Introduction

Regular readers will recall that I believe that if we have to have an energy transition, then we should be focusing on reliable nuclear as the main power generation technology. I say this more for reasons of geopolitics and geology rather than because of some great fear of the demon gas carbon dioxide. As the membership of the BRICS expands, more and more of the world’s hydrocarbon resources will be controlled by powers that are less than friendly and of course, big new discoveries tend to be in less hospitable locations meaning the cost of extraction will rise.

Even though Kazakhstan is currently the largest uranium producer, about 38% of the unexploited uranium resources in the world are in five-eyes allies Australia and Canada. Over the long term, we will be more secure if we rely on these allies for the supply of fuel than if we rely on BRICS countries.

However, in the short term, it is becoming clear that there is a shortage of uranium that will create significant bumps in the road to a nuclear-powered future that has implications for UK energy policy and energy security.

The Uranium Fuel Cycle

Before delving into the detail of supply and demand, we should look at a simplified view of the Uranium fuel cycle, because the supply and demand dynamics are important at each stage.

Broadly speaking, uranium miners produce uranium concentrate known as “yellowcake” or U3O8. This is then converted into uranium hexafluoride gas or UF6. The UF6 is then enriched in centrifuges to increase the concentration of the fissile isotope U235 from around 0.7% to between the 3% and 5% required to make nuclear fuel for most reactors. New types of reactors are being designed to use High-Assay Low-Enriched Uranium (HALEU) which is enriched to more than 5% but less than 20% U235, but we shall ignore this for now. Before anyone gets too excited, weapons grade Uranium usually contains around 90% U235.

Uranium Supply and Demand

Bearing in mind the fuel cycle outlined above, let us look at the supply and demand dynamics, starting at the end of the cycle with enrichment.

Emerging Enriched Uranium Shortage

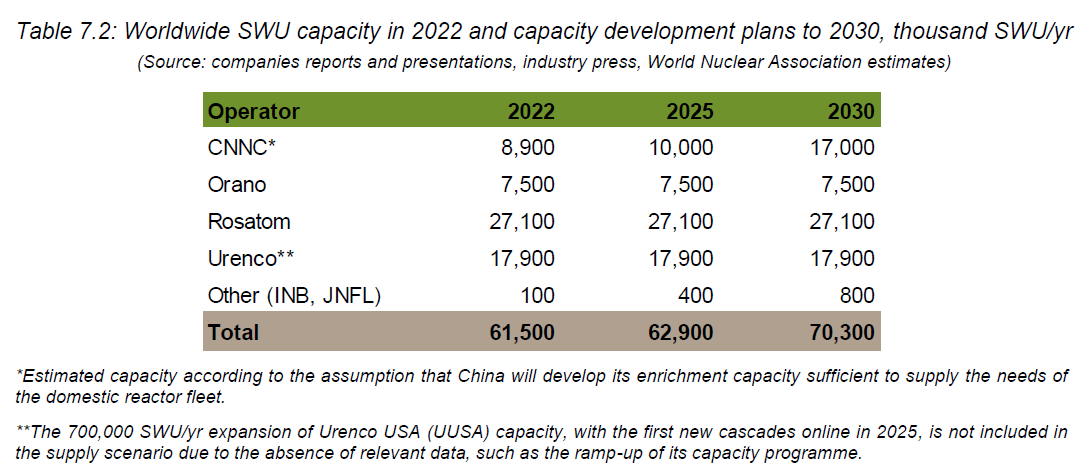

The World Nuclear Association (WNA) produces its Nuclear Fuel Report every two years. This shows the current installed enrichment capacity measured in Separative Work Units (SWU) as shown in Figure 1 (their Figure 7.2).

This shows a steady increase in capacity out to 2030. Although it should be noted that almost all the increase in capacity comes from China. In 2022 Russia (Rosatom) accounted for 44% of global enrichment capacity, with China (CNNC) representing around 14%. By 2030 their respective shares are forecast to change to 38% and 24%. The main western suppliers are Orano and Urenco. Orano is the French nuclear conglomerate. Urenco is owned one third by the UK Government, one third by the Dutch Government and one third by two German utilities. It has operations in those three countries and in the USA.

Figure 2 (their Figure 7.5) shows how the WNA see the global supply and demand picture developing out to 2040.

Using the WNA’s Reference Scenario, global demand exceeds supply around 2034 and using their Upper Scenario, a supply shortage emerges in 2029. Given that many countries pledged to triple nuclear capacity by 2050 at COP28, it is more likely than not that we will follow a trajectory close to the Upper Scenario.

However, this global picture masks some geopolitical issues. First, almost all of Chinese capacity is earmarked for their own massive nuclear expansion (covered here). The second issue is that, for understandable reasons, governments and utilities are shunning Russian sourced uranium and enrichment services. Indeed, the US House of Representatives has passed a Bill banning Russian sourced uranium altogether (except for limited exceptions). This Bill has not yet made it on to the statute book, but a vote in the Senate is expected soon.

This spells trouble for western nations because according to the US EIA (Uranium Marketing Report Table 16), Russia supplied 3,409 tSWU to the US in 2022, or about 24% of the total. Euratom reported that in 2022 Russia supplied about 30% or 3,239 tSWU of the EU’s enrichment requirements in their 2022 Annual Report (Table 6). The US and Europe will have to expand capacity to cover the shortfall arising from losing Russian capacity.

Uranium Conversion (UF6) Shortage

A similar picture arises when looking at conversion capacity. Figure 3 shows the WNA’s estimate of global conversion capacity and utilisation.

Russia represents about 20% of global licensed capacity, but over 28% of actual production. China represents 24% of global capacity and 25% of production.

Moreover, according to Euratom, Russia supplied over 22% of EU conversion services in 2022. The EIA does not disclose the breakdown of the origin of natural UF6 delivered to utilities in the US.

Figure 4 shows the WNA’s estimate of the global uranium conversion supply and demand balance out to 2040.

Here the picture is more urgent with global capacity struggling to keep up with current demand in the Reference Scenario. A gap of around 30,000tU emerges by 2040. The Upper Scenario shows a gap of 80-90,000tU by 2040, with this gap being larger than current capacity, meaning capacity would have to more than double in quite short order to meet demand.

Impact of Uranium Enrichment Under- and Over-Feeding

There is another wrinkle in the supply and demand dynamics for uranium enrichment and conversion. This is the phenomenon of under- and over-feeding in the enrichment part of the cycle (see Figure 5 from the WNA).

The capacity of enrichment plants is measured in separative work units (SWU). When natural uranium as UF6 is enriched, it starts with about 0.7% of the fissile isotope U235. As the uranium is spun in the centrifuges, the isotopes partially separate and typically the enriched portion has about 5% U235 and the remaining uranium, called the tails, contains about 0.25% U235. This is called the tails assay.

If the enrichers have surplus SWU capacity, they can spin the UF6 for longer and generate more enriched uranium per kilogramme of input material and the tails will have a lower assay, say 0.2%. The enricher then has surplus UF6 left over and can sell this into the market. This material is one source of what is often called secondary supply.

Conversely, if the enrichers are short on capacity, they can run the centrifuges for less time and produce the output with a higher tails assay. This requires more input material, so the enricher will be short of UF6 and have to purchase extra material in the market to produce the same output of enriched uranium product. This might be termed secondary demand. So, when enrichment capacity is tight, this leads to extra demand for UF6 that then translates to extra demand for U3O8, or yellowcake.

Figure 6 illustrates how higher demand pressure in the market has led to much higher prices for enrichment and conversion over the past couple of years. Data sourced from this article, which sourced data from UxC and a series of tweets that reported monthly data from UxC and/or Trade Tech.

Enrichment prices have nearly tripled since January 2022 and conversion prices have more than tripled. This indicates that both markets are already tight and the WNA charts above show it is likely the markets will get tighter still until new capacity comes online.

Natural Uranium Shortage and Primary Supply Deficit

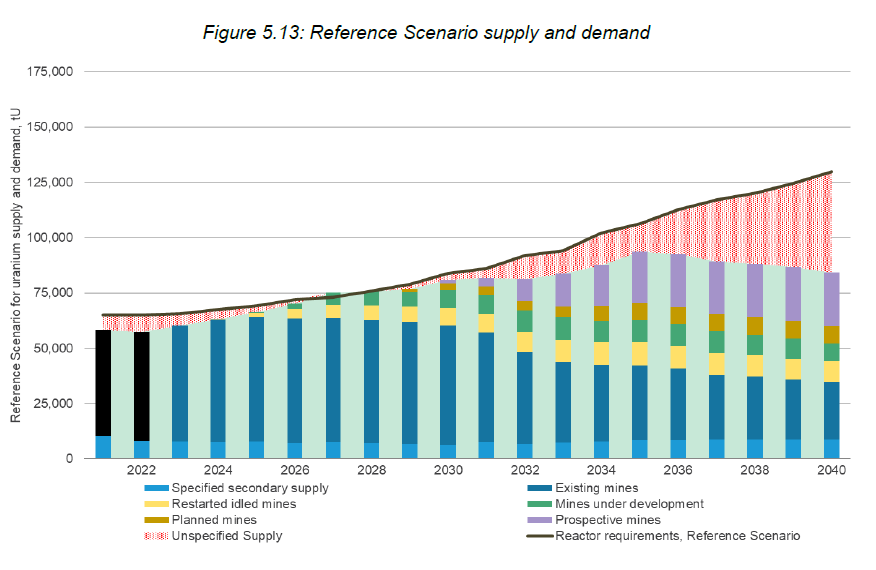

This brings us on to the supply and demand picture for yellowcake. Again, WNA have produced three scenarios for supply and demand for raw U3O8. Figure 7 below shows their Reference Scenario.

This shows a supply deficit from 2021 to 2026, a balanced market in 2027 and 2028, then a growing deficit out to 2040. Overall demand roughly doubles from ~65,000tU in 2023 to ~130,000tU in 2040. The supply gap in 2040 is around 50-55,000tU. Their Upper Scenario is even more extreme with demand rising to ~180,000tU in 2040 and with slightly higher supply, the gap is ~90,000tU. Until recently, the supply gap was closed by drawing down inventory. However, the recent steep rise in the price of U3O8 indicates that available inventories have all but dried up.

Unfortunately, there are several reasons to believe that the WNA estimate of the near-term supply gap is too low. The first is that as we saw above, enrichment prices are rising meaning enrichment supply is scarce, which is pushing enrichers to stop underfeeding and perhaps begin to overfeed their facilities. So, a significant portion of the “secondary supply” shown in Figure 7 which comes from under-feeding will likely not materialise and may in fact become a source of secondary demand instead.

The second reason is that the world’s largest Uranium supplier, Kazatomprom has recently announced a big downgrade to its production forecasts for 2024 and said its plans for 2025 are at risk. Kazatomprom represents around 40% of global uranium production and is effectively the OPEC of the uranium market. When Kazatomprom has production problems, the rest of the world has supply problems. Its latest announcement cut the guidance for 2024 production by 3,500tU (or ~9m lbs U3O8) which represents about 6% of global primary mine supply. Moreover, Cameco, the world’s second largest producer also declared production problems in 2023 and missed its own downgraded production forecasts. It is planning to increase production somewhat in 2024, but it remains to be seen if they can deliver on their plans. Even if they meet their targets, this will not make up for the shortfall announced by Kazatomprom. Moreover, the coup in Niger disrupted production at Orano’s SOMAIR mine.

The third reason is that uranium demand may well be higher than the WNA anticipated. Some countries (for example, Japan) have announced accelerated restarts of idled nuclear power plants, leading to a short term need for fuel. Others are extending the life of existing reactors (for example, Diablo Canyon in California) which also leads to more short-term demand for uranium.

It is therefore likely that the real supply gap shown by the WNA in 2024 and 2025 is larger than they anticipated, and the market will likely not be in balance in 2027 and 2028. Figure 8 demonstrates that prices of yellowcake have risen sharply in response.

High prices will eventually be the cure for high prices. There is no shortage of uranium in the ground, but there is a shortage of permitted mines to extract it. There are several mines poised to re-start or begin construction in established uranium producing countries like Namibia and friendly jurisdictions like Australia, Canada and the USA. However, it takes a long time for new developments to pass through the permitting process and raise finance to bring new mines online.

Impact on UK Energy Policy and Energy Security

So, what does all this mean for UK energy policy and energy security? The Government signed up to the agreement at COP28 to triple nuclear power by 2050. It has also gone further and has an ambition to deliver 24GW of nuclear capacity by 2050. If this ambition is to be more than rhetoric, it needs to be backed by concrete plans to ensure we build capacity and capability throughout the nuclear supply chain. 24GW of nuclear capacity will require around 12m lbs of U3O8 or 4,600tU per year to operate.

Through its part ownership of Urenco, the UK already has three uranium enrichment plants at Capenhurst. Moreover, the UK has committed £300m to support domestic production of HALEU fuel that will be required for next generation nuclear power plants. This part of the fuel cycle looks like it is on track, to meet domestic requirements, but there might be an opportunity to expand to meet growing demand in other countries.

The UK does not currently have an operating uranium conversion facility. However, Orano has two plants in France. The Government has awarded £13m to Westinghouse to explore the development of domestic uranium conversion facilities at its Springfields facility in Lancashire. It appears we do not yet have domestic conversion facilities to ensure security of supply. However, there are signs we are moving in the right direction, but these plans probably ought to be accelerated.

The conversion and enrichment facilities need a reliable supply of raw uranium to operate. Of course, the UK does not have its own uranium mines, so we are always going to be reliant upon other countries for the supply of yellowcake. Fortunately, five-eyes allies Canada and Australia have abundant resources. However, as we saw above, the uranium market is very tight and is likely to become tighter still, probably until the end of the decade when large new mines are scheduled to come on stream.

We should consider that the US has approved the creation of a strategic uranium reserve to serve as a backup supply for the US nuclear power industry and China already has a sizeable stockpile of uranium to support its ambitious nuclear programme. The UK should follow suit and build its own strategic uranium reserve. In the current market, that is far easier said than done. However, mining giant BHP is listed on the London Stock Exchange and operates the giant Olympic Dam mine in Australia. This is a multi-mineral mine that produces considerable volumes of uranium as a by-product. Perhaps the Government ought to enter into an agreement with BHP to supply some of their output to build a domestic strategic stockpile of uranium. Alternatively, the UK could enter into contracts with one or more of the uranium mine developers in Canada to take a total of 1m lbs per year over 12 years to build a strategic stockpile of uranium to support its nuclear power ambitions. This approach would help those developers to raise finance and bring on their new mines more quickly and alleviate the looming uranium shortage.

Conclusions

Energy security is becoming an increasingly important geo-political issue. Many countries are realising that if they are to meet their carbon reduction goals, they are going to need to a supply of clean, reliable baseload energy. The only technology that can meet these goals is nuclear power.

However, as we have seen, all stages of the uranium fuel cycle are going to struggle to meet this increasing demand. The UK has taken some steps in the right direction on enrichment and conversion but needs to increase its efforts to secure a reliable supply of raw uranium. Building a national strategic stockpile would be a welcome step to ensure future energy security.

If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Thanks for a great article. Building a strategic uranium reserve should be a national priority but who could take such a decision. Nuclear policy like many important decisions in the UK has been handed to a quango called Great British Nuclear. They won’t be taking a final investment decision on SMRs until 2029, which is the end of the next Westminster political cycle.

“GBN has launched the next phase of the SMR technology selection process and invites SMR vendors to register their interest. This is an important next step in identifying those companies best able to reach a project Final Investment Decision (FID) by the end of 2029, which could result in billions of pounds of public and private investment in SMR projects.”

Meanwhile according to the Tekegraph Rolls Royce CEO Tufan Erginbilgic is promising to build his first SMR project in Europe, before the UK.

https://www.telegraph.co.uk/business/2024/02/22/rolls-royce-boosted-post-pandemic-jump-demand-jet-engines/

Back when the UK was considering a new reactor for Hinkley Point, GE offered to build PRISMs that would burn the UKs excess reactor grade plutonium and SNF, which they claimed they really wanted a solution for. At a much lower electricity cost than the French EPR boondoggle, the most expensive, poorly designed GenIII reactor on the planet. They could have gone with the South Korean APR-1400 at a far lower cost for a far better reactor, as the UAE did. Of course they would have had to have the cojones to tell the EU dictatorship to F-OFF and the meddlesome Austrian government should have been sued for maybe $100B. After sending the Austrian ambassador home with a good swift boot to his rear end and told never to come back. Unfortunately the British government woozed out, as usual.

http://prismsuk.blogspot.com/

They had an excellent SMR design in the UK, Moltex Stable Salt Reactor, which Pratt's analysis concluded it would be the cheapest electricity in Britain. And would run on the spent nuclear fuel the Government is always whining about, that they need to do something with. And they were not allowed to develop them in the UK. So they had to move to Canada where they have passed their 1st stage licensing. And this while the UK gov't claimed to have an SMR program and were promoting their development. Lying, corrupt politicians.

'Self described elite' are 'deliberately DISMANTLING' Western democracy - Neil Oliver - YouTube:

https://www.youtube.com/watch?v=ATWG0bBWe_o

"'The time has come again to be rid of the whole rotten lot of them'. Neil Oliver says the 'self described elite' have been carefully and deliberately dismantling Western democracies and holding on to power for too long."