Gone with the Wind

Frankly, my dear, I don’t give a damn that wind operators are issuing profit warnings.

Introduction

There has been a string of profit warnings from renewables companies and funds complaining about a lack of wind. Even Ed Miliband has not been able to invent a scheme that pays subsidies when the wind doesn’t blow, so this year’s low wind conditions have hit the revenues of wind operators hard. The Contract for Difference (CfD) subsidy figures for September have been released, so we can take a look at what is happening.

Profit Warnings

First to sound the alarm in July was Swedish state-owned utility Vattenfall that saw a 54% year-on-year drop in profits. They said lower wind speeds led to a 7% reduction in generation in April-June 2025. Then in August RWE reported a drop in profits in the first half of the year as unusually low winds offset gains from new capacity. The troubled Danish 50% state-owned renewables company Orsted followed with its own profit warning on September 5th as it lowered its profit guidance, driven by lower than expected wind speeds.

Investment funds TRIG and Greencoat UK Wind also issued warnings as low wind speeds reduced both revenue and profits and threatened their dividend payouts. Greencoat had to sell of some assets to ensure it remained within its borrowing limit.

Low Wind Generation

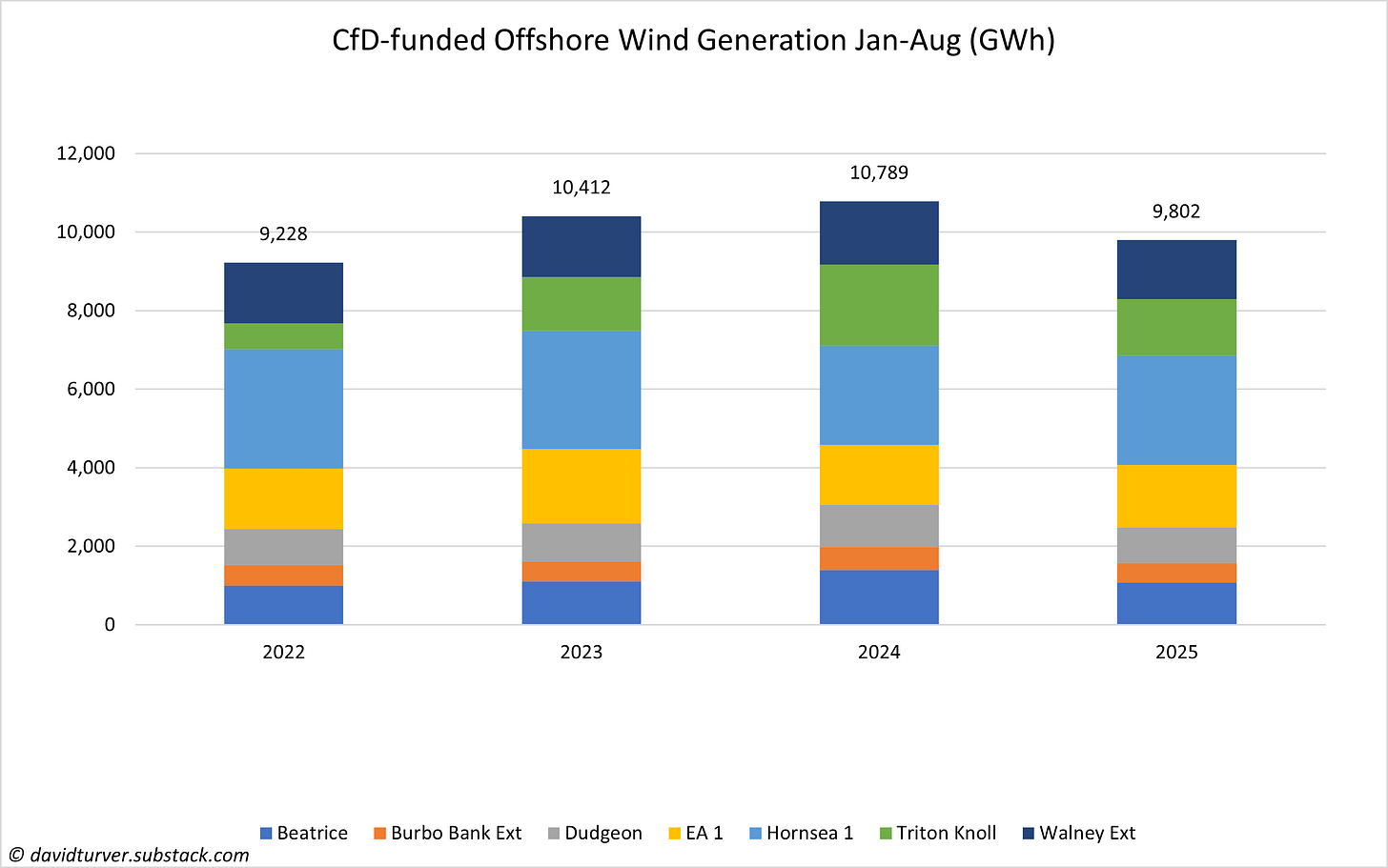

We can get a good idea of how the whole UK fleet is performing from the sample of wind farms that are CfD funded. If we look first at the sample of offshore windfarms that have a full year track record back to 2022 and looking at just January to August for each year, we can see how generation has changed over time as shown in Figure 1.

Generation so far is 9,802GWh, down 9.2% compared to 2024 but still above the performance in 2022. Looking at the individual windfarms, the worst performers are Triton Knoll, down 30.1% and Beatrice that has seen a 22.7% reduction in output. RWE has a large stake in Triton Knoll and TRIG has a 17.5% stake in Beatrice. East Anglia One and Hornsea One both saw increases in output.

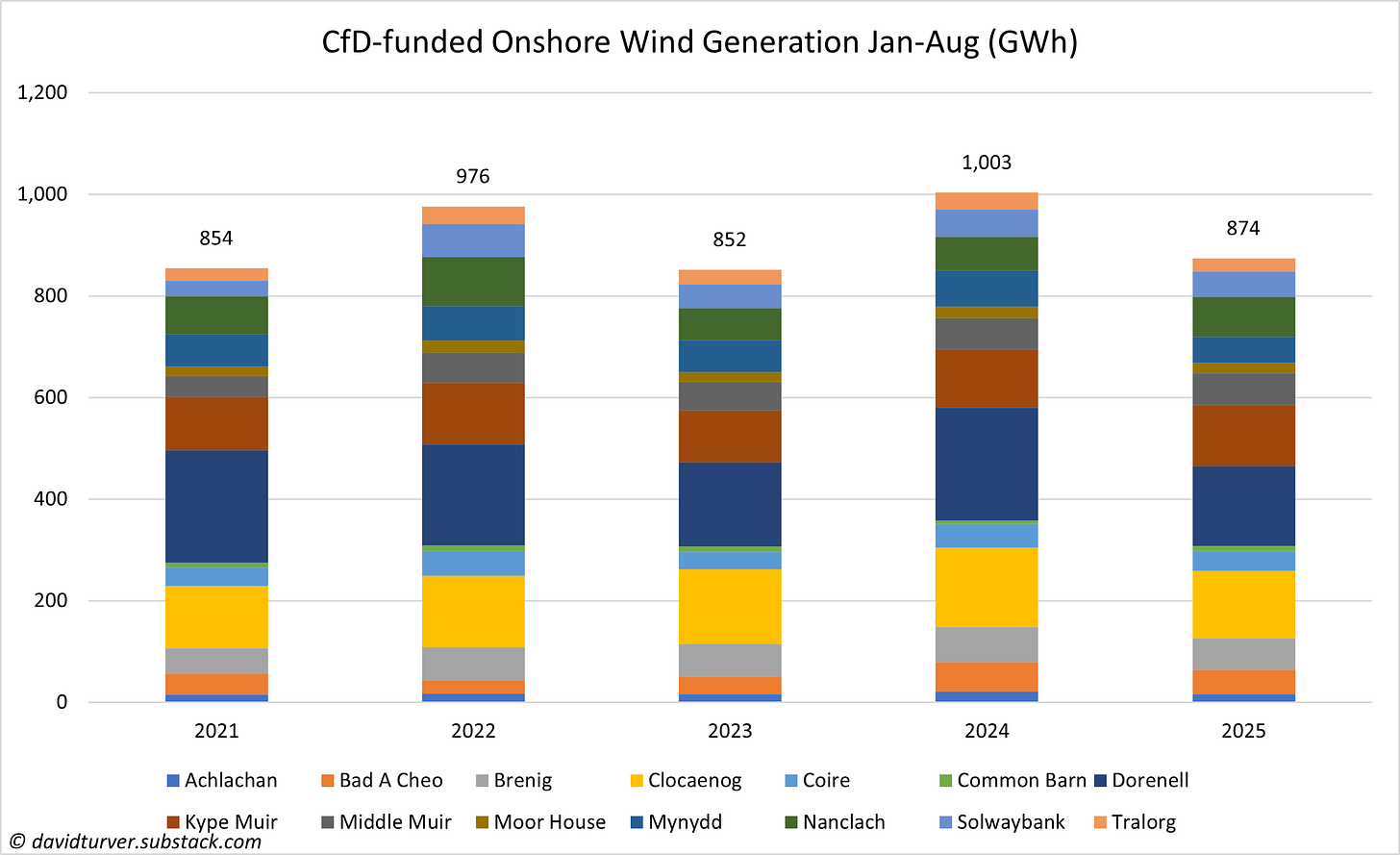

Turning now to onshore wind as shown in Figure 2 and the drop-off in performance since last year has been even more marked.

Overall generation for January to August 2025 is down 12.9% compared to last year. Worst performer is the Mynydd Y Gwair Wind Farm, wholly owned by RWE where generation is down 28.6% compared to last year. Achlachan and Tralorg were down 24.8% and 21.4% respectively. Kype Muir, owned by Greencoat UK wind and Middle Muir both generated slightly more than last year.

Even though there is a drop in generation compared to last year, both onshore and offshore wind are within the range of generation for the past few years.

Overall Subsidies

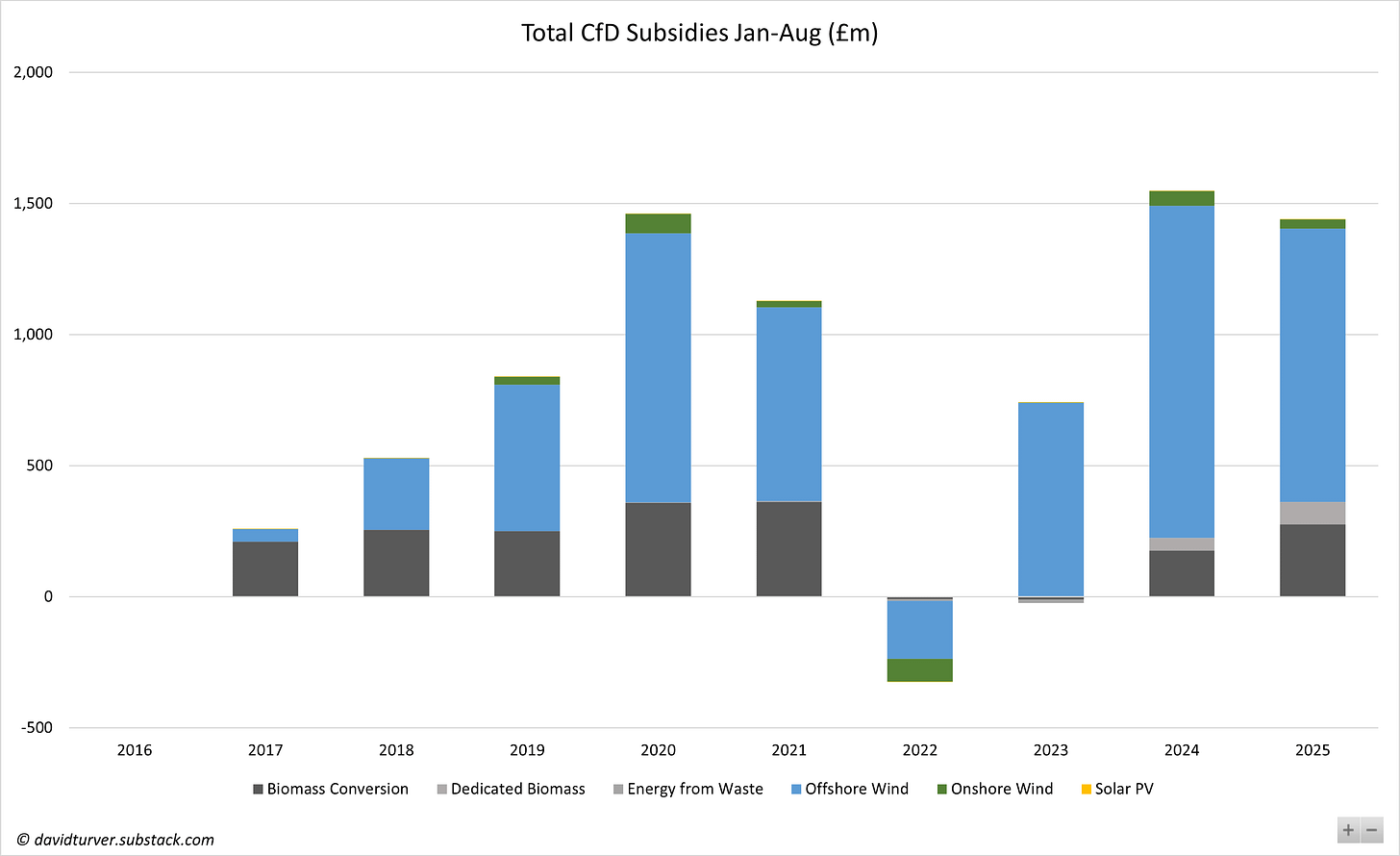

If we now return to look at the whole fleet of renewables as shown in Figure 3, we can see that so far this year overall subsidies are down slightly on last year despite rising strike prices and more projects coming online.

January to August subsidies are down almost £108m from £1,548m to £1,441m. Within that, offshore wind subsidies are down £224m. Subsidies for onshore wind and solar are also down, but they are offset by a big increase in Biomass Conversion (£100m) and Dedicated Biomass (£37m).

CfD Subsidies Per MWh

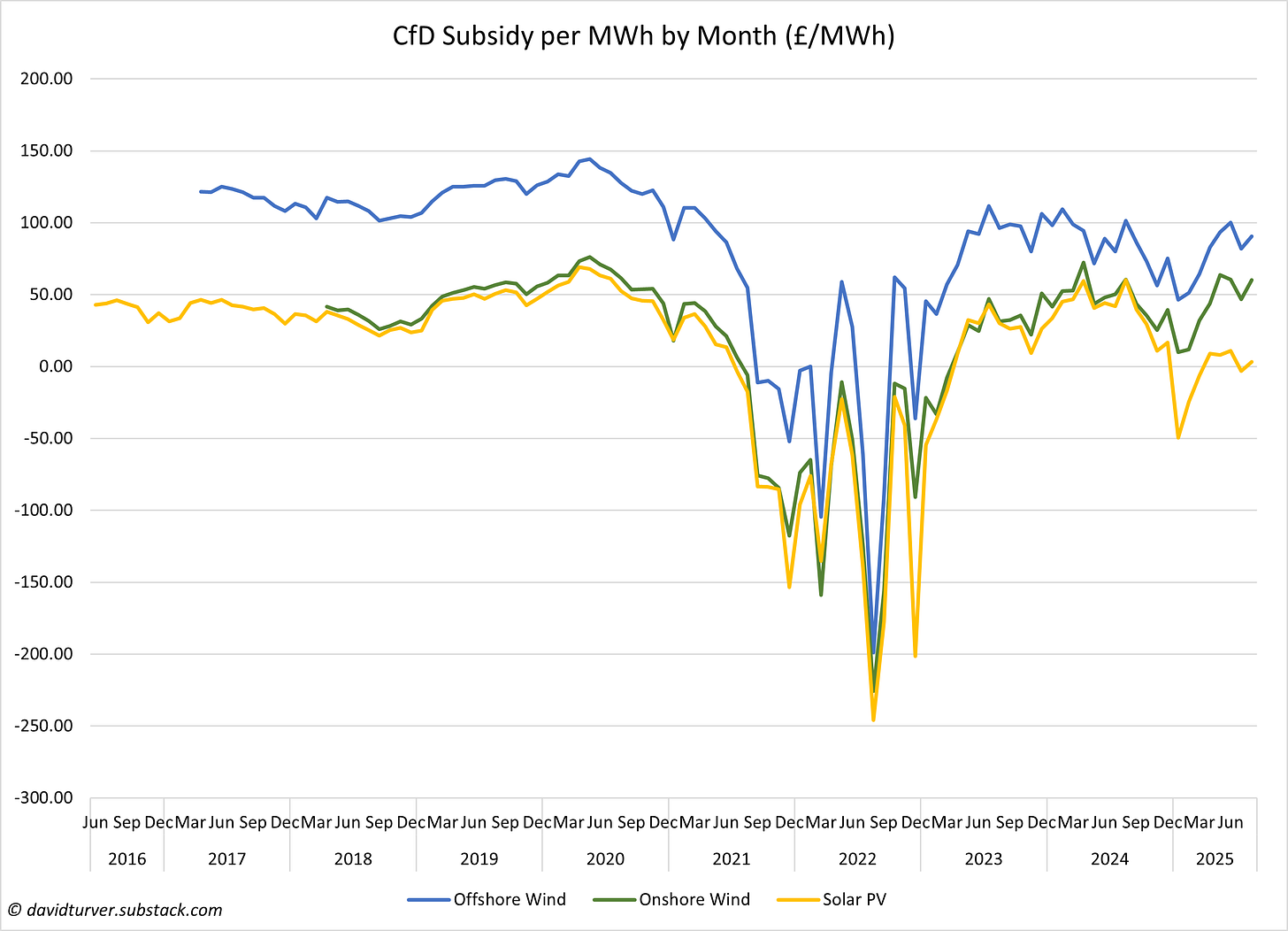

As shown in Figure 4, subsidies per MWh are generally lower than in 2024 but now show a distinct upward trend.

Gas prices rose sharply at the end of 2024 into the early part of this year but have since fallen and remained relatively stable. This has reduced wholesale electricity prices, so subsidies are rising to maintain the higher strike prices.

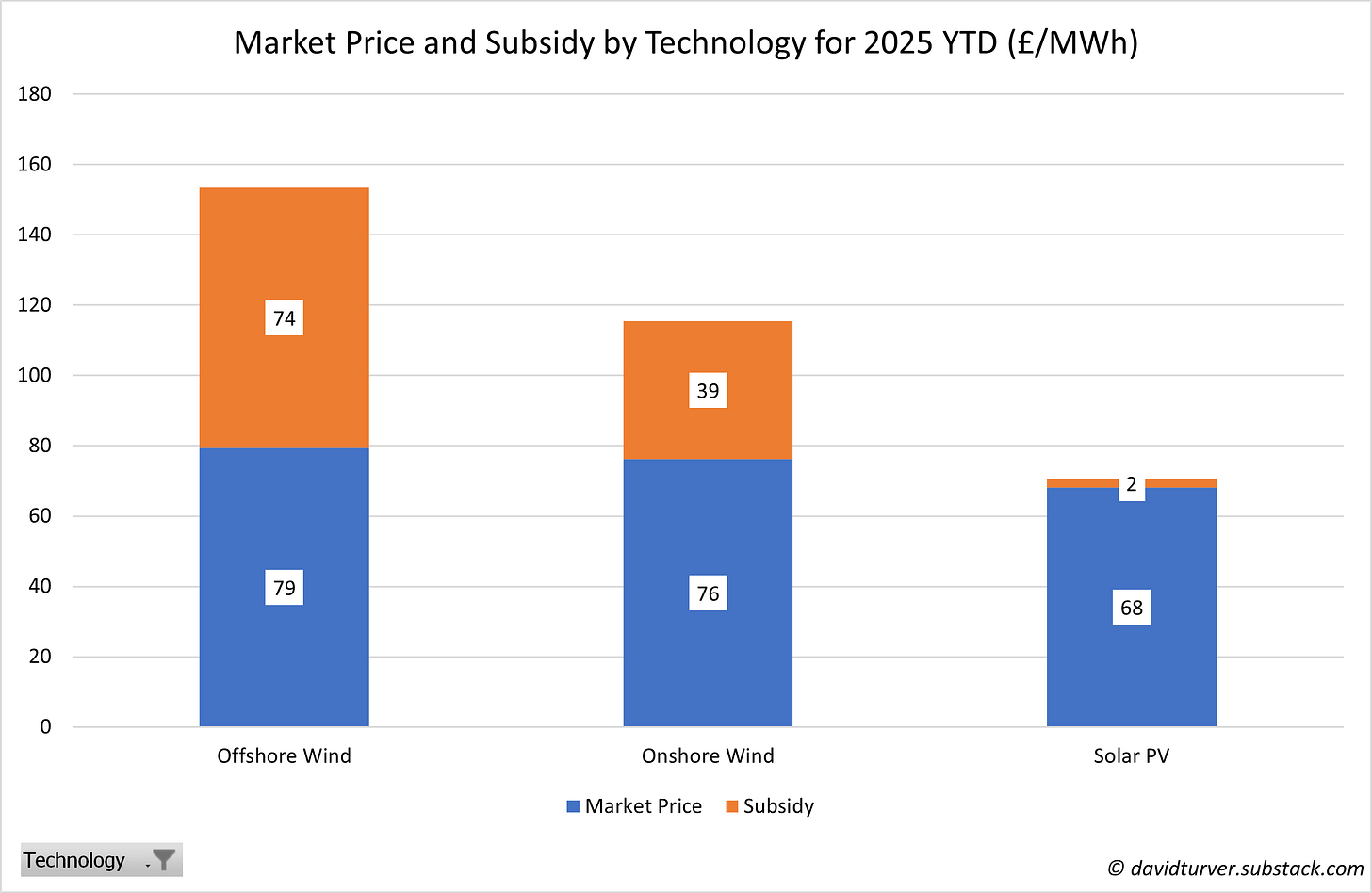

The resulting split of market price and subsidies so far this year is shown in Figure 5.

Offshore wind has so far this year received subsidies of £74/MWh or about 48% of revenue. Onshore wind received £39/MWh (34%) and solar got £2/MWh (3%) of their revenue from subsidies. This result comprehensively belies the claim that renewables are cheaper than gas. Reference prices are mostly set by gas and the subsidies are paid in addition to the reference price, so when subsidies are positive, the basic costs of renewables are more expensive than gas-fired electricity, even with a rising carbon tax.

Conclusions

We have been warning for some time that it is crazy for a developed economy to try and run its electricity generation system using technologies that are dependent on the weather. Even though there has been only a relatively modest decline in wind output this year, the operators and owners of wind farms are learning the hard way that it is very difficult to run a business that is at the mercy of the vagaries of the weather. Many of these companies are up to their eyeballs in debt. They better hope the wind blows hard this Autumn and Winter so they can collect higher subsidies, or they will be in real trouble.

Their perilous finances are an even bigger reason to insist that proper funds are set aside to fund decommissioning or the long-suffering taxpayer will be on the hook for another hidden cost of renewables.

This Substack now has over 4,500 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

I have been invited to speak at the Battle of Ideas Festival in October on the subject of “Why is my energy bill so high?” You can get 20% off any ticket price by clicking on this link.

The sooner the whole lot of them go bankrupt the better.

An appalling financial and environmental scandal.

Complete and utter madness. I wonder where the power will come from and what cost to U.K. tax payers for the drive to the AI revolution, Starmer is pinning his growth hopes on?