Offshore Wind: Follow the Money

UK billpayers subsidising overseas investors and getting expensive, unreliable energy in return

Introduction

Having previously compared the level of profitability of selected windfarms to the profits of British Gas, it is time to follow the money. This article looks at various windfarms, where the revenue comes from, where it ends up and who benefits.

Where does Offshore Wind Revenue Come From?

The first item on the agenda is the source of revenue. To recap, some offshore wind farms are funded by Contracts for Difference (CfDs) and others by Renewable Obligation Certificates (ROCs). From the beginning of 2018 to January 2024, those offshore windfarms that have taken up their CfD contracts have received over £5.25bn in subsides as shown in Figure A.

For the avoidance of doubt, CfD subsidies are paid when the strike price is above the reference price. Effectively, the reference price is set by gas-fired generation, so subsidies are paid when the strike price is higher than the gas price. So, that £5.25bn represents subsides in excess of electricity produced from gas.

In parts of 2021 and 2022, the market price for their output was above the CfD strike price, so the generators paid back some money. Now that energy prices have stabilised around pre-crisis levels, record subsidies are being paid.

Other windfarms are subsidised using Renewable Obligation Certificates (ROCs). Generators are awarded certificates in relation to the amount of power they produce. These ROCs are paid in addition to what ever price the generators achieve in the market. Electricity suppliers are obliged to buy these certificates, and this gives generators an extra source of revenue, in addition to the price they achieve for the power they generate. So, by definition, ROC funded generation is more expensive than market prices. As Figure B demonstrates, the value of ROC certificates issued for offshore wind in the scheme years ending March 2018 to March 2023 is over £12.3bn and now runs at over £2bn per year.

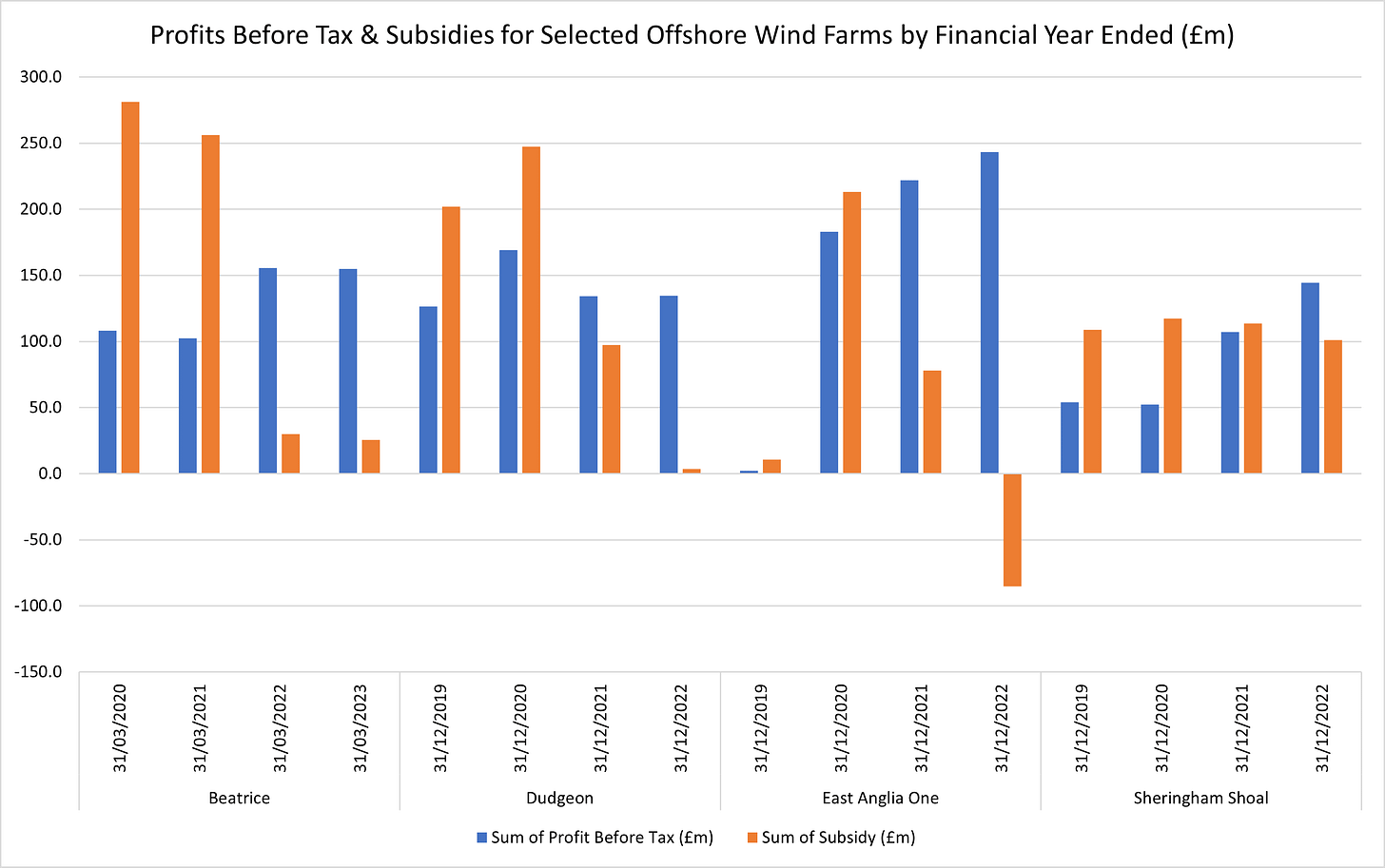

These subsidies contribute significantly to the profits of offshore wind farms; in fact, sometimes the subsidies are larger than profits as seen in Figure C.

Four offshore windfarms Beatrice, Dudgeon, East Anglia One and Sheringham Shoal were selected for analysis and their latest accounts were downloaded from Companies House. The first three are funded through CfDs and Sheringham Shoal is subsidised with ROCs. In the first two years of analysis, the subsidies received by Beatrice were larger than their profits. As energy prices rose in 2021 and 2022, the CfD subsidies fell and profits remained high. However, as we saw in Figure A above, CfD subsidies are now rising again, so it would not be surprising to see subsidies exceed profits for the current financial year. A similar picture emerges for Dudgeon and East Anglia One, although the latter did pay back subsidies in year ended December 2022.

Sheringham Shoal’s subsidy remained fairly stable because it is funded by ROCs. In the first two years of analysis, subsidies exceeded profits, but more latterly, profits exceeded subsidies as it received more for the electricity generated. Now that gas-fired electricity prices have fallen back, subsidies will likely exceed profit again.

Note: Race Bank was excluded from this part of the analysis because they do not break out their ROC income in their accounts.

Offshore Wind Dividends to Foreign Investors

Now we have established the source of a substantial part of the revenue and profits for offshore wind farms is subsidies, time to look at where the money goes. The profits they make lead to massive dividends for shareholders. Five offshore windfarms Beatrice, Dudgeon, East Anglia One, Race Bank and Sheringham Shoal were selected for analysis. These five windfarms paid out £1.89bn in dividends over the past four years and the split is shown in Figure D.

Figure E below shows the latest dividends compared to profit before tax and the ultimate ownership of the companies.

Beatrice made £155m in profit and distributed £134.9m to its shareholders. 40% of the company is beneficially owned by SSE Renewables, but the remaining 60% is owned by China’s Red Rock Power as well as TRIG and Equitix (part of TFG) that are both ultimately majority-owned by offshore entities in Guernsey. This means that offshore investors are receiving most of the dividend payments. Profits and dividends that are largely funded by the CfD payments we make through our bills.

Dudgeon and Sheringham Shoal are both operated by Norwegian energy group Equinor. Dudgeon is also partly-owned by Masdar from Abu Dhabi and China Resources. Sheringham Shoal is part owned by the Green Investment Group (GIG) which is part of Australian investment bank Macquarie and Equitix.

East Anglia One is majority owned by Spanish group Iberdrola, with the remaining 40% stake held by GIG. Race Bank is operated and 50% owned by Danish group Orsted with the other half owned by Macquarie funds and Japan’s Sumitomo Corporation.

For these four companies, all the dividends are effectively distributed offshore, funded by subsidies paid through our bills. It is difficult to see how it makes economic sense to subsidise unreliable, intermittent energy, charge a fortune for it and distribute the profits offshore. Effectively, consumers are subsidising overseas fat-cats in return for expensive, unreliable energy.

Offshore Wind Debt Mountains Reducing Corporation Tax Liability

However, this is not the only way UK billpayers and taxpayers are losing out. Because these windfarms are guaranteed high and rising prices for the electricity they produce, they are viewed as good credit risks by the banks. This enables the generators to take on massive amounts of debt and build precarious financial structures. Figure F shows the pre-tax profits, debt, assets and interest expense for a selection of offshore wind farms.

Beatrice has a total debt of £1,705m backed by just £1,770m of plant, property and equipment assets. The debt amounts to over 96% of the main assets. This debt needs to be serviced and they paid nearly £62m of interest expense to MUFG (a Japanese bank) in year to end March 2023.

Dudgeon’s debt is about 91% of tangible assets and they paid £26.1m in interest expenses to their debt providers. Japan’s MUFG and French BNP Paribas hold charges over their assets.

Triton Knoll’s debt represents more than 98% of their main assets. MUFG was the recipient of a total £117m debt interest from Race Bank and Triton Knoll wind farms in the year to end December 2022. Walney is also highly indebted to a consortium of banks, and America’s Citibank holds a charge over their assets. Walney’s debtors earned £54m in interest in year ended December 31st 2022.

In many cases, the interest expense is being sent abroad to enrich overseas bankers. In addition, the interest expense is tax deductible and reduces taxable profits, so reducing the amount of tax payable. If the debt structures were less extreme, they would pay less in interest and the UK Exchequer would receive more tax revenue. It is the guaranteed prices from UK billpayers that are supporting these debt structures and overseas banks are profiting from this largesse as the Chancellor is deprived of revenue.

Note that East Anglia One and Sheringham Shoal have little to no debt, so pay higher dividends.

Offshore Traders Take Their Cut

In addition, many of the offshore wind farms, particularly those operated by Equinor, sell their power to offshore trading entities in Germany and Norway (see Figure G).

According to the notes in the accounts, Dudgeon wind farm sells all of its power to Danske Commodities AS and Statkraft Markets GmbH. Danske is owned by Norwegian energy giant Equinor and Statkraft is a Norwegian state-owned company. The other Equinor operated windfarms such as Hywind Scotland and Sheringham Shoal operate in this way and Beatrice sells a portion of its output to Danske too. Offshore traders are taking their cut before selling the electricity to end customers.

Promoting the Business Model

To keep these lucrative arrangements going, the operators invest some of their gains in promoting their business model. Equinor, Orsted, Scottish Power (Iberdrola) and SSE are members of lobby group Energy UK. Equinor, Scottish Power and SSE Renewables are also “strategic partners” of RenewableUK.

The Chief Executive of Energy UK, Emma Pinchbeck can often be seen on Twitter/X, as seen in Figure H, seeking additional support for the wind industry.

Here she is pleading for a level playing field for renewables, as if subsidised prices, preferential market access, getting paid to not produce (curtailment) and getting the rest of us to pick up the tab for network investment and grid balancing is not enough.

Sadly, it seems Energy UK seems to have access to the the very heart of Government power. Here is Emma proudly attending a business event at 10 Downing Street (Figure I).

Here she is again cheering the additional £800m (at 2012 prices) of our money allocated to offshore wind in AR6. More subsidies that no doubt will eventually find their way offshore like those that came before.

Conclusions

What we have seen is that it is not just the wind turbines that are offshore. The subsidies are harvested from UK billpayers and exported in the form of dividends and interest payments to offshore entities. Even the electricity itself is sold to traders in foreign countries so they can take their cut. The offshore wind industry is merely a means of lining the pockets of overseas investors at the expense of British energy consumers and UK taxpayers. What we get in return is expensive and intermittent energy that cannot be described as good value on any measure. We even have UK-based lobbyists taking their own cut to promote this rip-off. How do they sleep at night? It is the classic bait and switch trick on a grand scale. The overseas operators, financiers and banks are having a field day using our money.

We appear to have fallen prey to an offshore parasitic class, facilitated by Government and lobbyists who are getting rich by sucking the lifeblood from society. Yet, all the while they insist it is good for us and the planet. It is time this industry was held to account.

If you have enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

I would be interested in any views you may have on these two posts

The first says do absolutely nothing

https://edmhdotme.wpcomstaging.com/minimal-future-warming-from-co2-ch4-n2o/

The second says Weather-Dependent “Renewables” are absolutely useless at doing nothing but pointlessly very expensive

https://edmhdotme.wpcomstaging.com/the-myth-of-cheap-renewables/

If Western politicians had any sense and took some notice they could save Western Civilisation from an self-inflicted disaster and a lot of money.

Beatrice (and others) operate a further money-grubbing trick which Andrew Montford discovered, gaming the system to charge us twice for the same electricity. When a windfarm generates too much electricity for the national grid to absorb it is obliged to curtail its output, for which it receives a generous constraint payment. The Blackhillock substation which serves Beatrice has a facility which can divert the Beatrice electricity into an off-grid low voltage network and/or battery storage system for which they can receive payment even when they have accepted a constraint payment from the grid, apparently quite legally. https://www.netzerowatch.com/all-news/how-windfarms-charge-you-twice-for-the-same-electricity.