Greencoat Flapping in the Wind

Despite huge subsidies, Greencoat UK Wind is warning about profits

Introduction

While researching earlier articles on the offshore wind decommissioning timebomb, and the recent spate of wind operator profit warnings I had occasion to dig into the accounts of some of the funds offering exposure to renewable energy to retail investors. There were some interesting findings from that research, so this is the second of two articles in a mini-series looking in more detail at two of the funds. The first covered Octopus Renewables Infrastructure Trust (ORIT) and this one takes a closer look at Greencoat UK Wind (UKW).

Share Price Performance

As we can see from Figure 1, the UKW’s share price has been in a long down trend since peaking in September 2022.

The share price has fallen despite paying £249.8m in dividends in 2024 and buying back £81m of its own shares. Share buybacks have been continuing in 2025 too.

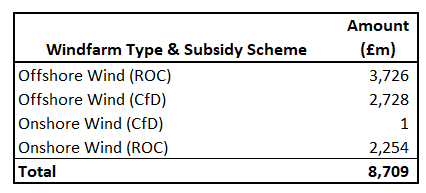

The dividends are paid because the renewable assets that UKW invests in harvest billions in subsidies. The company has stakes in eight offshore windfarms and over 40 onshore windfarms. Six of the offshore windfarms are subsidised under the Renewables Obligation Certificate (ROC) scheme and two under Contracts for Difference (CfD). Almost all the onshore windfarms are covered by the ROC scheme, although some operate without any subsidy and one is subsidised through CfDs. Figure 2 shows the total subsidies received by windfarms where UKW has a stake.

These windfarms have received total subsides of some £8,709m over their lives. The ROC data is up to March 2025 and CfD data is up to early August 2025. Note that in many cases UKW has a minority stake and/or has not owned a part of the windfarm for its whole life, so the amount received by UKW will be much less.

The subsidy largesse does not stop there though. Many of the windfarms that UKW has a stake in also receive constraint payments. In other words, they get paid to turn off the turbines when there is more wind power than the grid can handle, or when supply exceeds demand. According to data from the Renewable Energy Foundation, windfarms where UKW has a stake have received over £350m in constraint payments too. Again, only a minority of this cash would have been paid to UKW because it does not own 100% of most of the assets, but it is an indication of the scale of the money that is being thrown at both onshore and offshore wind farms.

Greencoat UK Wind Risks

Despite receiving stable, index-linked revenues from subsidies, there are several risks to UKW’s business model.

Diminishing Assets

The net asset value (NAV) of the company fell ~£385m to £3,409m during 2024, largely due to a £517m reduction in the gross asset value to £5,652m. Aggregate group debt was recorded as £2,244m at the end of 2024 and the gross asset value of investments was recorded at £5,142m. Both gross and net asset value fell again in the half-year report for 2025 and group debt increased slightly.

The company’s stated aim is to provide investors with an annual dividend that increases in line with inflation while preserving the capital value of its investment portfolio in the long term. However, UKW is selling assets to pay for share buybacks. A declining asset base is not conducive increasing dividends or capital growth.

Rising Discount Rates

In common with other renewables investment funds, UKW assets are classified as Level 3, which means that in the absence of observable market data, management determines the fair value of the assets on the balance sheet. They do not disclose the full methodology, but in effect, they calculate present value of the expected cashflows from the assets over the remainder of their lives. This figure is highly sensitive to several variables such as the discount rate, inflation, energy yield, power price and asset life.

The discount rate is linked to long-term interest rates which have been rising recently. They disclose (p84 of the accounts) that a 0.5% increase in the discount rate would decrease NAV by 6.6%. However, any decrease in valuation caused by an increasing discount rate might be offset by rising inflation which has also been edging up. They say that an increase in inflation of 0.5% would increase NAV by 6.9%.

Falling Electricity Generation

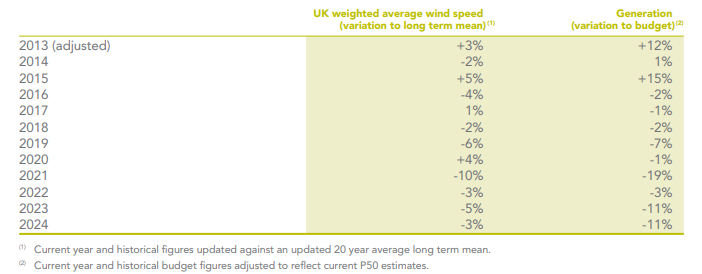

Of course the volume of electricity generated impacts the asset value. They disclose that a reduction from the P50 level to the P90 level (90% probability of being exceeded) would cause a 14.7% decrease in portfolio value. However, as shown in Figure 3, their track record of budgeting the amount of electricity generated is somewhat suspect.

They have produced less than budget in all years since 2016, with both 2023 and 2024 producing 11% below budget. In their 2025 half year results announcement, the again reported lower power generation due to low wind. It is also interesting to note that UK wind speeds have been below the long-term average for the past four years, and all but one of the years since 2016.

This creates a risk that the actual NAV is lower than their modelled value.

Optimistic Asset Lives

The future revenue from generation is obviously impacted by the assumed asset life. UKW assumes a 30-year life as a base case and notes that if asset lives were to be cut by 5 years, then the NAV would reduce by 14.6%. But how realistic is a 30-year asset life, particularly for wind assets?

UKW is an investor in the London Array Offshore wind farm operated by RWE. The ownership structure is complex. However, RWE Renewables UK London Array Limited is the company that owns RWE’s stake. In the accounts, that company records the expected life of the asset as 23 years. London Array started earning Renewables Obligation Certificates (ROCs) in 2012, so we might expect those subsidies to run out in 2032 and RWE expects the wind farm to continue operating until 2035 and decommissioning to take place in 2036. However, UKW holds its stake in the windfarm through Greencoat London Array Limited. This company records the expected asset life as 20 years, but as we have seen above UKW expects the life to be 30 years, meaning the end of life is expected to be 2042.

How can it be that UKW expects London Array to be generating power for six years after the operator, RWE has decommissioned the asset? Adjusting the asset lives down to more realistic levels would lead to a significant fall in NAV.

Electricity Price Risk

UKW identifies changes in power prices as a risk to NAV, noting that a 10% reduction price would result in NAV falling by 14.4%. Conversely, a 10% price increase would see NAV rising by 14.6%.

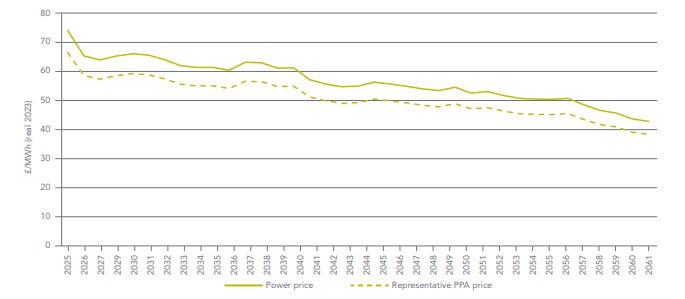

They expect their realised prices to be 10-20% below forecast power prices as shown in Figure 4.

In their discussion of risks, the company recognises that the Government might change the financial support mechanisms for the renewable energy sector by making changes to ROCs or carbon prices. They also believe that the chance of the Government making changes in the next five years to be low.

However, last week Claire Coutinho announced that a future Tory government would abolish ROCs and eliminate carbon taxes. The Reform Party is committed to ending net zero and flying high in the opinion polls. If they were to gain office then it is likely they would copy these Tory policies.

Data from Ember shows the combination of the Emissions Trading Scheme and the Carbon Price Support mechanism (carbon costs) make up nearly a third of wholesale prices, mostly set by gas. If carbon costs were eliminated, then wholesale prices would fall dramatically and the prices realised by UKW would likely fall significantly and NAV would collapse.

Decommissioning Liabilities

Note 10 to their accounts identifies about £280m of guarantees and indemnities made by the company to cover things like decommissioning and other indemnities. However, Note 2 records that they consider the fair value of these indemnities to be zero because they “do not expect Group cashflows to crystalise as a result of these guarantees”.

However, this might not be the full extent of the under-recording of decommissioning liabilities. For instance, Note 10 indicates a guarantee to the Crown Estate of £3.4m for the decommissioning of Rhyl Flats offshore wind farm. However, the 2023 accounts for Rhyl Flats shows the present value of decommissioning liabilities of £29.2m. Grossing this up using their discount rate of 3.75% to the expected life of 23 years gives an expected cash cost of some £40.7m in 2032. UKW owns 24.95% of Rhyl Flats, so its share of the total would be £10.2m, three times more than the amount recorded in Note 10.

Similarly, they record in Note 10 a guarantee of £11.8m to cover decommissioning and rent for North Hoyle wind farm. However, the 2024 accounts declare a provision for decommissioning with a present value of £12.1m. Grossing this up to at their discount rate of 6% out to 2034 gives a cash cost of £21.7m. UKW owns 100% of North Hoyle, so it will be on the hook for then entire amount, nearly double the recorded guarantee.

Combined Impact

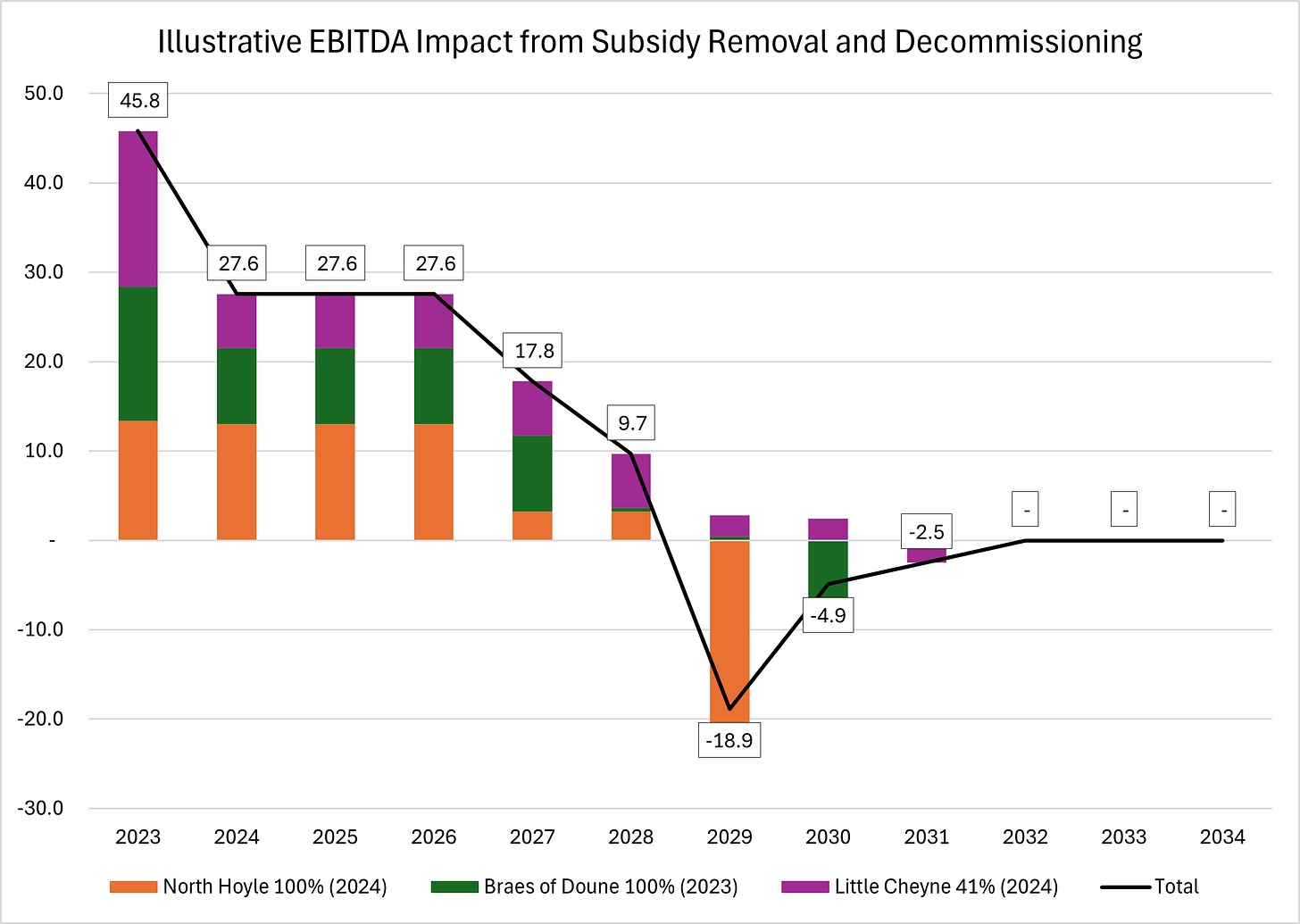

We can estimate the combined impact of shorter asset lives and crystalised decommissioning liabilities by looking at three wind farms where the subsidies are due to run out in the next few year: North Hoyle, Braes of Doune and Little Cheyne.

North Hoyle started earning ROC subsidies in 2006, so we can expect them to run out in 2026 (some eight years earlier than recorded in UKW’s accounts). This windfarm recorded EBITDA of £13m in 2024 and earned about £9.8m from ROC subsidies, giving a post-subsidy EBITDA of £3.2m. As mentioned above the cash cost of decommissioning is expected to be £21.7m. We can estimate that it might remain cashflow positive for a couple of years after the subsidies run out, but then it will need to stop operations and be decommissioned.

The subsidies for Breas of Doune and Little Cheyne are expected to run out in 2027 and 2028, respectively. Braes of Doune has not recognised a decommissioning provision because they expect the wind farm to have a life beyond 30 years. However, we can estimate the gross costs by scaling the estimate for Little Cheyne which has an estimated life of 20 years and adjusting for the fact that UKW owns 41% of Little Cheyne and 100% of Braes of Doune.

The results of this simple, illustrative model are shown in Figure 5 below.

2023 was a good year with combined EBITDA of £45.8m. However, total EBITDA fell to £27.6m in 2024. It is assumed that 2024 earnings project forwards until the subsidies run out for each asset. They then continue operating for a couple of years without subsidy. EBITDA falls to £9.7m in 2028 and goes negative to £-18.9m in 2029 as North Hoyle is decommissioned and continues negative in 2030 and 2031 as the other two windfarms are dismantled. There is zero EBITDA thereafter.

There is a big risk to dividends and NAV from reduced asset lives and decommissioning liabilities. Moreover, as we saw in the earlier article about ORIT, funds like UKW are also very vulnerable to reductions in carbon costs and early termination of Renewables Obligation subsidies.

Conclusions

In common with other funds focused on renewables, Greencoat UK Wind appears to be adopting some rather aggressive accounting policies that have the impact of inflating asset values and probably under-stating the risks facing the company.

They benefit from fairly predictable income by harvesting renewables subsidies, but have loaded the company with debt, assumed asset lives that are far too optimistic and ignore the risk of a change in the political weather that could see Net Zero abandoned and their power price assumptions undermined if carbon taxes and subsidies are cut and subsidies removed early. They are also not factoring in the cost of decommissioning in their asset valuation.

The falling share price perhaps tells us that the market is catching on to the risks surrounding funds of this nature. It looks like shareholders will be left flapping in the wind for some time to come.

This Substack now has over 4,600 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

I have been invited to speak at the Battle of Ideas Festival in October on the subject of “Why is my energy bill so high?” You can get 20% off any ticket price by clicking on this link.

Thank you David. From the share price, it looks like sophisticated investors have done similar analysis to yours, and reached a similar conclusion - confidence is draining away.

As to lower than anticipated wind and asset life, unless I missed an announcement, the half-life of uranium-235 remains 704 million years and the asset life of nuclear plant around the globe has been on an increasing trend.

The drive for wind and solar and the neglect or dismissal of nuclear energy are both case studies in psychology, divorced from facts - we believe it so it must be true. When my interest in the subject was superficial and very time-limited, it seemed to me self-evident that wind and solar were the way to go: but facts are stubborn things.

Nine straight years of below budget generation. Surely their luck has to turn soon!