Silver and Copper Will Derail Net Zero Fantasy

Growing gaps between supply and demand mean the cost of Net Zero is going to soar

Introduction

The way Britain and other countries are going about implementing Net Zero means we are relying heavily on technologies such as wind, solar and batteries for storage and electric vehicles. However, these technologies are highly mineral intensive requiring lots of metals such as copper, cobalt, silver, lithium and rare earth metals.

However, the outlook for demand for some of these metals far exceeds estimates of supply meaning prices are set to rise so far they are likely to derail the whole project. This article focuses on two key metals, silver and copper to illustrate the scale of the problem.

Growing Silver Supply Deficit

Silver is a key element for the production of solar panels and if the futurologists are to be believed, silver will also play a crucial role in a new range of solid-state batteries for electric vehicles.

Solar power has been growing quickly and last year, the Economist predicted that “exponential growth of solar power will change the world” and that solar would become “humankind’s largest source of primary energy – not just electricity – by the 2040s.” Now the thing about exponential growth is that small numbers can become very large, very quickly.

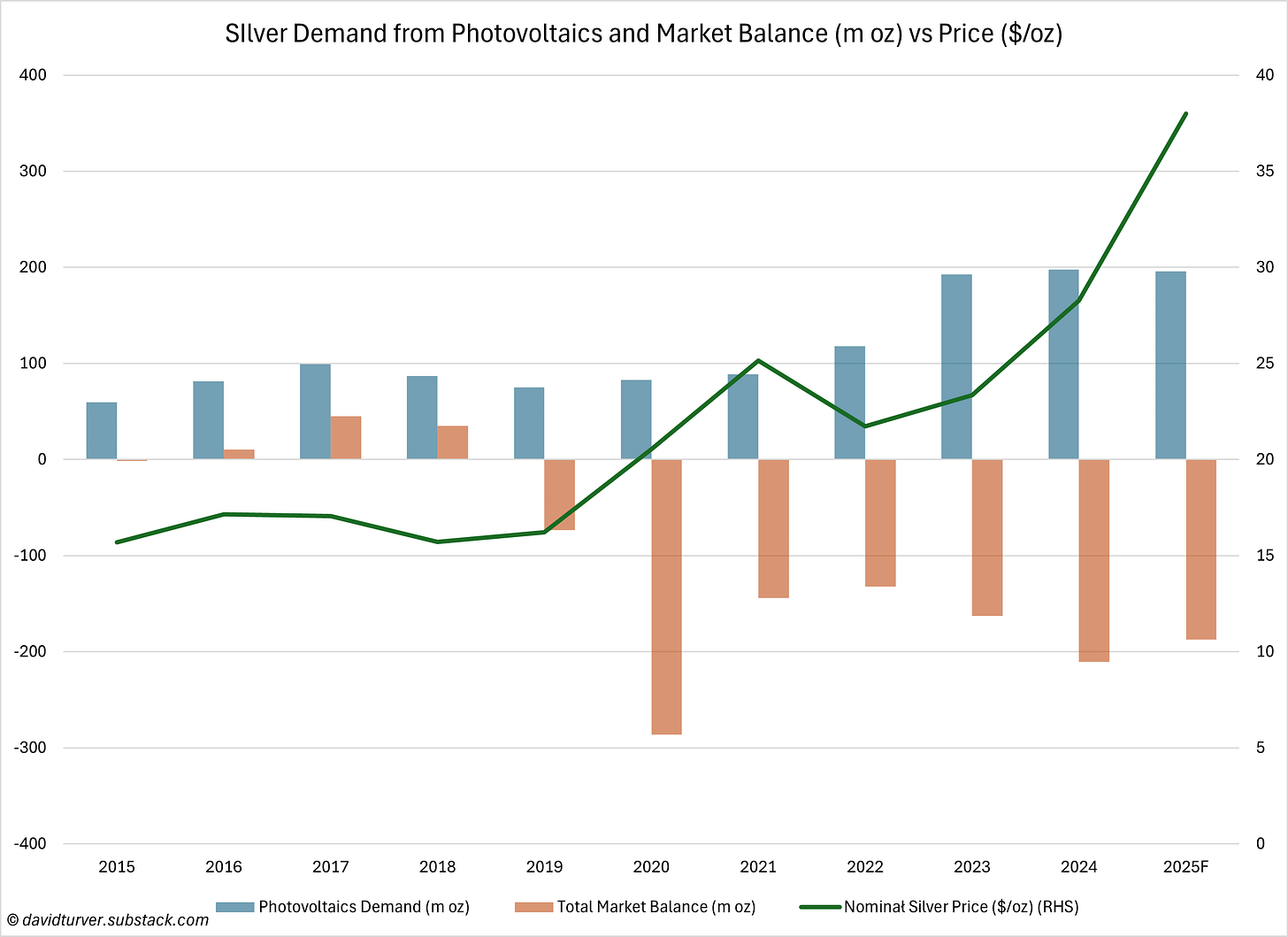

Data from the Silver Institute in Figure 1 shows us how demand for silver for use in solar panels has grown since 2015 as the total market balance for silver has declined and what has happened to the silver price.

Total supply of silver has fluctuated around 1bn ounces per year since 2015. Demand, including investment demand in exchange traded products has been larger than supply since 2019, with large deficits of close to 200m oz. Part of the explanation for the deficits is the explosion in demand for silver for photovoltaic cells used in solar panels. Demand has risen from less than 60m oz in 2015 to just below 200m oz in 2023 and 2024 and is forecast to remain at a similar level this year. The price of silver has more than doubled since 2019, going from $16/oz to over $38/oz today.

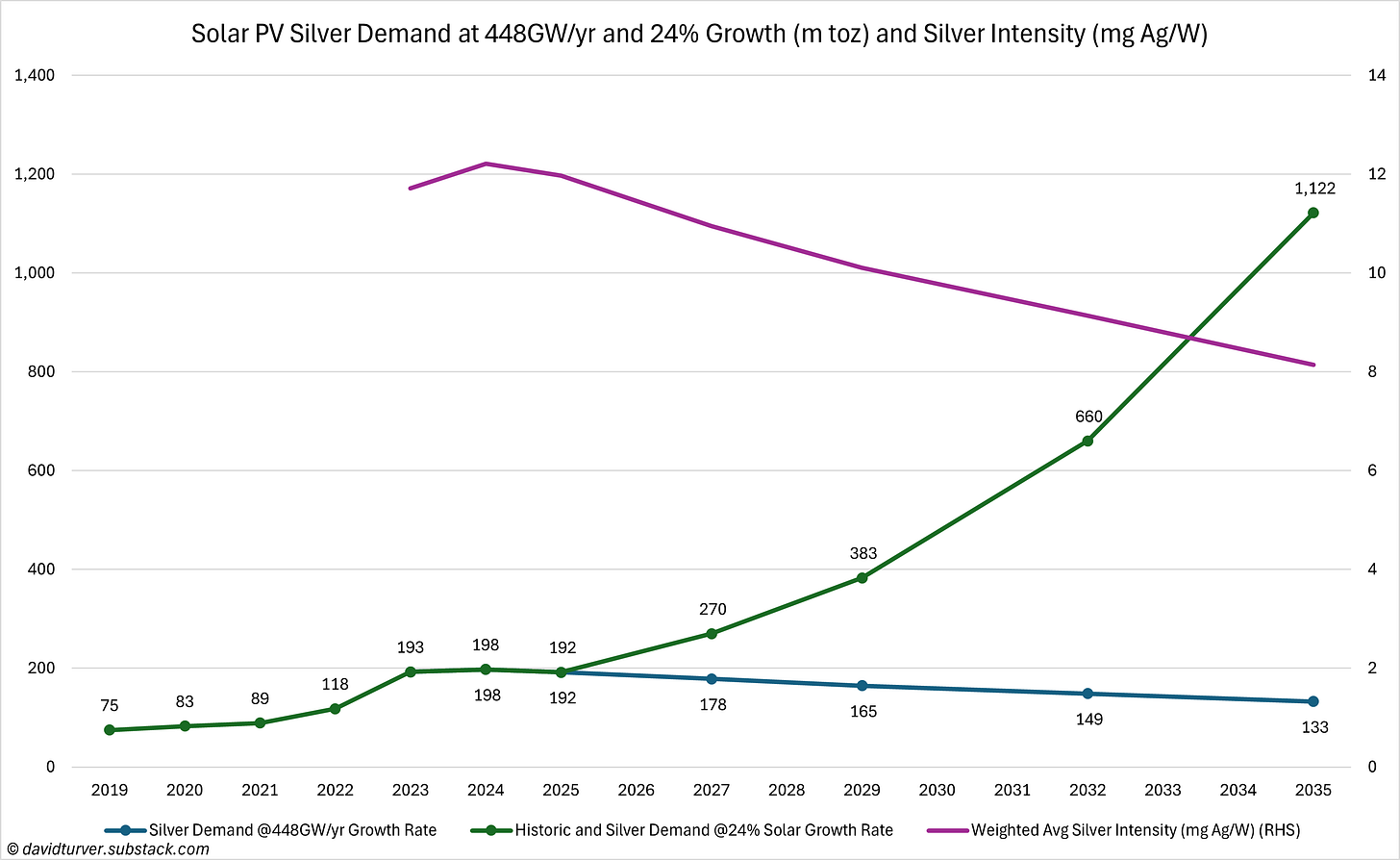

In their International Technology Roadmap for Photovoltaics (ITRPV) report, the VDMA forecasts the market share for each type of solar panel and the silver requirements per watt of output capacity for each technology. By combining these datasets, we can forecast the overall silver intensity for the solar panel market and see what happens to silver demand under a range of demand forecasts as shown in Figure 2.

The magenta line shows that silver intensity falls from about 12mgAg/W to about 8mgAg/W out to 2035 as technological improvements outweigh the shift from PERC type cells to more silver intensive TopCon and silicon hetero-junction (SHJ) type cells. The blue line shows what happens to silver demand if we keep adding 448GW of solar capacity each year. Silver demand falls from about 192m oz in 2024 to 133m oz in 2035, still enough for the silver market to remain in deficit. Data from IRENA shows Solar PV has grown on average above 24% per annum for the past few years. The green line shows what happens if solar PV grows exponentially at a steady 24% per year. Silver demand broadly doubles to 383m oz by 2029 and by 2035, solar panels would consume 1,122m oz, or more than the entire global supply. Silver prices would soar, probably rendering solar panels uneconomic even in tropical zones, so it is safe to say that sometime in the next few years, the growth rate of solar power is going to fall.

The supply and demand picture for silver gets even worse when the potential demand for solid-state batteries is considered. The weaknesses of current EVs are range and charging time. Samsung is trying to fix these weaknesses by designing a battery with a new type of solid-state battery that could deliver a 600-mile range and charge in nine minutes. The energy density of these batteries is claimed to be 500Wh per kilogram, or around twice the density of current batteries. The downside being that to achieve such fast charge times, charging stations would need to deliver 480-600kW which is many times the current 50-100kW for rapid chargers in the UK. Despite these challenges and even though they are more expensive than current battery technology, there are plans to introduce them in high-end vehicles like Lexus by 2027.

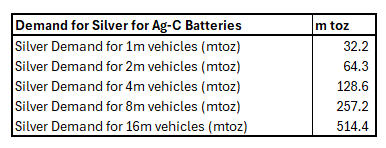

These new batteries use a silver-carbon anode, and it is estimated that a 100kWh battery would need 1kg of silver, or about 32 toz. Estimates of global car production varies from 80-94m units, with about 17m of them being EVs. If the range and charge-time benefits of these new batteries are real, then we might expect them to take a significant market share of new EV sales and we might expect mass production to bring down costs. However, the batteries for these vehicles would consume large amounts of silver as we can see in Figure 3.

If there is demand for 4m EVs, each with a 100kWh sold-state battery, then that would consume 128.6m oz. If demand were to really take off, 16m vehicles would consume over half a billion troy ounces or about half the total global silver supply.

We can see that demand for silver from solar power and solid-state batteries is going to rise substantially. Silver prices are notoriously volatile and demand increases of this scale would send prices soaring, moderating the demand for both solar panels and these new batteries. The green revolution would be derailed by the price of silver.

Looming Copper Shortage

Silver is not the only metal with a structural supply deficit. The International Energy Agency (IEA) and mining giant BHP are warning of a looming copper shortage. Copper is a vital element in the drive for electrification. Because of its superior conductivity, copper is used in electric motors as well as electricity transmission and distribution cables. This means that as demand for EVs grows, so does demand for copper. The rapid increase in wind and solar power plants needs proportionately more copper per TWh of electricity production because of low load factors and low energy density of those sources.

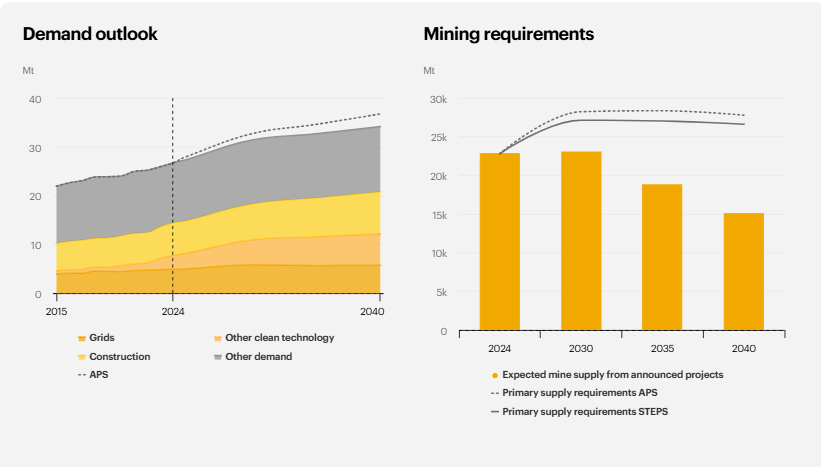

Figure 4 shows the supply and demand forecast from the IEA.

The IEA sees annual global copper demand growing from 26,717kt in 2024 to 34,137kt by 2040. Even though they forecast that secondary supply of copper from recycling to almost double in that time, they expect primary mine supply requirements of 25,428kt in 2040, set against around 15,000kt of expected mine capacity, a shortfall of over 10,000kt per year.

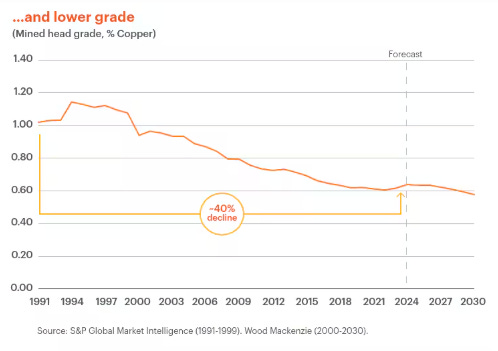

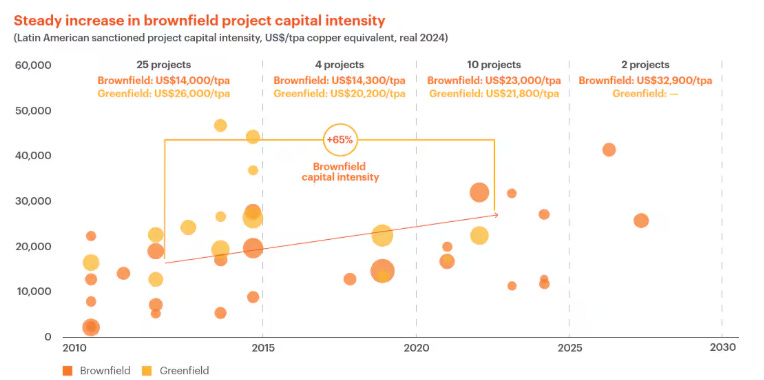

As Figures 5 and 6 show, BHP is warning that the ore grade of copper mines is falling and the capital needed to bring a new mine online is rising.

The head grade of copper mines has fallen about 40% since 1991.

The capital cost of bringing new mines online has gone up by around 65%. Lower head grades also increase the operating costs of new mines because more rock needs to be mined to get the same copper output and typically, the ore needs to be ground to smaller particle sizes to efficiently extract the copper from the ore.

These fundamentals have led to the copper price rising substantially since 2020 to recent peaks over $5.50/lb, although the price has fallen back since, as shown in Figure 7, using data from investing.com.

The growing gap between supply and demand is likely to lead to further increases in the price of copper to incentivise new, lower grade and higher cost mines to be built. Increases in the price of copper will have knock on effects in the cost of building EVs and in the cost of bringing new wind and solar power plants online.

Conclusions

We have warned for some time that new sources of electricity like wind and solar are highly mineral intensive. EVs also require more critical materials than their petrol-engined counterparts. Looking at just two metals in the production of power lines, solar panels, wind turbines, EV motors and new solid-state batteries shows that the Net Zero bubble could be about to burst.

Net Zero zealots often talk about the finite nature of natural resources. Yet simultaneously they advocate policies that are more mineral and energy intensive than the status quo. True environmentalists should recognise that being kind to the environment means minimising use of materials, not increasing it.

Eventually, the Net Zero fantasy world of unicorns and rainbows will be brought down to Earth by reality. The gap between their fantasy and reality is illustrated by the growing gap between supply and demand in both copper and silver. As the price of these vital commodities rises, the cost of Net Zero will soar. Silver and copper will derail the Net Zero fantasy.

This Substack now has over 4,400 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content. I would be grateful if more people would sign up for a paid subscription, so for a limited time I am offering a discount off annual subscriptions.

It is not only new deployment of generation assets and transmission & distribution infrastructure driving demand for the likes of silver & copper it is total replacement of generation assets every 15/20/25 years forever, with questionable levels of recovery.

Then we have the somewhat precious highly processed hydrocarbons intrinsic in wind turbine blades, remember when free supermarket bags disappeared because they were demonised for being ‘single use’ despite many of us using them to bag kitchen food waste? Now we have massive wind turbine blades, quite possibly the biggest single use plastic structures ever, which also employ lots of single use balsa a one time harvest from the Amazon rainforest.

Mention is made by the green blob that shredded ‘waste’ resin reinforcement composite from the wind turbine blades can be used to bulk out concrete foundations, but effectively that’s just redirecting landfill (and escaping landfill taxes?)

We should be getting the very highest return that we possibly can, that’s everything, minerals, labour, water, land use, hydrocarbons. I’m probably at odds with some in that I believe burning hydrocarbons for energy isn’t a good thing, it’s as unsustainable as ‘renewables’ Nuclear is the only sane solution.

These ‘valuable green jobs’ don’t ’solve the problem’ They create more problems, masses of landfill for future generations while simultaneously crippling the economy. That a country claims to do this in order to save the planet and control the weather is off the scale batshit crazy

It is the economics of the madhouse.

Thank you David! To complement your article, Mark Mills (referred to by Steve Elliott) and mining expert Simon Michaux have been trying to draw attention to this for some time. In his book 'More and More and More', Jean-Baptiste Fressoz describes how previous energy "transitions" have been no such thing, but additions instead. There is a chapter on copper in Ed Conway's compelling read 'Material World: A Substantial Story of Our Past and Future', in which one gains an impression of the gargantuan size and despoliation of copper mines, from which which transition zealots look away.

My own interest is in mining irony: it takes a great deal of risky money and many years to establish a new mine. We were told we had to have wind and solar because we couldn't afford the cost or the wait for nuclear energy.