1Q25 and the trend is still upwards. These costs are the average for onshore and offshore turbines, and we can expect offshore turbines to be more expensive than the average.

The Climate Change Committee is living in fantasy land if they think the total capital expenditure for offshore wind is going to fall below the bare cost of the turbines themselves. They also need piling and foundations, cables to connect to the shore, transformers and the labour and ships required to move them to position do not come cheap either.

The load factors assumed by the CCC for offshore wind are also wildly out of kilter with reality. According to their own data, the offshore wind fleet delivered a load factor of 38.4% in 2023 and they expect this to miraculously rise to 46.5% by 2050.

The CCC assumes as asset life of 30 years for offshore wind, yet the very first German offshore wind farm is being dismantled after just 15 years when the subsidies ran out. There is plenty of evidence (for example, here and here) that the output of wind turbines degrades over time, so it is unlikely they will be economic to operate over ~20 years of life.

Finally, as far as I can tell, the CCC has made no mention of the impact of higher interest rates on the cost of offshore wind (or indeed any other technology). Because all these intermittent technologies have high upfront costs, the final cost of energy delivered is highly sensitive to the cost of capital.

On initial capex, load factor, asset life and cost of capital, the Climate Change Committee is making wildly optimistic assumptions that give a fake and misleading view of the costs of their Net Zero plans.

Solar Power Cost Errors

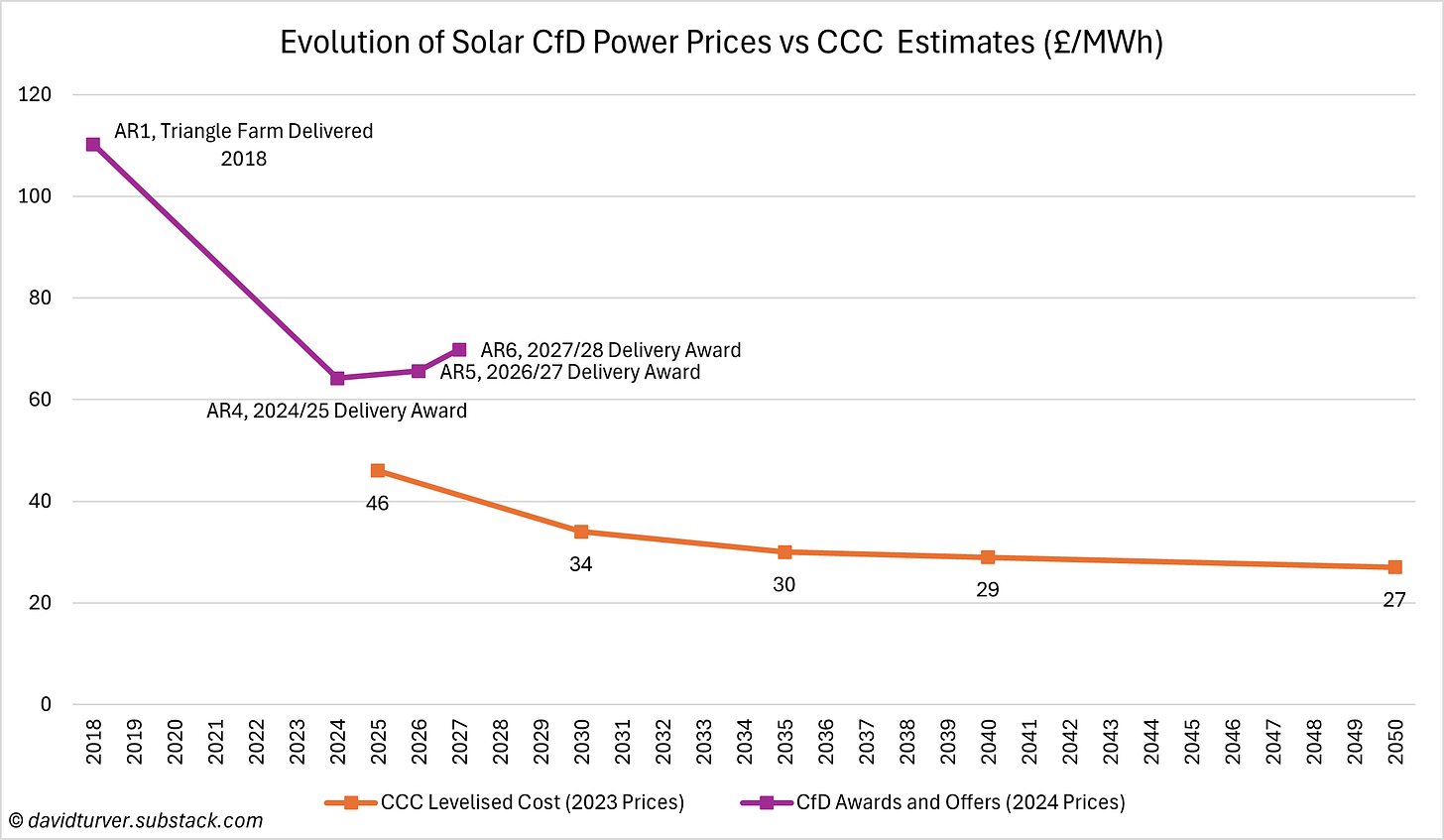

A similar picture emerges with solar power. Figure 4 compares the results of renewables auctions with the CCC estimates.

Solar projects were awarded contracts at £70/MWh at 2024 prices in last year’s AR6, but the CCC is expecting costs of less than half that by 2030.

Although the CCC is forecasting slightly higher capital costs than the Government’s 2023 Generation Cost report, they are making similarly heroic assumptions compared to the actual costs of recently activated Solar Power CfDs as shown in Figure 5.

Both Alfreton and Stokeford solar farms were awarded contracts in AR4 and activated their CfDs earlier this year. Both have only submitted their accounts up to the end of 2023, so we can expect that they spent even more money during 2024. However, if we just take their capital expenditure up to the end of 2023, Stokeford had spent £733/kW and Alfreton some £822/kW, both massively more than the CCC’s estimate of just £564/kW for 2025 delivery. The cost of panels may continue to fall, but the cost of the panels is becoming a very small proportion of the overall installation costs, so the chances of the CCC’s estimate of costs halving by 2050 is simply pie in the sky. This is borne out by solar projects being awarded contracts at a higher price in AR6 compared to AR4.

The CCC is also estimating a very ambitious asset life of 35 years for solar panels.

Onshore Wind Costs Missing

The CCC expects onshore wind capacity to expand from 15GW installed in 2023 to over 37GW by 2050. Despite expecting capacity to more than double, they have not deemed it relevant to provide their cost estimates for onshore wind. Omitting the unit costs probably also means they have missed out the total costs of onshore wind from their Balanced Pathway.

Impact on Total Costs

As Figure 6 shows, the CCC expects the Net Cost of their Balanced Pathway plan to turn to benefits (black line) by 2030 [Correction 8 June 2025: should read 2040].

But if they have dramatically underestimated the costs of offshore wind and solar and completely omitted the costs of onshore wind, then their estimates are simply junk. They are worth less than the paper they are written on.

Conclusions

The Climate Change Committee is a public body that should adhere to the Nolan Principles that include selflessness, integrity, objectivity and openness. Moreover, there should be a general expectation of competence and a duty of care to the public.

Sadly, we can see that their estimates do not pass the objectivity nor the integrity tests and they have fallen woefully short of the level of competence that we have a right to expect from public bodies making recommendations about spending our money. The Seventh Carbon Budget is the result of either institutional incompetence or wilful negligence. It should not be taken seriously by anyone.

The Government should reject their advice and ask them to come back with more realistic estimates for the cost of their fantasies.

Recently we achieved two significant milestones. First, we have published for more than 100 weeks in a row, putting us in the top 1% of publishers. Second, I am very grateful to have attracted over 100 paying customers which now makes Eigen Values a Bestseller on Substack. Thank you for your continued support.

This Substack now has over 4,100 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Great analysis again David. Think you should join the CCC and bring some much needed knowledge and intelligence to UK energy policy.

Thank you David. Not to be outdone by the Climate Change Committee, I offer a complete fantasy of my own. When I sweep to power, the CCC will be gone and there will be no more public investment in wind and solar. I shall focus on new gas plant, hoping against hope to replace the current ageing plant before the lights go out. The principal focal point will be new nuclear plant on existing sites, cloned under licence from Korea, hoping to win the race against existing wind power reaching the end of its life. The Office for Nuclear Regulation will be instructed to give rapid approval or take to their bicycles.

I shall enjoy a few years of absolute power, while aiming to retain my humility.