Something in the Water

Yet another paper from Oxford University fantasising about wind and solar

Introduction

There must be something in the water around Oxford that has caused an outbreak of scientific dysentery judging by the number of misguided reports lauding the virtues of intermittent renewables flowing from the University.

First we had the Royal Society (RS) paper (main author from Oxford University) on long term storage that was riddled with over-optimistic assumptions on costs and efficiencies, then another claiming illusory energy efficiencies from a society electrified by low EROEI renewables. Now we have got a third paper claiming that our domestic energy needs can be practically and economically met using wind and solar.

This latest report is entitled “Could Britain’s energy demand be met entirely by wind and solar?” and the lead author is Brian O’Callaghan who is the Lead Researcher and Project Manager at the Oxford Smith School of Enterprise and the Environment (SSEE). Hannah Ritchie has also summarised the paper on her Substack. The paper goes through a lot of detail however this article will focus on just a few aspects of it.

What is the Smith School of Enterprise and Environment (SSEE)?

So what is the Oxford Smith School of Enterprise and Environment? They claim to shape business practices, government policy and strategies to achieve net-zero emissions and sustainable development. They say they offer innovative evidence-based solutions to the environmental challenges facing humanity over the coming decades. The partners of the sustainable finance part of the school include two Government departments and what we might consider the usual suspects in green finance such as the Children’s Investment Fund Foundation and the European Climate Foundation as seen in Figure 1.

Fantasy Costs of Renewables

Let’s start with costs. According to the new report from Oxford University, renewables are cheap and getting cheaper. They produced a chart showing the long-term fall in the cost of renewables shown in Figure 2 (their Figure 6) below.

In the text, they go on to claim new-build costs of £60/MWh for solar, £36/MWh for onshore wind and £47/MWh for offshore wind, presumably meaning fixed, not floating offshore.

Meanwhile, in the real world away from the ivory-clad dreaming spires of Oxford, the recent AR5 auction results and other market developments show a very different picture as illustrated in Figure 3.

The only estimate where they are reasonably close is solar power, where their estimate of £60/MWh compares to the index-linked ~£64/MWh in current money awarded in the Government’s latest Allocation Round (AR5).

Onshore wind was awarded at £72/MWh in AR5 which is approximately double the price the SSEE report estimated.

Of course, no fixed offshore wind projects were awarded contracts at the 2012 strike price of £44/MWh (approximately £60/MWh in today’s money). However, we do know that Tom Glover, chairman of RWE’s UK arm recently called for offshore wind strike prices to rise by 70%. He called for prices of £65-75/MWh in 2012 terms, the average of which is around £96/MWh in today’s terms. This is double what the SSEE report estimated.

No floating offshore wind was awarded at the indicated price of £116/MWh in 2012 terms. That equates to around £159/MWh today. So, we can safely say the current cost of floating offshore wind is well above £159/MWh.

Of course, none of these numbers includes the enormous costs of the storage required to balance the grid when the sun is not shining and the wind is not blowing.

So much for our energy needs being economically met by renewables.

Real World Financial Trouble

The imaginary cost estimates the SSEE report made for renewables are further illustrated by recent announcements from operators and manufacturers.

The share price of Danish utility Orsted plunged last week when it took a $4bn hit as it abandoned two offshore wind projects in the US. Apparently, it made more economic sense to take the the hit than to continue with the project. Siemens Energy has warned of a €4.5bn loss as it struggles to fix its ailing turbine business. Vestas, another turbine maker, is loss-making. GE Renewables also posted a loss of $2.2bn in 2022 and is still reporting losses this year.

The financial woes in the renewables sector are not confined to wind power either. The share price of SolarEdge Technologies has plunged recently as it warned of falling demand in the US and Europe.

It does seem rather odd that companies supposedly offering cheap energy should be in so much financial trouble during an energy crisis. Demand should be soaring and the companies should be booming.

Contrary to the luxury beliefs of elite academia, there are clearly big economic problems in the real world of renewables.

Glossing Over Storage Requirements

The SSEE report glosses over the storage requirements to support the renewables powered grid they espouse. The good thing about the Royal Society report is that it analysed 37 years of weather data and concluded that 89.4GW of electrolysers, 123TWhLHV of hydrogen storage and 100GW of hydrogen-fuelled generators would be required to meet their assumed 570TWh of demand. This is because the supply we can expect from renewables varies from year to year. Sometimes there are multiple years of low supply such as 2009-2011 which drives such high storage requirements. Using the references in the RS report, the whole infrastructure would take up about 144km2 of land.

Of course, the storage system adds cost pushing up the overall cost of delivering reliable electricity. Even using the flawed assumptions of the Royal Society report, the storage system roughly doubles the underlying (under-estimated) cost of the renewable electricity. In addition, the storage system adds additional embedded input energy, pushing down the already low EROEI of renewables.

Scaling up the storage system to meet 1,500TWh of demand would require approximately 235GW of electrolysers, 324TWhLHV of hydrogen storage and 263GW of hydrogen fuelled generators. In reality, a different demand profile will alter these figures somewhat, but this is a reasonable first order estimate. This would take up 380km2 of land. The storage system would of course also dramatically increase the already high underlying costs of the electricity delivered by the renewable generators.

The only storage system the SSEE report provides a cost for is Lithium-Ion batteries which they claim now cost £122/kWh. The electrical equivalent storage to 324TWhLHV of hydrogen is 178TWh. Even if the minerals required to deliver this sort of capacity existed in the world, a battery this size would cost something like £21,719bn at the unit cost they indicate or 8.7 times UK GDP. The available energy stored in EV batteries would be a rounding error in this calculation. This is why the RS report ruled out battery storage other than for providing 15GWh (0.015TWh) of grid balancing services.

Clearly, the SSEE report has glossed over the size and cost of storage required to make a renewables only grid work. So, the economics get even worse.

Optimistic Load Factors

The SSEE report assumes 38% load factor for onshore wind and 50% load factor for offshore wind, not differentiating between fixed and floating technologies. However, as shown in Figure 4 below, these bear little resemblance to what has been achieved so far.

Over the past five years, the average load factor for onshore wind has been 26.4%. Yet, the SSEE report assumes 38% over the entire fleet. They use this assumption even though it is likely that the windiest sites have already been taken. It is far more likely that average load factors, or delivered energy, will fall as the quality of available sites declines. Their onshore wind assumptions are crazy.

The 2023 generation cost report assumed offshore wind load factors would rise to 69% by 2040. Thankfully, the SSEE report has moderated that expectation somewhat by expecting 50% load factors. Still, this is higher than the 41% average over the past five years. It is conceivable that load factors will rise a bit as technology improves, but 50% average for the entire fleet over their whole operating life is very optimistic to say the least.

Inconsistency of Final Demand Estimates

The RS report referred to above estimated 570TWh of final energy demand, delivered as electricity. This represents energy demand per capita roughly halving between now and 2050. The new report “conservatively” estimates final demand at 1,500TWh. It is heart-warming to see they are implicitly acknowledging the risks of an energy scarce world and seeking to plan for energy abundance. They say their estimate takes account of population growth and the energy needs of emerging technologies such as cultivated meat and Direct Air Carbon Capture and Storage (DACCS).

The inconsistency comes because one of the authors of the SSEE report, Professor Chris Llewellyn Smith, is the lead author of the Royal Society report referred to above. It is quite astonishing that the same author can put his name to two reports, published within a month of each other, that have such widely differing estimates of final demand. We shall see why this matters below.

Deliverability

Remember the SSEE report said our energy needs could be “practically” met using wind and solar. Time to look at deliverability. The RS report assumed that 741TWh of renewable electricity would need to be generated to meet the final demand of 570TWh. This “overbuild” is to account for the roundtrip losses from making hydrogen when supply is greater than demand, to be burnt later when demand exceeds supply. Applying this same overbuild ratio to the SSEE report would indicate that the renewables would need to generate 1,500 * 1.3 = 1,950TWh.

If this were split the same way as the RS report assumes 20% or 390TWh would come from solar power. 468TWh would come from onshore wind and 1,092TWh from offshore wind, assumed to be fixed as the RS report did not mention floating offshore wind.

There we run into our first deliverability problem. The SSEE report calculates, that even with their optimistic load factors, the most we could achieve from onshore wind is 206 TWh. This leaves more to be delivered from offshore wind and there we run into another snag. The most they think is achievable from fixed offshore wind is 563TWh. Which means the balance must be delivered by floating offshore wind. As we saw above, floating offshore wind is significantly more expensive than fixed offshore wind.

However, we may now have a reason why the RS report worked with such a low estimate of final demand. To deliver the overall 741TWh of renewable generation sufficient to provide 570TWh of demand, around 415TWh was expected to come from fixed offshore wind. If demand was much higher, they would have needed to incorporate expensive floating offshore wind in their plan.

It looks like the underlying message from the SSEE report is that if we expect renewables to deliver a sensible amount of end user demand in the future, then we will be forced to use floating offshore wind because there simply will not be enough onshore or fixed offshore wind capacity available.

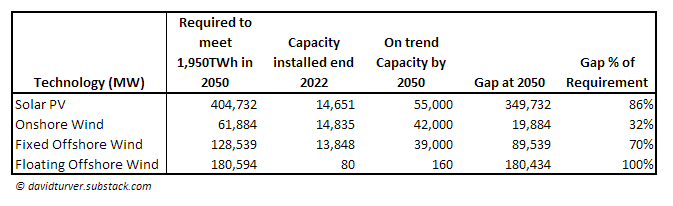

Now let us look at how the requirements compare to the trends in current installed capacity. The 390TWh to be delivered by solar equates to around 405GW installed capacity, using an 11% load factor. The 206TWh we need from onshore wind equates to ~62GW of installed capacity. The maximum fixed offshore wind capacity of 563TWh equates to ~129GW and the remaining 791TWh of floating offshore wind translates to ~181GW of installed capacity.

It is helpful to look at these requirements and compare them to what is installed today and what we might expect by 2050 if the trend was extrapolated. I usually do this in the form of a chart, but it looked ridiculous, so I showed it in a table instead as per Figure 5 below.

We currently have ~14.7GW of solar installed. To deliver the required generation to meet 1,500TWh of overall demand, we would need ~405GW. Extrapolating the trend of installations would deliver only around 55GW of installed capacity. This leaves a gap of ~350GW, or 86% of the requirement. It’s a pipedream.

Similarly, if current trends were extrapolated, there would still be nearly one third of the 2050 requirement for onshore wind missing by 2050. 70% of fixed offshore wind would be absent too.

We currently have only 80MW of floating wind capacity installed, compared to a requirement of 180,594MW. The Kincardine Offshore wind farm claims to be the largest floating offshore windfarm in the world and its capacity is only 50MW. There might be something in the water around Oxford, but there’s precious little floating offshore wind capacity in the water anywhere else. Any plan to meet the SSEE estimate of demand would have to rely on a very expensive technology that is unproven at scale. Yet they claim their plan is “practical”. It’s insane.

Conclusion

The good thing about this SSEE report is they seem to have acknowledged that halving per capita energy demand is not a good idea. We also learned that to deliver a sensible amount of energy in 2050, we are going to need lots of expensive floating offshore wind capacity.

However, they assumed costs, particularly for wind, are nowhere near what is being achieved today, nor what is likely in the future; out by a factor of 2, 3, or even 4 for floating offshore wind. To claim their plans are “economical” is a complete fantasy. The “practical” capacities are completely undeliverable on any reasonable timescale.

I do not know what has happened to the Academy. It seems to have been infected by circular thinking from the seemingly endless supply of funding from groups (including the Government) who all share the same opinion. But when everyone thinks the same thing, it’s clear that nobody is thinking at all. Oxford University used to be a respected institution. Yet, they are pumping out endless pages of marketing literature for the renewables industry masquerading and scientific research. It seems to have been written by people who have never delivered anything more difficult than pizza. We desperately need some sort of Red Team approach to break the circle of group think. The sooner we start, the better.

If you have enjoyed this article please share it with your family, friends and colleagues and sign up to receive more content.

This report from Oxford appears to be a variant of The Iron Triangle relationship (https://en.wikipedia.org/wiki/Iron_triangle_%28US_politics%29) that is so common nowadays in Western economies despite president Eisenhower warning us about such policy capture in his farewell address:-

"The prospect of domination of the nation's scholars by Federal employment, project allocations, and the power of money is ever present and is gravely to be regarded.

Yet, in holding scientific research and discovery in respect, as we should, we must also be alert to the equal and opposite danger that public policy could itself become the captive of a scientific-technological elite."

(https://www.archives.gov/milestone-documents/president-dwight-d-eisenhowers-farewell-address)

One way to break the Triangle is, as you and others propose, to instigate a systematic Red Team review process to answer Juvenal's question, "Who will watch the watchmen?" or "Who will guard the guardians?"

https://en.wikipedia.org/wiki/Quis_custodiet_ipsos_custodes%3F

This is surely one of the most urgent and important tasks for Western societies in the immediate future if we are not to fall permaently into the clutches of self-serving elites whether it be for Covid or Climate Change or WHO regulations.

At the moment we are failing badly, very badly.

Regards,

John.

It looks like I have already made a report to Parliament on this Oxford Paper. The introduction to my analysis makes a similar comment to David’s analysis here. It says:

Smiths School of Enterprise

Oxford University

cc: Parliament

Re: Wind Power Errors and Disinformation.

Oxford University Report.

Sir,

Another report on wind power has just been issued, that again contains errors and omissions.

The greatest failing within this report, is it contains no provision for backup energy storage. We cannot install unreliable wind power without backup energy storage, otherwise the lights will go out. At present we are 100% dependent upon gas-powered electricity for backup, but when gas is phased out by 2030 or 2035, we will need an alternate backup system.

Missing out 30-50% of electrical generation system costs, is akin to misinformation by the Oxford team. It makes wind look more feasible when in reality it is likely to bankrupt the nation, both through excessive costs and through incessant blackouts. Observe the electrical supply problems in South Africa, and multiply by 100.

The Oxford Group Report.

Britain’s energy demand could be met entirely by wind and solar:

https://www.smithschool.ox.ac.uk/sites/default/files/2023-09/Policy-brief-Britains-energy-demand-could-be-met-entirely-by-wind-and-solar.pdf

Ralph